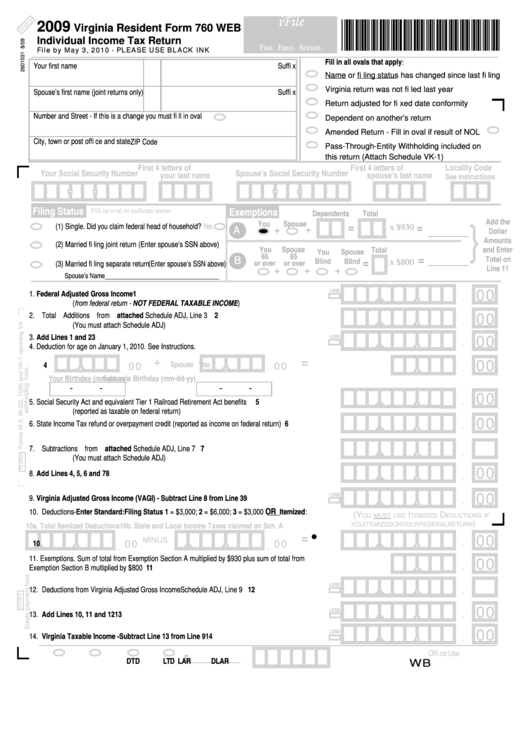

Virginia Resident Form 760 Web - Individual Income Tax Return - 2009

ADVERTISEMENT

iFile

2009

Virginia Resident Form 760 WEB

Individual Income Tax Return

File by May 3, 2010 - PLEASE USE BLACK INK

Fast. Easy. Secure.

Fill in all ovals that apply:

Your fi rst name

M.I.

Last name

Suffi x

Name or fi ling status has changed since last fi ling

Virginia return was not fi led last year

Spouse’s fi rst name (joint returns only) M.I.

Last name

Suffi x

Return adjusted for fi xed date conformity

Number and Street - If this is a change you must fi ll in oval

Dependent on another’s return

Amended Return - Fill in oval if result of NOL

City, town or post offi ce and state

ZIP Code

Pass-Through-Entity Withholding included on

this return (Attach Schedule VK-1)

First 4 letters of

First 4 letters of

Locality Code

Your Social Security Number

Spouse’s Social Security Number

your last name

spouse’s last name

See instructions

-

-

-

-

Filing Status

Exemptions

Fill in oval to indicate status

Dependents

Total

}

Add the

You

Spouse

(1) Single.

Did you claim federal head of household?

Yes

A

=

x $930

=

+

+

Dollar

Amounts

(2) Married fi ling joint return (Enter spouse’s SSN above)

You

Spouse

Total

and Enter

You

Spouse

65

65

B

Total on

=

Blind

Blind

(3) Married fi ling separate return (Enter spouse’s SSN above)

or over

or over

=

x $800

Line 11

+

+

+

Spouse’s Name____________________________________

LOSS

1. Federal Adjusted Gross Income .................................................................................................1

,

,

00

.

(from federal return - NOT FEDERAL TAXABLE INCOME)

2. Total Additions from attached Schedule ADJ, Line 3 ...................................................................2

,

,

.

00

(You must attach Schedule ADJ)

3. Add Lines 1 and 2 ........................................................................................................................3

LOSS

,

,

.

00

4. Deduction for age on January 1, 2010. See Instructions.

,

+

,

=

.

00

.

00

,

.

You

Spouse

00

4

Your Birthday (mm-dd-yy)

Spouse’s Birthday (mm-dd-yy)

-

-

-

-

,

,

.

00

5. Social Security Act and equivalent Tier 1 Railroad Retirement Act benefi ts ................................ 5

(reported as taxable on federal return)

,

,

.

00

6. State Income Tax refund or overpayment credit (reported as income on federal return) ...............6

,

,

,

,

.

00

7. Subtractions from attached Schedule ADJ, Line 7 .......................................................................7

(You must attach Schedule ADJ)

,

,

.

00

8. Add Lines 4, 5, 6 and 7 ................................................................................................................8

LOSS

,

,

.

00

9. Virginia Adjusted Gross Income (VAGI) - Subtract Line 8 from Line 3 ....................................9

OR

10. Deductions-Enter Standard: Filing Status 1 = $3,000; 2 = $6,000; 3 = $3,000

Itemized:

(Y

I

D

OU MUST USE

TEMIZED

EDUCTIONS IF

)

10a. Total Itemized Deductions

10b. State and Local Income Taxes claimed on Sch. A

YOU ITEMIZED ON YOUR FEDERAL RETURN

=

v

,

,

,

,

,

,

.

00

00

00

MINUS

.

.

10

11. Exemptions. Sum of total from Exemption Section A multiplied by $930 plus sum of total from

,

.

00

Exemption Section B multiplied by $800 ...................................................................................... 11

,

,

,

,

LOSS

.

00

12. Deductions from Virginia Adjusted Gross Income Schedule ADJ, Line 9 ....................................12

,

,

.

00

LOSS

13. Add Lines 10, 11 and 12 ............................................................................................................13

,

,

LOSS

00

.

14. Virginia Taxable Income - Subtract Line 13 from Line 9 ........................................................14

Offi ce Use

_________

$

WB

LAR

DLAR

DTD

LTD

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3