Request For Review Of Property Tax Assessment Form - Nyc Department Of Finance

ADVERTISEMENT

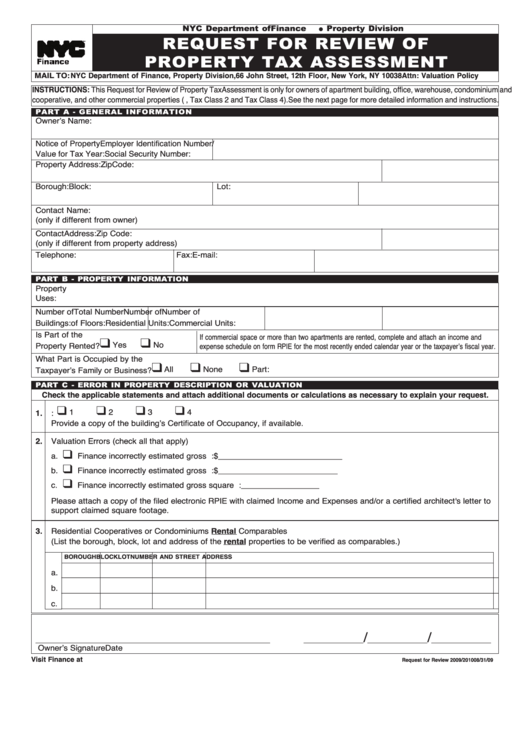

NYC Department of Finance

Property Division

REQUEST FOR REVIEW OF

G

PROPERTY TAX ASSESSMENT

MAIL TO: NYC Department of Finance, Property Division, 66 John Street, 12th Floor, New York, NY 10038 Attn: Valuation Policy

INSTRUCTIONS: This Request for Review of Property Tax Assessment is only for owners of apartment building, office, warehouse, condominium and

cooperative, and other commercial properties (i.e., Tax Class 2 and Tax Class 4). See the next page for more detailed information and instructions.

PART A - GENERAL INFORMATION

Ownerʼs Name:

Notice of Property

Employer Identification Number/

Value for Tax Year:

Social Security Number:

Property Address:

Zip Code:

Borough:

Block:

Lot:

Contact Name:

(only if different from owner)

Contact Address:

Zip Code:

(only if different from property address)

Telephone:

Fax:

E-mail:

PART B - PROPERTY INFORMATION

Property

Uses:

Number of

Total Number

Number of

Number of

Buildings:

of Floors:

Residential Units:

Commercial Units:

Is Part of the

If commercial space or more than two apartments are rented, complete and attach an income and

K

K

Yes

No

Property Rented?

expense schedule on form RPIE for the most recently ended calendar year or the taxpayerʼs fiscal year.

What Part is Occupied by the

K

K

K

All

None

Part:

Taxpayerʼs Family or Business?

PART C - ERROR IN PROPERTY DESCRIPTION OR VALUATION

Check the applicable statements and attach additional documents or calculations as necessary to explain your request.

K

K

K

K

1.

1

2

3

4

The property is misclassified. The correct class is: ...............................................

Provide a copy of the buildingʼs Certificate of Occupancy, if available.

2.

Valuation Errors (check all that apply)

K

a.

Finance incorrectly estimated gross income. The correct gross income is: $ ___________________________

K

b.

Finance incorrectly estimated gross expense. The correct gross expense is: $ __________________________

K

c.

Finance incorrectly estimated gross square footage. The correct gross square footage is: _________________

Please attach a copy of the filed electronic RPIE with claimed Income and Expenses and/or a certified architect's letter to

support claimed square footage.

3.

Residential Cooperatives or Condominiums Rental Comparables

(List the borough, block, lot and address of the rental properties to be verified as comparables.)

BOROUGH

BLOCK

LOT

NUMBER AND STREET ADDRESS

a. _______________________________________________________________________________________________

b. _______________________________________________________________________________________________

c. _______________________________________________________________________________________________

/

/

___________________________________________________

_____________

_____________

_____________

Ownerʼs Signature

Date

Visit Finance at nyc.gov/finance

Request for Review 2009/2010 08/31/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1