Form Gr-1040 - Grand Rapids Individual Return - 2010

ADVERTISEMENT

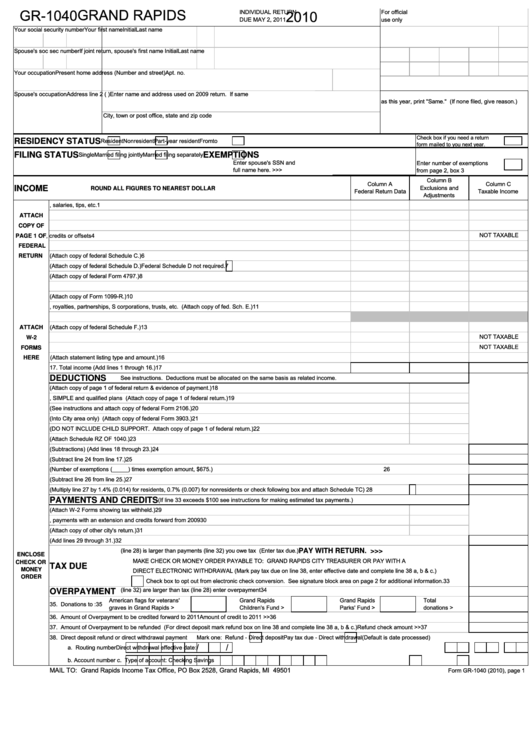

GR-1040

GRAND RAPIDS

2010

INDIVIDUAL RETURN

For official

DUE MAY 2, 2011

use only

Your social security number

Your first name

Initial Last name

Spouse's soc sec number

If joint return, spouse's first name

Initial Last name

Your occupation

Present home address (Number and street)

Apt. no.

Spouse's occupation

Address line 2 (P.O. Box address form mailing use only)

Enter name and address used on 2009 return. If same

as this year, print "Same." (If none filed, give reason.)

City, town or post office, state and zip code

Check box if you need a return

Resident

Nonresident

Part-year resident

From

to

RESIDENCY STATUS

form mailed to you next year.

Single

Married filing jointly

Married filing separately

FILING STATUS

EXEMPTIONS

Enter spouse's SSN and

Enter number of exemptions

full name here. >>>

from page 2, box 3

Column B

Column A

Column C

Exclusions and

INCOME

ROUND ALL FIGURES TO NEAREST DOLLAR

Federal Return Data

Taxable Income

Adjustments

1.

Wages, salaries, tips, etc.

1

2.

Taxable interest

2

ATTACH

COPY OF 3.

Ordinary dividends

3

NOT TAXABLE

PAGE 1 OF 4.

Taxable refunds, credits or offsets

4

FEDERAL 5.

Alimony received

5

6.

Business income (Attach copy of federal Schedule C.)

6

RETURN

7.

Capital gains or losses (Attach copy of federal Schedule D.)

Federal Schedule D not required.

7

8.

Other gains or losses (Attach copy of federal Form 4797.)

8

9.

Taxable IRA distributions

9

10. Taxable pension distributions (Attach copy of Form 1099-R.)

10

11. Rental real estate, royalties, partnerships, S corporations, trusts, etc. (Attach copy of fed. Sch. E.)

11

12. Reserved

12

13. Farm income or loss (Attach copy of federal Schedule F.)

13

ATTACH

14. Unemployment compensation

14

NOT TAXABLE

W-2

NOT TAXABLE

15. Social security benefits

15

FORMS

16. Other income (Attach statement listing type and amount.)

16

HERE

17.

Total income (Add lines 1 through 16.)

17

See instructions. Deductions must be allocated on the same basis as related income.

DEDUCTIONS

18. IRA deduction (Attach copy of page 1 of federal return & evidence of payment.)

18

19. Self Employed SEP, SIMPLE and qualified plans (Attach copy of page 1 of federal return.)

19

20. Employee business expenses (See instructions and attach copy of federal Form 2106.)

20

21. Moving expenses (Into City area only) (Attach copy of federal Form 3903.)

21

22. Alimony paid (DO NOT INCLUDE CHILD SUPPORT. Attach copy of page 1 of federal return.)

22

23. Renaissance Zone deduction (Attach Schedule RZ OF 1040.)

23

24.

Total deductions (Subtractions) (Add lines 18 through 23.)

24

25.

Total income after deductions (Subtract line 24 from line 17.)

25

26. Amount for exemptions (Number of exemptions (_____) times exemption amount, $675.)

26

27.

Total income subject to tax (Subtract line 26 from line 25.)

27

28. Tax

(Multiply line 27 by 1.4% (0.014) for residents, 0.7% (0.007) for nonresidents or check following box and attach Schedule TC)

28

(If line 33 exceeds $100 see instructions for making estimated tax payments.)

PAYMENTS AND CREDITS

29. Tax withheld by your employer (Attach W-2 Forms showing tax withheld.)

29

30. Payments on 2010 Declaration of Estimated Income Tax, payments with an extension and credits forward from 2009

30

31. Credit for tax paid to another city and for tax paid by a partnership (Attach copy of other city's return.)

31

32.

Total payments and credits (Add lines 29 through 31.)

32

33. If tax (line 28) is larger than payments (line 32) you owe tax (Enter tax due.)

PAY WITH RETURN. >>>

ENCLOSE

MAKE CHECK OR MONEY ORDER PAYABLE TO: GRAND RAPIDS CITY TREASURER OR PAY WITH A

CHECK OR

TAX DUE

MONEY

DIRECT ELECTRONIC WITHDRAWAL (Mark pay tax due on line 38, enter effective date and complete line 38 a, b & c.)

ORDER

Check box to opt out from electronic check conversion. See signature block area on page 2 for additional information.

33

OVERPAYMENT

34. If total payments and credits (line 32) are larger than tax (line 28) enter overpayment

34

a.

American flags for veterans'

b.

Grand Rapids

c.

Grand Rapids

Total

35. Donations to :

35

graves in Grand Rapids >

Children's Fund >

Parks' Fund >

donations >

36. Amount of Overpayment to be credited forward to 2011

Amount of credit to 2011 >> 36

37. Amount of Overpayment to be refunded (For direct deposit mark refund box on line 38 and complete line 38 a, b & c.)

Refund check amount >> 37

38. Direct deposit refund or direct withdrawal payment

Mark one:

Refund - Direct deposit

Pay tax due - Direct withdrawal

(Default is date processed)

/

/

a. Routing number

Direct withdrawal effective date:

b. Account number

c. Type of account:

Checking

Savings

MAIL TO: Grand Rapids Income Tax Office, PO Box 2528, Grand Rapids, MI 49501

Form GR-1040 (2010), page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6