Form Ft-1000-A - Certification Of Exclusion Of Sales, Diesel Motor Fuel, And Petroleum Business Taxes From Selling Price

ADVERTISEMENT

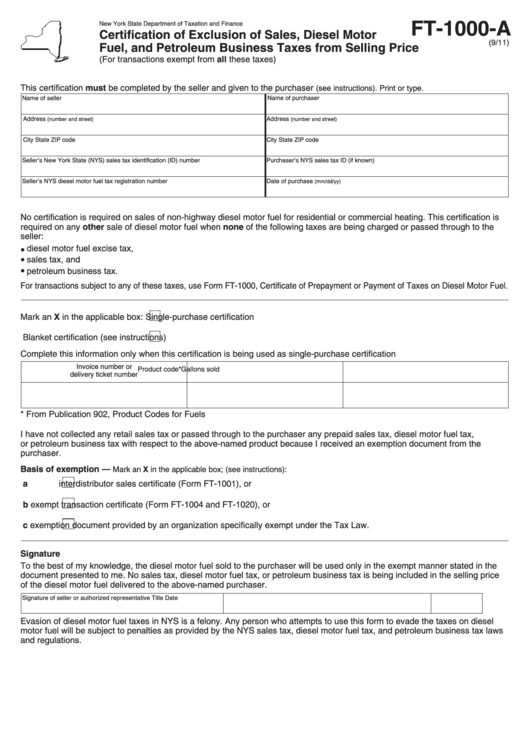

FT-1000-A

New York State Department of Taxation and Finance

Certification of Exclusion of Sales, Diesel Motor

(9/11)

Fuel, and Petroleum Business Taxes from Selling Price

(For transactions exempt from all these taxes)

This certification must be completed by the seller and given to the purchaser

(see instructions). Print or type.

Name of seller

Name of purchaser

Address

Address

(number and street)

(number and street)

City

State

ZIP code

City

State

ZIP code

Seller’s New York State (NYS) sales tax identification (ID) number

Purchaser’s NYS sales tax ID (if known)

Seller’s NYS diesel motor fuel tax registration number

Date of purchase

(mm/dd/yy)

No certification is required on sales of non-highway diesel motor fuel for residential or commercial heating. This certification is

required on any other sale of diesel motor fuel when none of the following taxes are being charged or passed through to the

seller:

diesel motor fuel excise tax,

sales tax, and

petroleum business tax.

For transactions subject to any of these taxes, use Form FT-1000, Certificate of Prepayment or Payment of Taxes on Diesel Motor Fuel.

Mark an X in the applicable box:

Single-purchase certification

Blanket certification (see instructions)

Complete this information only when this certification is being used as single-purchase certification

Invoice number or

Product code*

Gallons sold

delivery ticket number

* From Publication 902, Product Codes for Fuels

I have not collected any retail sales tax or passed through to the purchaser any prepaid sales tax, diesel motor fuel tax,

or petroleum business tax with respect to the above-named product because I received an exemption document from the

purchaser.

Basis of exemption —

Mark an X in the applicable box; (see instructions):

a

interdistributor sales certificate (Form FT-1001), or

b

exempt transaction certificate (Form FT-1004 and FT-1020), or

c

exemption document provided by an organization specifically exempt under the Tax Law.

Signature

To the best of my knowledge, the diesel motor fuel sold to the purchaser will be used only in the exempt manner stated in the

document presented to me. No sales tax, diesel motor fuel tax, or petroleum business tax is being included in the selling price

of the diesel motor fuel delivered to the above-named purchaser.

Signature of seller or authorized representative

Title

Date

Evasion of diesel motor fuel taxes in NYS is a felony. Any person who attempts to use this form to evade the taxes on diesel

motor fuel will be subject to penalties as provided by the NYS sales tax, diesel motor fuel tax, and petroleum business tax laws

and regulations.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2