Form St-P-3 - Maine Revenue Services Direct Payment Permit - State Of Maine State Tax Assessor

ADVERTISEMENT

State Tax Assessor or within 30 days after receipt of the Assessor's permission for

discontinuance of the direct payment permit by the taxpayer, the permit holder must:

A. Give notice to each supplier with whom it had transacted business pursuant to

the direct payment authority, that subsequent to any appropriate effective date, it

will no longer claim exemption from payment of tax by reason of a direct

payment permit; and

B. Return the direct payment permit to the State Tax Assessor.

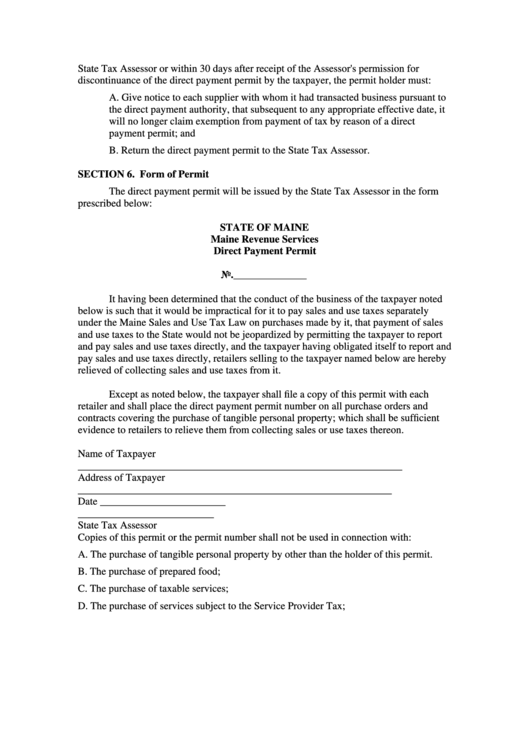

SECTION 6. Form of Permit

The direct payment permit will be issued by the State Tax Assessor in the form

prescribed below:

STATE OF MAINE

Maine Revenue Services

Direct Payment Permit

No.______________

It having been determined that the conduct of the business of the taxpayer noted

below is such that it would be impractical for it to pay sales and use taxes separately

under the Maine Sales and Use Tax Law on purchases made by it, that payment of sales

and use taxes to the State would not be jeopardized by permitting the taxpayer to report

and pay sales and use taxes directly, and the taxpayer having obligated itself to report and

pay sales and use taxes directly, retailers selling to the taxpayer named below are hereby

relieved of collecting sales and use taxes from it.

Except as noted below, the taxpayer shall file a copy of this permit with each

retailer and shall place the direct payment permit number on all purchase orders and

contracts covering the purchase of tangible personal property; which shall be sufficient

evidence to retailers to relieve them from collecting sales or use taxes thereon.

Name of Taxpayer

______________________________________________________________

Address of Taxpayer

____________________________________________________________

Date ________________________

__________________________

State Tax Assessor

Copies of this permit or the permit number shall not be used in connection with:

A. The purchase of tangible personal property by other than the holder of this permit.

B. The purchase of prepared food;

C. The purchase of taxable services;

D. The purchase of services subject to the Service Provider Tax;

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2