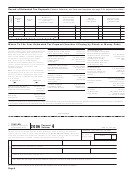

2006 Estimated Tax Worksheet

Keep for Your Records

1

1

Adjusted gross income you expect in 2006 (see instructions below)

● If you plan to itemize deductions, enter the estimated total of your itemized deductions.

2

Caution: If line 1 above is over $150,500 ($75,250 if married filing separately), your deduction may be

2

reduced. See Pub. 505 for details.

● If you do not plan to itemize deductions, enter your standard deduction from page 1.

3

3

Subtract line 2 from line 1

4

Exemptions. Multiply $3,300 by the number of personal exemptions. Caution: See Pub. 505 to figure the

amount to enter if you provided housing in 2006 to a person displaced by Hurricane Katrina, or if line 1 above

is over: $225,750 if married filing jointly or qualifying widow(er); $188,150 if head of household; $150,500 if

4

single; or $112,875 if married filing separately

5

5

Subtract line 4 from line 3

6

Tax. Figure your tax on the amount on line 5 by using the 2006 Tax Rate Schedules on page 5. Caution: If

6

you have qualified dividends or a net capital gain, see Pub. 505 to figure the tax

7

7

Alternative minimum tax from Form 6251

8

Add lines 6 and 7. Also include any tax from Forms 4972 and 8814 and any recapture of education credits

8

(see instructions below)

9

9

Credits (see instructions below). Do not include any income tax withholding on this line

10

10

Subtract line 9 from line 8. If zero or less, enter -0-

11

Self-employment tax (see instructions below). Estimate of 2006 net earnings from self-employment

$

; if $94,200 or less, multiply the amount by 15.3%; if more than $94,200, multiply the

amount by 2.9%, add $11,680.80 to the result, and enter the total. Caution: If you also have wages subject to

11

social security tax, see Pub. 505 to figure the amount to enter

12

12

Other taxes (see instructions below)

13a

13a

Add lines 10 through 12

13b

b

Earned income credit, additional child tax credit, and credits from Form 4136 and Form 8885

13c

c Total 2006 estimated tax. Subtract line 13b from line 13a. If zero or less, enter -0-

14a

14a

Multiply line 13c by 90% (66

2

⁄

% for farmers and fishermen)

3

b

Enter the tax shown on your 2005 tax return (110% of that amount if you are not

a farmer or fisherman and the adjusted gross income shown on that return is

14b

more than $150,000 or, if married filing separately for 2006, more than $75,000)

14c

c Required annual payment to avoid a penalty. Enter the smaller of line 14a or 14b

Caution: Generally, if you do not prepay (through income tax withholding and estimated tax payments) at least the amount on

line 14c, you may owe a penalty for not paying enough estimated tax. To avoid a penalty, make sure your estimate on line 13c

is as accurate as possible. Even if you pay the required annual payment, you may still owe tax when you file your return. If you

prefer, you can pay the amount shown on line 13c. For details, see Pub. 505.

15

Income tax withheld and estimated to be withheld during 2006 (including income tax withholding on pensions,

15

annuities, certain deferred income, etc.)

16

Subtract line 15 from line 14c. (Note: If zero or less or line 13c minus line 15 is less than $1,000, stop here. You

16

are not required to make estimated tax payments.)

17

If the first payment you are required to make is due April 17, 2006, enter

1

⁄

of line 16 (minus any 2005

4

overpayment that you are applying to this installment) here, and on your estimated tax payment voucher(s) if

you are paying by check or money order. (Note: Household employers, see instructions below.)

17

● Alternative motor vehicle credit. See Form

● You will have federal income tax withheld

Instructions for the 2006

8910.

from wages, pensions, annuities, gambling

Estimated Tax Worksheet

● Alternative fuel vehicle refueling property

winnings, or other income, or

● You would be required to make estimated

Line 1. Adjusted gross income. Use your

credit. See Form 8911.

2005 tax return and instructions as a guide to

● Clean renewable energy bond credit. See

tax payments (to avoid a penalty) even if you

figuring the adjusted gross income you expect

did not include household employment taxes

Form 8912.

in 2006 (but be sure to consider the items

when figuring your estimated tax.

Line 11. Self-employment tax. If you and

listed under What’s New for 2006 that begin

Do not include tax on recapture of a federal

your spouse make joint estimated tax

on page 1). For more details on figuring your

mortgage subsidy, social security and

payments and you both have self-employment

adjusted gross income, see Expected

Medicare tax on unreported tip income,

income, figure the self-employment tax for

Adjusted Gross Income in Pub. 505. If you are

uncollected employee social security and

each of you separately. Enter the total on

self-employed, be sure to take into account

Medicare tax or RRTA tax on tips or

line 11. When figuring your estimate of 2006

the deduction for one-half of your

group-term life insurance, tax on golden

net earnings from self-employment, be sure to

self-employment tax.

parachute payments, or excise tax on insider

use only 92.35% of your total net profit from

Line 8. Include on this line the additional

stock compensation from an expatriated

self-employment.

taxes from Form 4972, Tax on Lump-Sum

corporation. These taxes are not required to

Line 12. Other taxes. Except as noted

Distributions, and Form 8814, Parents’

be paid until the due date of your income tax

below, enter any other taxes, such as the

Election To Report Child’s Interest and

return (not including extensions).

taxes on distributions from a Coverdell

Dividends. Also include any recapture of

Line 17. If you are a household employer and

education savings account or a qualified

education credits.

you make advance EIC payments to your

tuition program, and early distributions from

Line 9. Credits. See the instructions for the

employee(s), reduce your required estimated

(a) an IRA or other qualified retirement plan,

2005 Form 1040, lines 47 through 55, or Form

tax payment for each period by the amount of

(b) an annuity, or (c) a modified endowment

1040A, lines 29 through 34. Also include any

advance EIC payments paid during the

contract entered into after June 20, 1988.

of the following credits in the total on line 9.

period.

Include household employment taxes

● Residential energy credit. See Residential

(before subtracting advance EIC payments

Energy Credits that begins on page 1.

made to your employee(s)) on line 12 if:

Page 4

1

1 2

2 3

3 4

4 5

5 6

6