Form 39r - Idaho Supplemental Schedule For Form 40 - 2010

ADVERTISEMENT

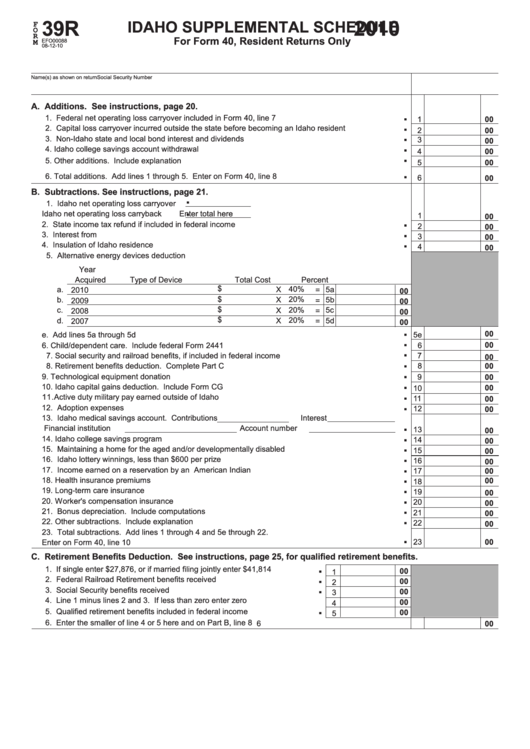

39R

2010

F

IDAHO SUPPLEMENTAL SCHEDULE

O

R

For Form 40, Resident Returns Only

M

EFO00088

08-12-10

Name(s) as shown on return

Social Security Number

.

A. Additions. See instructions, page 20.

. .

1. Federal net operating loss carryover included in Form 40, line 7 .....................................................

1

00

2. Capital loss carryover incurred outside the state before becoming an Idaho resident .....................

2

00

. .

3. Non-Idaho state and local bond interest and dividends ....................................................................

3

00

4. Idaho college savings account withdrawal ........................................................................................

4

00

5. Other additions. Include explanation ...............................................................................................

.

5

00

6. Total additions. Add lines 1 through 5. Enter on Form 40, line 8 ....................................................

6

00

.

B. Subtractions. See instructions, page 21.

.

1. Idaho net operating loss carryover

.

Idaho net operating loss carryback

Enter total here ...................................

1

00

. .

2. State income tax refund if included in federal income .......................................................................

2

00

3. Interest from U.S. Government obligations .......................................................................................

3

00

4. Insulation of Idaho residence ............................................................................................................

4

00

5. Alternative energy devices deduction

Year

Acquired

Type of Device

Total Cost

Percent

$

a.

40%

5a

X

2010

=

00

$

b.

20%

5b

X

2009

=

00

$

c.

20%

5c

X

2008

=

00

$

20%

. .

d.

X

5d

2007

=

00

00

e. Add lines 5a through 5d ................................................................................................................

5e

.

00

6. Child/dependent care. Include federal Form 2441 ...........................................................................

6

.

7. Social security and railroad benefits, if included in federal income ...................................................

7

00

.

8. Retirement benefits deduction. Complete Part C .............................................................................

8

00

.

9. Technological equipment donation ....................................................................................................

9

00

. .

10. Idaho capital gains deduction. Include Form CG .............................................................................

00

10

11. Active duty military pay earned outside of Idaho ...............................................................................

11

00

12. Adoption expenses ............................................................................................................................

12

00

. .

13. Idaho medical savings account. Contributions

Interest

Financial institution

Account number

13

00

. .

14. Idaho college savings program .........................................................................................................

14

00

15. Maintaining a home for the aged and/or developmentally disabled ..................................................

15

00

. .

16. Idaho lottery winnings, less than $600 per prize ...............................................................................

16

00

17. Income earned on a reservation by an American Indian ..................................................................

17

00

. .

18. Health insurance premiums ...............................................................................................................

00

18

19. Long-term care insurance .................................................................................................................

19

00

. .

20. Worker's compensation insurance ....................................................................................................

20

00

21. Bonus depreciation. Include computations .......................................................................................

21

00

22. Other subtractions. Include explanation ...........................................................................................

22

00

.

23. Total subtractions. Add lines 1 through 4 and 5e through 22.

23

00

Enter on Form 40, line 10 ..................................................................................................................

C. Retirement Benefits Deduction. See instructions, page 25, for qualified retirement benefits.

.

.

1. If single enter $27,876, or if married filing jointly enter $41,814 ................

00

1

.

2. Federal Railroad Retirement benefits received .........................................

00

2

3. Social Security benefits received ...............................................................

00

3

.

4. Line 1 minus lines 2 and 3. If less than zero enter zero ...........................

00

4

5. Qualified retirement benefits included in federal income ...........................

00

5

6. Enter the smaller of line 4 or 5 here and on Part B, line 8 ................................................................

6

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2