We ask for tax return information to carry out the tax laws of

Privacy Act and Paperwork Reduction Act Notice. The Privacy

Act of 1974 and the Paperwork Reduction Act of 1980 require

the United States. We need it to figure and collect the right

amount of tax.

that when we ask you for information we must first tell you our

legal right to ask for the information, why we are asking for it,

We may disclose the information to the Department of Justice

and how it will be used. We must also tell you what could

and to other federal agencies, as provided by law. We may

happen if we do not receive it and whether your response is

disclose it to cities, states, the District of Columbia, and U.S.

voluntary, required to obtain a benefit, or mandatory under the

commonwealths or possessions to carry out their tax laws. We

law.

may also disclose this information to other countries under a tax

treaty, to federal and state agencies to enforce federal nontax

This notice applies to all papers you file with us. It also applies

criminal laws, or to federal law enforcement and intelligence

to any questions we need to ask you so we can complete,

agencies to combat terrorism.

correct, or process your return; figure your tax; and collect tax,

interest, or penalties.

If you do not file a return, do not give the information asked

for, or give fraudulent information, you may be charged penalties

Our legal right to ask for information is Internal Revenue Code

and be subject to criminal prosecution.

sections 6001, 6011, and 6012(a), and their regulations. They say

that you must file a return or statement with us for any tax for

Please keep this notice with your records. It may help you if

which you are liable. Your response is mandatory under these

we ask you for other information. If you have any questions

sections. Code section 6109 and its regulations say that you

about the rules for filing and giving information, please call or

must provide your taxpayer identification number on what you

visit any Internal Revenue Service office.

file. This is so we know who you are, and can process your

The average time and expenses required to complete and file

return and other papers.

this form will vary depending on individual circumstances. For

You are not required to provide the information requested on

the estimated averages, see the instructions for your income tax

a form that is subject to the Paperwork Reduction Act unless the

return.

form displays a valid OMB control number. Books or records

If you have suggestions for making this package simpler, we

relating to a form or its instructions must be retained as long as

would be happy to hear from you. See the instructions for your

their contents may become material in the administration of any

income tax return.

Internal Revenue law. Generally, tax returns and return

information are confidential, as stated in Code section 6103.

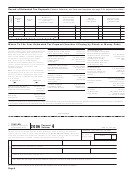

2006 Tax Rate Schedules

Caution. Do not use these Tax Rate Schedules to figure your 2005 taxes. Use only to figure your 2006 estimated taxes.

Schedule X—Use if your 2006 filing status is Single

Schedule Z—Use if your 2006 filing status is

Head of household

If line 5 is:

The tax is:

of the

If line 5 is:

The tax is:

of the

But not

But not

amount

amount

over—

Over—

over—

over—

Over—

over—

$0

$7,550

10%

$0

$0

$10,750

10%

$0

7,550

30,650

$755.00 + 15%

7,550

10,750

41,050

$1,075.00 + 15%

10,750

30,650

74,200

4,220.00 + 25%

30,650

41,050

106,000

5,620.00 + 25%

41,050

74,200

154,800

15,107.50 + 28%

74,200

106,000

171,650

21,857.50 + 28%

106,000

154,800

336,550

37,675.50 + 33%

154,800

171,650

336,550

40,239.50 + 33%

171,650

336,550

97,653.00 + 35%

336,550

336,550

94,656.50 + 35%

336,550

Schedule Y-1—Use if your 2006 filing status is

Schedule Y-2—Use if your 2006 filing status is

Married filing jointly or Qualifying widow(er)

Married filing separately

If line 5 is:

The tax is:

of the

If line 5 is:

The tax is:

of the

But not

But not

amount

amount

over—

Over—

over—

over—

Over—

over—

$0

$7,550

10%

$0

$0

$15,100

10%

$0

15,100

61,300

$1,510.00 + 15%

15,100

7,550

30,650

$755.00 + 15%

7,550

30,650

61,850

4,220.00 + 25%

30,650

61,300

123,700

8,440.00 + 25%

61,300

123,700

188,450

24,040.00 + 28%

123,700

61,850

94,225

12,020.00 + 28%

61,850

94,225

168,275

21,085.00 + 33%

94,225

188,450

336,550

42,170.00 + 33%

188,450

336,550

91,043.00 + 35%

336,550

168,275

45,521.50 + 35%

168,275

Page 5

1

1 2

2 3

3 4

4 5

5 6

6