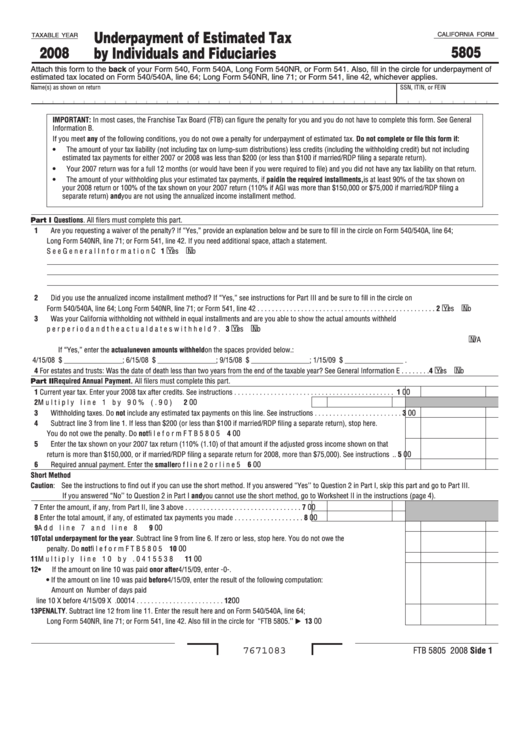

Underpayment of Estimated Tax

CALIFORNIA FORM

TAXABLE YEAR

5805

2008

by Individuals and Fiduciaries

Attach this form to the back of your Form 540, Form 540A, Long Form 540NR, or Form 541. Also, fill in the circle for underpayment of

estimated tax located on Form 540/540A, line 64; Long Form 540NR, line 71; or Form 541, line 42, whichever applies.

Name(s) as shown on return

SSN, ITIN, or FEIN

IMPORTANT: In most cases, the Franchise Tax Board (FTB) can figure the penalty for you and you do not have to complete this form. See General

Information B.

If you meet any of the following conditions, you do not owe a penalty for underpayment of estimated tax. Do not complete or file this form if:

• The amount of your tax liability (not including tax on lump-sum distributions) less credits (including the withholding credit) but not including

estimated tax payments for either 2007 or 2008 was less than $200 (or less than $100 if married/RDP filing a separate return).

• Your 2007 return was for a full 12 months (or would have been if you were required to file) and you did not have any tax liability on that return.

• The amount of your withholding plus your estimated tax payments, if paid in the required installments, is at least 90% of the tax shown on

your 2008 return or 100% of the tax shown on your 2007 return (110% if AGI was more than $150,000 or $75,000 if married/RDP filing a

separate return) and you are not using the annualized income installment method.

Part I Questions. All filers must complete this part.

� Are you requesting a waiver of the penalty? If “Yes,” provide an explanation below and be sure to fill in the circle on Form 540/540A, line 64;

Long Form 540NR, line 71; or Form 541, line 42. If you need additional space, attach a statement.

See General Information C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . �

Yes

No

2 Did you use the annualized income installment method? If “Yes,” see instructions for Part III and be sure to fill in the circle on

Form 540/540A, line 64; Long Form 540NR, line 71; or Form 541, line 42 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Yes

No

3 Was your California withholding not withheld in equal installments and are you able to show the actual amounts withheld

per period and the actual dates withheld? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Yes

No

N/A

If “Yes,” enter the actual uneven amounts withheld on the spaces provided below.:

4/15/08 $ ________________; 6/15/08 $ ________________; 9/15/08 $ ________________; 1/15/09 $ ________________ .

4 For estates and trusts: Was the date of death less than two years from the end of the taxable year? See General Information E . . . . . . . . 4

Yes

No

Part II Required Annual Payment. All filers must complete this part.

00

� Current year tax. Enter your 2008 tax after credits. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�

00

2 Multiply line 1 by 90% (.90) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3 Withholding taxes. Do not include any estimated tax payments on this line. See instructions . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Subtract line 3 from line 1. If less than $200 (or less than $100 if married/RDP filing a separate return), stop here.

00

You do not owe the penalty. Do not file form FTB 5805 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Enter the tax shown on your 2007 tax return (110% (1.10) of that amount if the adjusted gross income shown on that

00

return is more than $150,000, or if married/RDP filing a separate return for 2008, more than $75,000). See instructions . .

5

00

6 Required annual payment. Enter the smaller of line 2 or line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Short Method

Caution: See the instructions to find out if you can use the short method. If you answered “Yes’’ to Question 2 in Part I, skip this part and go to Part III.

If you answered “No’’ to Question 2 in Part I and you cannot use the short method, go to Worksheet II in the instructions (page 4).

00

7 Enter the amount, if any, from Part II, line 3 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Enter the total amount, if any, of estimated tax payments you made . . . . . . . . . . . . . . . . . . .

8

00

9 Add line 7 and line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

�0 Total underpayment for the year. Subtract line 9 from line 6. If zero or less, stop here. You do not owe the

00

penalty. Do not file form FTB 5805 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�0

00

�� Multiply line 10 by .0415538 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

��

�2 • If the amount on line 10 was paid on or after 4/15/09, enter -0-.

• If the amount on line 10 was paid before 4/15/09, enter the result of the following computation:

Amount on

Number of days paid

.00014 . . . . . . . . . . . . . . . . . . . . . . . . �2

00

line 10

X

before 4/15/09

X

�3 PENALTY. Subtract line 12 from line 11. Enter the result here and on Form 540/540A, line 64;

00

Long Form 540NR, line 71; or Form 541, line 42. Also fill in the circle for “FTB 5805.’’ . . . . . . . . . . . . . . . . . . . . . . . . . . �3

FTB 5805 2008 Side �

7671083

1

1 2

2 3

3