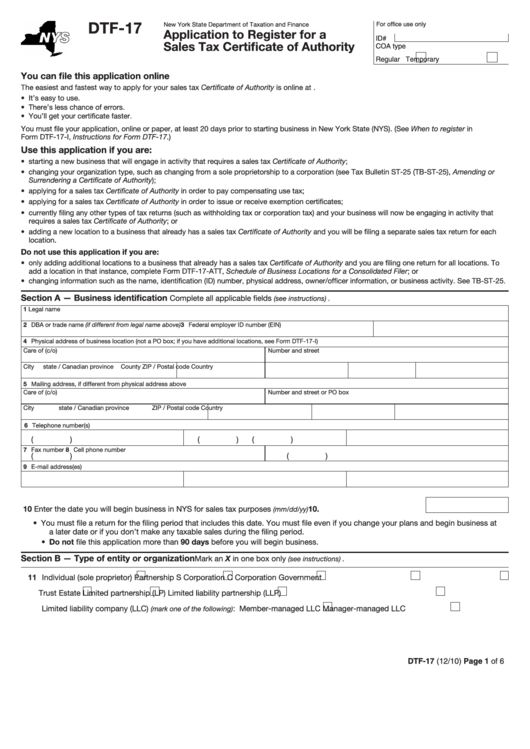

DTF-17

For office use only

New York State Department of Taxation and Finance

Application to Register for a

ID#

Sales Tax Certificate of Authority

COA type

Regular

Temporary

You can file this application online

The easiest and fastest way to apply for your sales tax Certificate of Authority is online at

• It’s easy to use.

• There’s less chance of errors.

• You’ll get your certificate faster.

You must file your application, online or paper, at least 20 days prior to starting business in New York State (NYS). (See When to register in

Form DTF-17-I, Instructions for Form DTF-17.)

Use this application if you are:

• starting a new business that will engage in activity that requires a sales tax Certificate of Authority;

• changing your organization type, such as changing from a sole proprietorship to a corporation (see Tax Bulletin ST-25 (TB-ST-25), Amending or

Surrendering a Certificate of Authority);

• applying for a sales tax Certificate of Authority in order to pay compensating use tax;

• applying for a sales tax Certificate of Authority in order to issue or receive exemption certificates;

• currently filing any other types of tax returns (such as withholding tax or corporation tax) and your business will now be engaging in activity that

requires a sales tax Certificate of Authority; or

• adding a new location to a business that already has a sales tax Certificate of Authority and you will be filing a separate sales tax return for each

location.

Do not use this application if you are:

• only adding additional locations to a business that already has a sales tax Certificate of Authority and you are filing one return for all locations. To

add a location in that instance, complete Form DTF-17-ATT, Schedule of Business Locations for a Consolidated Filer; or

• changing information such as the name, identification (ID) number, physical address, owner/officer information, or business activity. See TB-ST-25.

Section A — Business identification

Complete all applicable fields

(see instructions) .

1 Legal name

2 DBA or trade name (if different from legal name above)

3 Federal employer ID number (EIN)

4 Physical address of business location (not a PO box; if you have additional locations, see Form DTF-17-I)

Care of (c/o)

Number and street

City

U.S. state / Canadian province County

ZIP / Postal code

Country

5 Mailing address, if different from physical address above

Care of (c/o)

Number and street or PO box

City

U.S. state / Canadian province

ZIP / Postal code

Country

6 Telephone number(s)

( )

( )

( )

7 Fax number

8 Cell phone number

( )

( )

9 E-mail address(es)

10 Enter the date you will begin business in NYS for sales tax purposes

........................................ 10.

(mm/dd/yy)

• You must file a return for the filing period that includes this date. You must file even if you change your plans and begin business at

a later date or if you don’t make any taxable sales during the filing period.

• Do not file this application more than 90 days before you will begin business.

Section B — Type of entity or organization

Mark an X in one box only

(see instructions) .

11 Individual (sole proprietor)

Partnership

S Corporation

C Corporation

Government

Trust

Estate

Limited partnership (LP)

Limited liability partnership (LLP)

Limited liability company (LLC)

: Member-managed LLC

Manager-managed LLC

(mark one of the following)

DTF-17 (12/10) Page 1 of 6

1

1 2

2 3

3 4

4 5

5