Clear Form

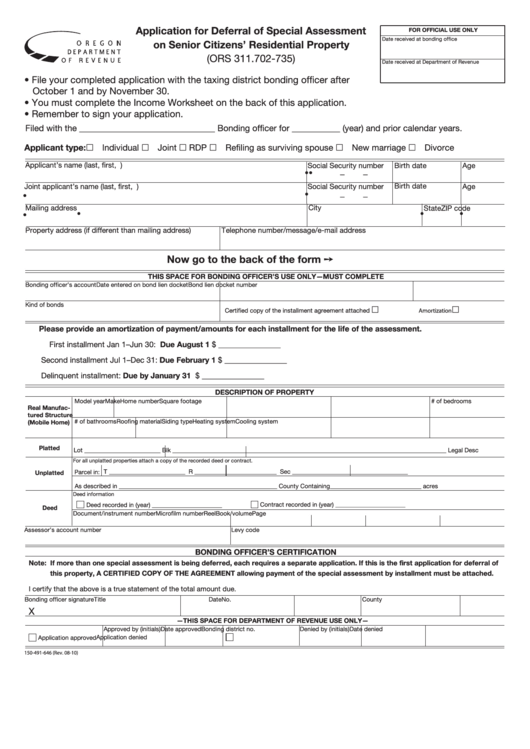

Application for Deferral of Special Assessment

FOR OFFICIAL USE ONLY

Date received at bonding office

on Senior Citizens’ Residential Property

(ORS 311.702-735)

Date received at Department of Revenue

• File your completed application with the taxing district bonding officer after

October 1 and by November 30.

• You must complete the Income Worksheet on the back of this application.

• Remember to sign your application.

Filed with the _______________________________ Bonding officer for ___________ (year) and prior calendar years.

Applicant type: Individual

Joint

RDP

Refiling as surviving spouse

New marriage

Divorce

Applicant’s name (last, first, M.I.)

Social Security number

Birth date

Age

•

•

—

—

Joint applicant’s name (last, first, M.I.)

Birth date

Social Security number

Age

•

•

—

—

Mailing address

City

State

ZIP code

•

•

•

•

Telephone number/message/e-mail address

Property address (if different than mailing address)

Now go to the back of the form ➙

THIS SPACE FOR BONDING OFFICER’S USE ONLY—MUST COMPLETE

Bonding officer’s account

Date entered on bond lien docket

Bond lien docket number

Kind of bonds

Certified copy of the installment agreement attached

Amortization

Please provide an amortization of payment/amounts for each installment for the life of the assessment.

First installment Jan 1–Jun 30: Due August 1

$ ________________

Second installment Jul 1–Dec 31: Due February 1 $ ________________

Delinquent installment: Due by January 31

$ ________________

DESCRIPTION OF PROPERTY

Model year

Make

Home number

Square footage

# of bedrooms

Real Manufac-

tured Structure

# of bathrooms

Roofing material

Siding type

Heating system

Cooling system

(Mobile Home)

Platted

Lot _________________________

Blk _____________________

_____________________________________________________________________ Legal Desc

For all unplatted properties attach a copy of the recorded deed or contract.

T _________________________

R ___________________________

Sec ______________________________________

Parcel in:

Unplatted

As described in ____________________________________________________ County

Containing______________________________ acres

Deed information

Contract recorded in (year) _______________________

Deed recorded in (year) _______________________

Deed

Document/instrument number

Microfilm number

Reel

Book/volume

Page

Assessor’s account number

Levy code

BONDING OFFICER’S CERTIFICATION

Note: If more than one special assessment is being deferred, each requires a separate application. If this is the first application for deferral of

this property, A CERTIFIED COPY OF THE AGREEMENT allowing payment of the special assessment by installment must be attached.

I certify that the above is a true statement of the total amount due.

Bonding officer signature

Title

Date

County

No.

X

—THIS SPACE FOR DEPARTMENT OF REVENUE USE ONLY—

Approved by (initials) Date approved

Denied by (initials)

Date denied

Bonding district no.

Application denied

Application approved

150-491-646 (Rev. 08-10)

1

1 2

2