General Instructions For Form 8832

ADVERTISEMENT

2

Form 8832 (Rev. 1-2006)

Page

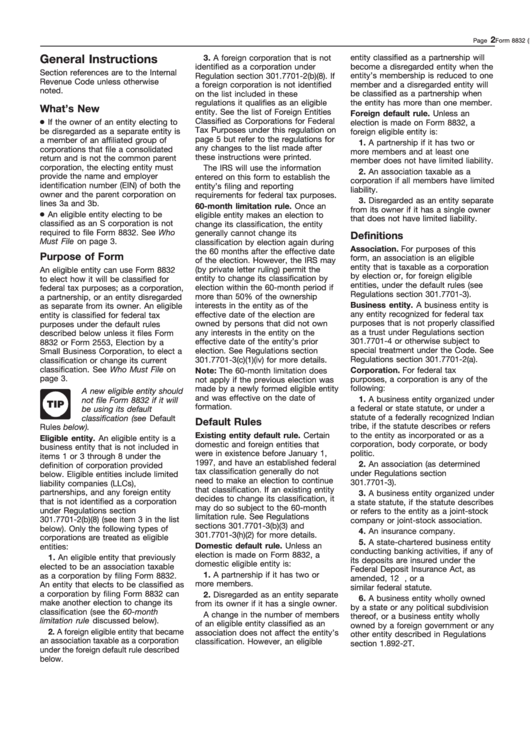

General Instructions

3. A foreign corporation that is not

entity classified as a partnership will

identified as a corporation under

become a disregarded entity when the

Section references are to the Internal

entity’s membership is reduced to one

Regulation section 301.7701-2(b)(8). If

Revenue Code unless otherwise

member and a disregarded entity will

a foreign corporation is not identified

noted.

on the list included in these

be classified as a partnership when

regulations it qualifies as an eligible

the entity has more than one member.

What’s New

entity. See the list of Foreign Entities

Foreign default rule. Unless an

● If the owner of an entity electing to

Classified as Corporations for Federal

election is made on Form 8832, a

Tax Purposes under this regulation on

be disregarded as a separate entity is

foreign eligible entity is:

page 5 but refer to the regulations for

a member of an affiliated group of

1. A partnership if it has two or

any changes to the list made after

corporations that file a consolidated

more members and at least one

these instructions were printed.

return and is not the common parent

member does not have limited liability.

corporation, the electing entity must

The IRS will use the information

2. An association taxable as a

provide the name and employer

entered on this form to establish the

corporation if all members have limited

identification number (EIN) of both the

entity’s filing and reporting

liability.

owner and the parent corporation on

requirements for federal tax purposes.

3. Disregarded as an entity separate

lines 3a and 3b.

60-month limitation rule. Once an

from its owner if it has a single owner

● An eligible entity electing to be

eligible entity makes an election to

that does not have limited liability.

classified as an S corporation is not

change its classification, the entity

required to file Form 8832. See Who

generally cannot change its

Definitions

Must File on page 3.

classification by election again during

Association. For purposes of this

the 60 months after the effective date

Purpose of Form

form, an association is an eligible

of the election. However, the IRS may

entity that is taxable as a corporation

(by private letter ruling) permit the

An eligible entity can use Form 8832

by election or, for foreign eligible

entity to change its classification by

to elect how it will be classified for

entities, under the default rules (see

election within the 60-month period if

federal tax purposes; as a corporation,

Regulations section 301.7701-3).

more than 50% of the ownership

a partnership, or an entity disregarded

Business entity. A business entity is

interests in the entity as of the

as separate from its owner. An eligible

any entity recognized for federal tax

effective date of the election are

entity is classified for federal tax

purposes that is not properly classified

owned by persons that did not own

purposes under the default rules

as a trust under Regulations section

any interests in the entity on the

described below unless it files Form

301.7701-4 or otherwise subject to

effective date of the entity’s prior

8832 or Form 2553, Election by a

special treatment under the Code. See

election. See Regulations section

Small Business Corporation, to elect a

Regulations section 301.7701-2(a).

301.7701-3(c)(1)(iv) for more details.

classification or change its current

classification. See Who Must File on

Corporation. For federal tax

Note: The 60-month limitation does

page 3.

purposes, a corporation is any of the

not apply if the previous election was

following:

made by a newly formed eligible entity

A new eligible entity should

and was effective on the date of

1. A business entity organized under

not file Form 8832 if it will

TIP

formation.

a federal or state statute, or under a

be using its default

statute of a federally recognized Indian

classification (see Default

Default Rules

tribe, if the statute describes or refers

Rules below).

Existing entity default rule. Certain

to the entity as incorporated or as a

Eligible entity. An eligible entity is a

corporation, body corporate, or body

domestic and foreign entities that

business entity that is not included in

were in existence before January 1,

politic.

items 1 or 3 through 8 under the

1997, and have an established federal

2. An association (as determined

definition of corporation provided

tax classification generally do not

under Regulations section

below. Eligible entities include limited

need to make an election to continue

301.7701-3).

liability companies (LLCs),

that classification. If an existing entity

partnerships, and any foreign entity

3. A business entity organized under

decides to change its classification, it

that is not identified as a corporation

a state statute, if the statute describes

may do so subject to the 60-month

under Regulations section

or refers to the entity as a joint-stock

limitation rule. See Regulations

301.7701-2(b)(8) (see item 3 in the list

company or joint-stock association.

sections 301.7701-3(b)(3) and

below). Only the following types of

4. An insurance company.

301.7701-3(h)(2) for more details.

corporations are treated as eligible

5. A state-chartered business entity

Domestic default rule. Unless an

entities:

conducting banking activities, if any of

election is made on Form 8832, a

1. An eligible entity that previously

its deposits are insured under the

domestic eligible entity is:

elected to be an association taxable

Federal Deposit Insurance Act, as

1. A partnership if it has two or

as a corporation by filing Form 8832.

amended, 12 U.S.C. 1811 et seq., or a

more members.

An entity that elects to be classified as

similar federal statute.

a corporation by filing Form 8832 can

2. Disregarded as an entity separate

6. A business entity wholly owned

make another election to change its

from its owner if it has a single owner.

by a state or any political subdivision

classification (see the 60-month

A change in the number of members

thereof, or a business entity wholly

limitation rule discussed below).

of an eligible entity classified as an

owned by a foreign government or any

2. A foreign eligible entity that became

association does not affect the entity’s

other entity described in Regulations

an association taxable as a corporation

classification. However, an eligible

section 1.892-2T.

under the foreign default rule described

below.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4