(

)

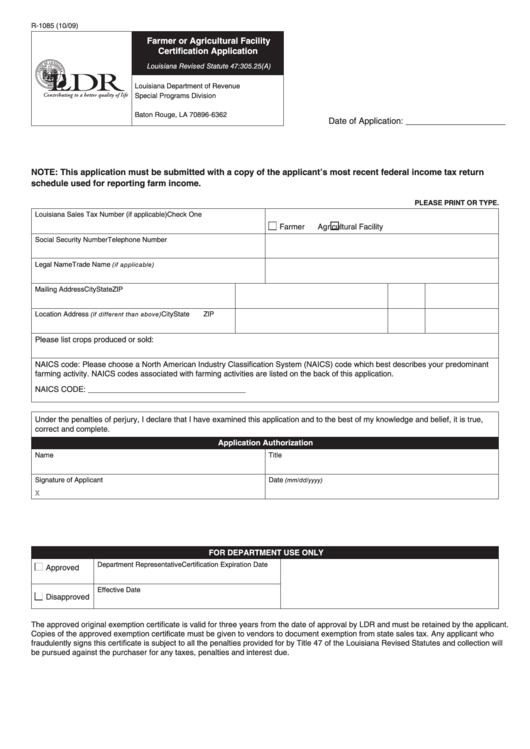

R-1085 (10/09)

Farmer or Agricultural Facility

Certification Application

Louisiana Revised Statute 47:305.25(A)

Louisiana Department of Revenue

Special Programs Division

P.O. Box 66362

Baton Rouge, LA 70896-6362

Date of Application: _____________________

NOTE: This application must be submitted with a copy of the applicant’s most recent federal income tax return

schedule used for reporting farm income.

PLEASE PRINT OR TYPE.

Louisiana Sales Tax Number (if applicable)

Check One

■

■

Farmer

Agricultural Facility

Social Security Number

Telephone Number

Legal Name

Trade Name

(if applicable)

Mailing Address

City

State

ZIP

Location Address

City

State

ZIP

(if different than above)

Please list crops produced or sold:

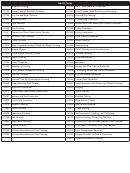

NAICS code: Please choose a North American Industry Classification System (NAICS) code which best describes your predominant

farming activity. NAICS codes associated with farming activities are listed on the back of this application.

NAICS CODE: ____________________________________

Under the penalties of perjury, I declare that I have examined this application and to the best of my knowledge and belief, it is true,

correct and complete.

Application Authorization

Name

Title

Signature of Applicant

Date

(mm/dd/yyyy)

X

FOR DEPARTMENT USE ONLY

Department Representative

Certification Expiration Date

■

Approved

Effective Date

■

Disapproved

The approved original exemption certificate is valid for three years from the date of approval by LDR and must be retained by the applicant.

Copies of the approved exemption certificate must be given to vendors to document exemption from state sales tax. Any applicant who

fraudulently signs this certificate is subject to all the penalties provided for by Title 47 of the Louisiana Revised Statutes and collection will

be pursued against the purchaser for any taxes, penalties and interest due.

1

1 2

2