Clear This Page

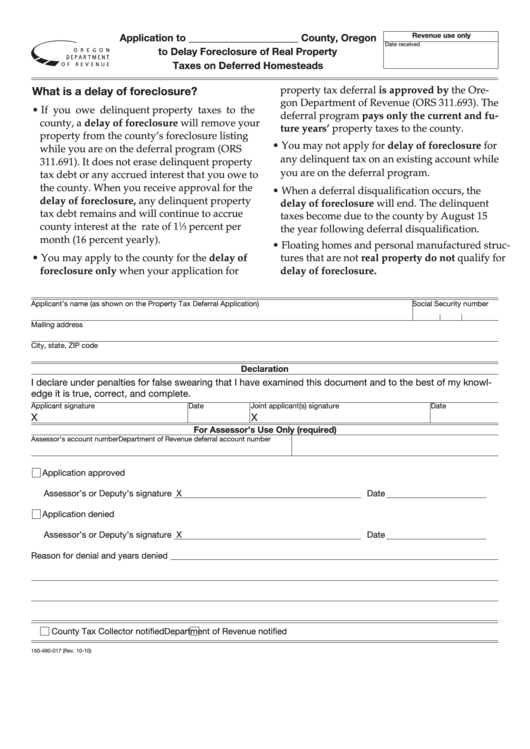

Revenue use only

Application to ______________________ County, Oregon

Date received

to Delay Foreclosure of Real Property

Taxes on Deferred Homesteads

property tax deferral is approved by the Ore-

What is a delay of foreclosure?

gon Department of Revenue (ORS 311.693). The

• If you owe delinquent property taxes to the

deferral program pays only the current and fu-

county, a delay of foreclosure will remove your

ture years’ property taxes to the county.

property from the county’s foreclosure listing

• You may not apply for delay of foreclosure for

while you are on the deferral program (ORS

any delinquent tax on an existing account while

311.691). It does not erase delinquent property

you are on the deferral program.

tax debt or any accrued interest that you owe to

the county. When you receive approval for the

• When a deferral disqualification occurs, the

delay of foreclosure, any delinquent property

delay of foreclosure will end. The delinquent

tax debt remains and will continue to accrue

taxes become due to the county by August 15

county interest at the rate of 1

⁄

percent per

1

the year following deferral disqualification.

3

month (16 percent yearly).

• Floating homes and personal manufactured struc-

• You may apply to the county for the delay of

tures that are not real property do not qualify for

foreclosure only when your application for

delay of foreclosure.

Applicant’s name (as shown on the Property Tax Deferral Application)

Social Security number

Mailing address

City, state, ZIP code

Declaration

I declare under penalties for false swearing that I have examined this document and to the best of my knowl-

edge it is true, correct, and complete.

Applicant signature

Date

Joint applicant(s) signature

Date

X

X

For Assessor’s Use Only (required)

Assessor’s account number

Department of Revenue deferral account number

Application approved

Assessor’s or Deputy’s signature X

Date

Application denied

Assessor’s or Deputy’s signature X

Date

Reason for denial and years denied

County Tax Collector notified

Department of Revenue notified

150-490-017 (Rev. 10-10)

1

1