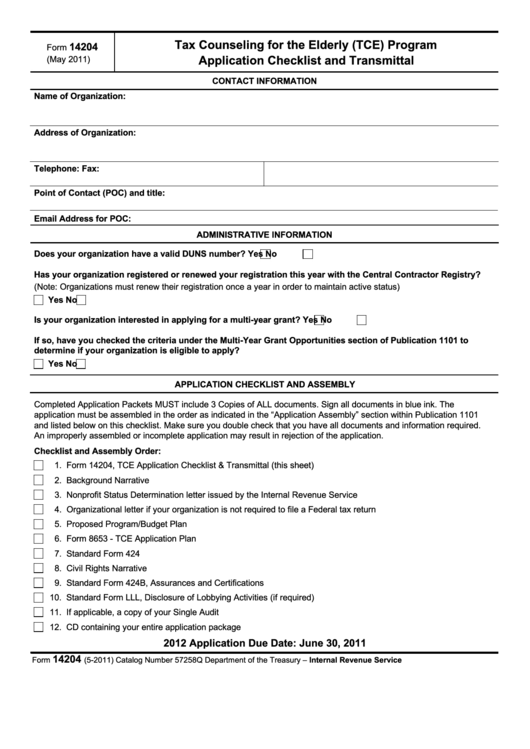

Tax Counseling for the Elderly (TCE) Program

14204

Form

Application Checklist and Transmittal

(May 2011)

CONTACT INFORMATION

Name of Organization:

Address of Organization:

Telephone:

Fax:

Point of Contact (POC) and title:

Email Address for POC:

ADMINISTRATIVE INFORMATION

Does your organization have a valid DUNS number?

Yes

No

Has your organization registered or renewed your registration this year with the Central Contractor Registry?

(Note: Organizations must renew their registration once a year in order to maintain active status)

Yes

No

Is your organization interested in applying for a multi-year grant?

Yes

No

If so, have you checked the criteria under the Multi-Year Grant Opportunities section of Publication 1101 to

determine if your organization is eligible to apply?

Yes

No

APPLICATION CHECKLIST AND ASSEMBLY

Completed Application Packets MUST include 3 Copies of ALL documents. Sign all documents in blue ink. The

application must be assembled in the order as indicated in the “Application Assembly” section within Publication 1101

and listed below on this checklist. Make sure you double check that you have all documents and information required.

An improperly assembled or incomplete application may result in rejection of the application.

Checklist and Assembly Order:

1. Form 14204, TCE Application Checklist & Transmittal (this sheet)

2. Background Narrative

3. Nonprofit Status Determination letter issued by the Internal Revenue Service

4. Organizational letter if your organization is not required to file a Federal tax return

5. Proposed Program/Budget Plan

6. Form 8653 - TCE Application Plan

7. Standard Form 424

8. Civil Rights Narrative

9. Standard Form 424B, Assurances and Certifications

10. Standard Form LLL, Disclosure of Lobbying Activities (if required)

11. If applicable, a copy of your Single Audit

12. CD containing your entire application package

2012 Application Due Date: June 30, 2011

14204

Form

(5-2011)

Catalog Number 57258Q

Department of the Treasury – Internal Revenue Service

1

1