If you are a member of a qualified

piping or wiring to interconnect such property

Alternative Motor Vehicles and

to the home. This credit is limited to:

condominium management

Refueling Property

TIP

association for a condominium

● $2,000 for qualified photovoltaic property

You may be able to take a credit if you place

which you own or a tenant-

costs,

an energy efficient motor vehicle or alternative

stockholder in a cooperative

● $2,000 for qualified solar water heating

fuel vehicle refueling property in service in

housing corporation, you are treated as having

2006. You can no longer take a deduction for

property costs, and

paid your proportionate share of any expenses

clean-fuel vehicles or refueling property. For

● $500 for each half kilowatt of capacity of

of such association or corporation. Credits

details, see Form 8910 (Form 8911 for

qualified fuel cell property for which qualified

must be allocated based on the ratio of

alternative fuel vehicle refueling property).

fuel cell property costs are paid.

individual qualified costs to total qualified

Qualified photovoltaic property costs.

Clean Renewable Energy Bond Credit

costs in the case of joint occupancy.

Qualified photovoltaic property costs are costs

Nonbusiness energy property credit. You

You may be able to take a credit based on the

for property which uses solar energy to

may be able to take a credit equal to (a) 10%

face amount of any clean renewable energy

generate electricity for use in a home located

of the amount paid in 2006 for qualified energy

bond you hold during 2006. The amount of any

in the United States and which is used by you

efficiency improvements installed during 2006,

credit claimed must be included as interest

as a home. This includes costs relating to a

plus (b) any residential energy property costs

income. For details, see Form 8912.

solar panel or other property installed as a roof

paid in 2006. However, this credit is limited as

Nonconventional Source Fuel Credit

or a portion of a roof.

follows.

You may be able to claim the nonconventional

Qualified solar water heating property

● A total accumulated credit limit of $500 for

source fuel credit for facilities producing coke

costs. Qualified solar water heating property

all tax years.

costs are costs for property to heat water for

or coke gas. Also, the nonconventional source

● A maximum accumulated credit limit of

fuel credit is now a general business credit

use in a home located in the United States and

$200 for windows for all tax years.

subject to the general business credit tax

which is used by you as a home if at least half

● A maximum credit for residential energy

of the energy used by such property for such

liability limits. In general, any 2006 unused

property costs of $50 for any advanced main

purpose is derived from the sun. This includes

credit can be carried forward 20 years. See

air circulating fan; $150 for any qualified

Form 8907 for details.

costs relating to a solar panel or other property

natural gas, propane, or oil furnace or hot

installed as a roof or a portion of a roof. To

Qualified Contributions Expired

water boiler; and $300 for any item of energy

qualify for the credit, the property must be

efficient building property.

You can no longer elect to treat gifts by cash

certified for performance by the nonprofit Solar

or check as qualified contributions on

Qualified energy efficiency

Rating Certification Corporation or a

Schedule A. Qualified contributions for which

improvements. Qualified energy efficiency

comparable entity endorsed by the

you made this election were not subject to the

government of the state in which such

improvements are the following items installed

50% of adjusted gross income limit or the

on or in your main home located in the United

property is installed.

overall limit on itemized deductions.

States if such items are new and can be

Qualified fuel cell property costs.

expected to remain in use for at least 5 years.

Qualified fuel cell property costs are costs for

● Any insulation material or system which is

Pending legislation may eliminate

qualified fuel cell property installed on or in

one or more of the following

specifically or primarily designed to reduce the

connection with your main home located in the

changes.

heat loss or gain of a home when installed in

United States. Qualified fuel cell property is an

CAUTION

or on such home.

integrated system comprised of a fuel cell

● Exterior windows (including skylights).

stack assembly and associated balance of

Certain Credits No Longer Allowed

plant components that converts a fuel into

● Exterior doors.

Against Alternative Minimum Tax

electricity using electrochemical means. To

● Any metal roof installed on a home, but only

(AMT)

qualify for the credit, the fuel cell property

if such roof has appropriate pigmented

The credit for child and dependent care

must have a nameplate capacity of at least

coatings which are specifically and primarily

one-half kilowatt of electricity using an

expenses, credit for the elderly or the disabled,

designed to reduce the heat gain of such

education credits, mortgage interest credit,

electrochemical process and an

home.

and carryforwards of the District of Columbia

electricity-only generation efficiency greater

first-time homebuyer credit are no longer

than 30%.

To qualify for the credit, qualified

allowed against AMT and a new tax liability

energy efficiency improvements

Costs allocable to a swimming

limit applies. For most people, this limit is your

pool, hot tub, or any other energy

must meet certain energy

regular tax minus any tentative minimum tax.

efficiency requirements.

storage medium which has a

CAUTION

function other than the function of

AMT Exemption Amount Decreased

CAUTION

Residential energy property costs.

such storage do not qualify for

The AMT exemption amount will decrease to

Residential energy property costs are costs of

the residential energy efficiency credit.

$33,750 ($45,000 if married filing jointly or a

new qualified energy property that is installed

qualifying widow(er); $22,500 if married filing

Earned Income Credit (EIC)

on or in connection with your main home

separately).

located in the United States. This includes

You may be able to take the EIC if:

labor costs properly allocable to the onsite

● A child lived with you and you earned less

Expired Tax Benefits

preparation, assembly, or original installation

than $36,348 ($38,348 if married filing jointly),

The following tax benefits have expired and

of the property. Qualified energy property is

or

will not apply for 2006.

any of the following.

● A child did not live with you and you earned

● Deduction from adjusted gross income for

● Certain electric heat pump water heaters;

less than $12,120 ($14,120 if married filing

educator expenses.

electric heat pumps; geothermal heat pumps;

jointly).

● Tuition and fees deduction.

central air conditioners; and natural gas,

● Deduction for state and local general sales

propane, or oil water heaters.

IRA Deduction Expanded

● Qualified natural gas, propane, or oil furnace

taxes.

You and your spouse, if filing jointly, may each

or hot water boilers.

● District of Columbia first-time homebuyer

be able to deduct up to $5,000 if age 50 or

● Certain advanced main air circulating fans

older at the end of 2006. You may be able to

credit (for homes purchased after 2005).

take an IRA deduction if you were covered by

used in a natural gas, propane, or oil furnace.

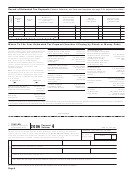

To Figure Your Estimated

a retirement plan and your 2006 modified AGI

To qualify for the credit, qualified

is less than $85,000 if married filing jointly or

Tax, Use:

energy property must meet

qualifying widow(er).

● The 2006 Estimated Tax Worksheet on

certain performance and quality

Standard Mileage Rates

standards.

page 4.

CAUTION

The 2006 rate for business use of your vehicle

● The Instructions for the 2006 Estimated Tax

Residential energy efficient property credit.

is 44

1

⁄

cents a mile. The 2006 rate for use of

2

Worksheet on page 4.

You may be able to take a credit of 30% of

your vehicle to get medical care or move is 18

● The 2006 Tax Rate Schedules on page 5.

your costs of qualified photovoltaic property,

cents a mile. The 2006 rate for charitable use

● Your 2005 tax return and instructions, as a

solar water heating property, and fuel cell

of your vehicle to provide relief related to

property. This includes labor costs properly

guide to figuring your income, deductions, and

Hurricane Katrina is 32 cents a mile. The 2006

allocable to the onsite preparation, assembly,

credits (but be sure to consider the items

rate of 14 cents a mile for other charitable use

or original installation of the property and for

listed under What’s New for 2006 that begins

is unchanged.

on page 1).

Page 2

1

1 2

2 3

3 4

4 5

5 6

6