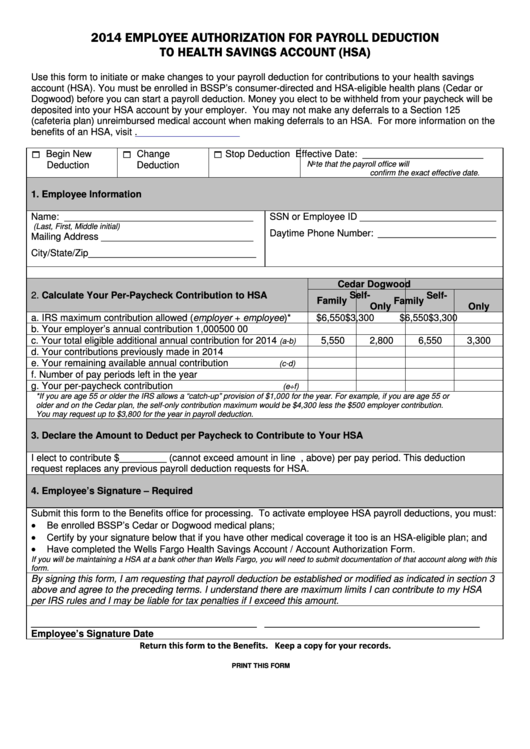

2014 EMPLOYEE AUTHORIZATION FOR PAYROLL DEDUCTION

TO HEALTH SAVINGS ACCOUNT (HSA)

Use this form to initiate or make changes to your payroll deduction for contributions to your health savings

account (HSA). You must be enrolled in BSSP’s consumer-directed and HSA-eligible health plans (Cedar or

Dogwood) before you can start a payroll deduction. Money you elect to be withheld from your paycheck will be

deposited into your HSA account by your employer. You may not make any deferrals to a Section 125

(cafeteria plan) unreimbursed medical account when making deferrals to an HSA. For more information on the

benefits of an HSA, visit

Begin New

Change

Stop Deduction

Effective Date: _______________________

Deduction

Deduction

Note that the payroll office will

confirm the exact effective date.

1. Employee Information

Name: ____________________________________

SSN or Employee ID __________________________

(Last, First, Middle initial)

Daytime Phone Number: _________________________

Mailing Address _____________________________

City/State/Zip________________________________

Cedar

Dogwood

2. Calculate Your Per-Paycheck Contribution to HSA

Self-

Self-

Family

Family

Only

Only

a. IRS maximum contribution allowed (employer + employee)*

$6,550

$3,300

$6,550

$3,300

b. Your employer’s annual contribution

1,000

500

0

0

c. Your total eligible additional annual contribution for 2014

5,550

2,800

6,550

3,300

(a-b)

d. Your contributions previously made in 2014

e. Your remaining available annual contribution

(c-d)

f.

Number of pay periods left in the year

g. Your per-paycheck contribution

(e÷f)

*If you are age 55 or older the IRS allows a “catch-up” provision of $1,000 for the year. For example, if you are age 55 or

older and on the Cedar plan, the self-only contribution maximum would be $4,300 less the $500 employer contribution.

You may request up to $3,800 for the year in payroll deduction.

3. Declare the Amount to Deduct per Paycheck to Contribute to Your HSA

I elect to contribute $_________ (cannot exceed amount in line 2.g., above) per pay period. This deduction

request replaces any previous payroll deduction requests for HSA.

4. Employee’s Signature – Required

Submit this form to the Benefits office for processing. To activate employee HSA payroll deductions, you must:

Be enrolled BSSP’s Cedar or Dogwood medical plans;

Certify by your signature below that if you have other medical coverage it too is an HSA-eligible plan; and

Have completed the Wells Fargo Health Savings Account / Account Authorization Form.

If you will be maintaining a HSA at a bank other than Wells Fargo, you will need to submit documentation of that account along with this

form.

By signing this form, I am requesting that payroll deduction be established or modified as indicated in section 3

above and agree to the preceding terms. I understand there are maximum limits I can contribute to my HSA

per IRS rules and I may be liable for tax penalties if I exceed this amount.

___________________________________________ _________________________________________

Employee’s Signature

Date

Return this form to the Benefits. Keep a copy for your records.

PRINT THIS FORM

1

1