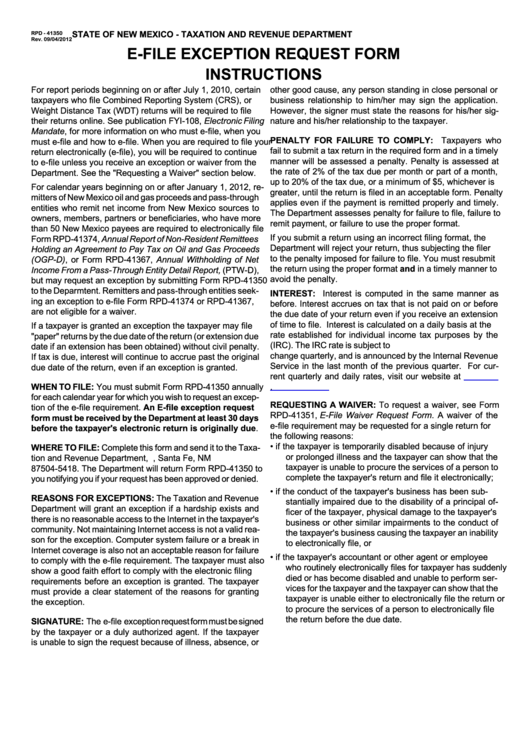

Form Rpd - 41350 - E-File Exception Request Form Instructions - Taxation And Revenue Department

ADVERTISEMENT

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

RPD - 41350

Rev. 09/04/2012

E-FILE EXCEPTION REQUEST FORM

INSTRUCTIONS

For report periods beginning on or after July 1, 2010, certain

other good cause, any person standing in close personal or

taxpayers who file Combined Reporting System (CRS), or

business relationship to him/her may sign the application.

Weight Distance Tax (WDT) returns will be required to file

However, the signer must state the reasons for his/her sig-

their returns online. See publication FYI-108, Electronic Filing

nature and his/her relationship to the taxpayer.

Mandate, for more information on who must e-file, when you

PENALTY FOR FAILURE TO COMPLY: Taxpayers who

must e-file and how to e-file. When you are required to file your

fail to submit a tax return in the required form and in a timely

return electronically (e-file), you will be required to continue

manner will be assessed a penalty. Penalty is assessed at

to e-file unless you receive an exception or waiver from the

the rate of 2% of the tax due per month or part of a month,

Department. See the "Requesting a Waiver" section below.

up to 20% of the tax due, or a minimum of $5, whichever is

For calendar years beginning on or after January 1, 2012, re-

greater, until the return is filed in an acceptable form. Penalty

mitters of New Mexico oil and gas proceeds and pass-through

applies even if the payment is remitted properly and timely.

entities who remit net income from New Mexico sources to

The Department assesses penalty for failure to file, failure to

owners, members, partners or beneficiaries, who have more

remit payment, or failure to use the proper format.

than 50 New Mexico payees are required to electronically file

If you submit a return using an incorrect filing format, the

Form RPD-41374, Annual Report of Non-Resident Remittees

Department will reject your return, thus subjecting the filer

Holding an Agreement to Pay Tax on Oil and Gas Proceeds

to the penalty imposed for failure to file. You must resubmit

(OGP-D), or Form RPD-41367, Annual Withholding of Net

the return using the proper format and in a timely manner to

Income From a Pass-Through Entity Detail Report, (PTW-D),

avoid the penalty.

but may request an exception by submitting Form RPD-41350

to the Deparmtent. Remitters and pass-through entities seek-

INTEREST: Interest is computed in the same manner as

ing an exception to e-file Form RPD-41374 or RPD-41367,

before. Interest accrues on tax that is not paid on or before

are not eligible for a waiver.

the due date of your return even if you receive an extension

of time to file. Interest is calculated on a daily basis at the

If a taxpayer is granted an exception the taxpayer may file

rate established for individual income tax purposes by the

"paper" returns by the due date of the return (or extension due

U.S. Internal Revenue Code (IRC). The IRC rate is subject to

date if an extension has been obtained) without civil penalty.

change quarterly, and is announced by the Internal Revenue

If tax is due, interest will continue to accrue past the original

Service in the last month of the previous quarter. For cur-

due date of the return, even if an exception is granted.

rent quarterly and daily rates, visit our website at

WHEN TO FILE: You must submit Form RPD-41350 annually

newmexico.gov.

for each calendar year for which you wish to request an excep-

REQUESTING A WAIVER: To request a waiver, see Form

tion of the e-file requirement. An E-file exception request

RPD-41351, E-File Waiver Request Form. A waiver of the

form must be received by the Department at least 30 days

e-file requirement may be requested for a single return for

before the taxpayer's electronic return is originally due.

the following reasons:

•

if the taxpayer is temporarily disabled because of injury

WHERE TO FILE: Complete this form and send it to the Taxa-

or prolonged illness and the taxpayer can show that the

tion and Revenue Department, P.O. Box 5418, Santa Fe, NM

taxpayer is unable to procure the services of a person to

87504-5418. The Department will return Form RPD-41350 to

complete the taxpayer's return and file it electronically;

you notifying you if your request has been approved or denied.

•

if the conduct of the taxpayer's business has been sub-

REASONS FOR EXCEPTIONS: The Taxation and Revenue

stantially impaired due to the disability of a principal of-

Department will grant an exception if a hardship exists and

ficer of the taxpayer, physical damage to the taxpayer's

there is no reasonable access to the Internet in the taxpayer's

business or other similar impairments to the conduct of

community. Not maintaining Internet access is not a valid rea-

the taxpayer's business causing the taxpayer an inability

son for the exception. Computer system failure or a break in

to electronically file, or

Internet coverage is also not an acceptable reason for failure

•

if the taxpayer's accountant or other agent or employee

to comply with the e-file requirement. The taxpayer must also

who routinely electronically files for taxpayer has suddenly

show a good faith effort to comply with the electronic filing

died or has become disabled and unable to perform ser-

requirements before an exception is granted. The taxpayer

vices for the taxpayer and the taxpayer can show that the

must provide a clear statement of the reasons for granting

taxpayer is unable either to electronically file the return or

the exception.

to procure the services of a person to electronically file

the return before the due date.

SIGNATURE: The e-file exception request form must be signed

by the taxpayer or a duly authorized agent. If the taxpayer

is unable to sign the request because of illness, absence, or

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1