Form Ft-101 - Virginia Motor Vehicle Fuel Sales Tax Worksheet - Virginia Department Of Taxation

ADVERTISEMENT

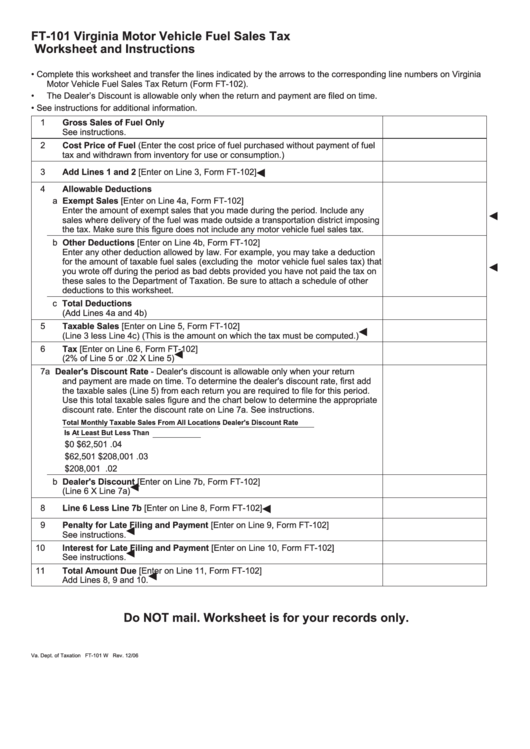

FT-101

Virginia Motor Vehicle Fuel Sales Tax

Worksheet and Instructions

•

Complete this worksheet and transfer the lines indicated by the arrows to the corresponding line numbers on Virginia

Motor Vehicle Fuel Sales Tax Return (Form FT-102).

•

The Dealer’s Discount is allowable only when the return and payment are filed on time.

•

See instructions for additional information.

1

Gross Sales of Fuel Only

See instructions.

2

Cost Price of Fuel (Enter the cost price of fuel purchased without payment of fuel

tax and withdrawn from inventory for use or consumption.)

3

Add Lines 1 and 2

[Enter on Line 3, Form FT-102]

§

4

Allowable Deductions

a Exempt Sales

[Enter on Line 4a, Form FT-102]

Enter the amount of exempt sales that you made during the period. Include any

§

sales where delivery of the fuel was made outside a transportation district imposing

the tax. Make sure this figure does not include any motor vehicle fuel sales tax.

b Other Deductions

[Enter on Line 4b, Form FT-102]

Enter any other deduction allowed by law. For example, you may take a deduction

for the amount of taxable fuel sales (excluding the motor vehicle fuel sales tax) that

§

you wrote off during the period as bad debts provided you have not paid the tax on

these sales to the Department of Taxation. Be sure to attach a schedule of other

deductions to this worksheet.

c Total Deductions

(Add Lines 4a and 4b)

5

Taxable Sales

[Enter on Line 5, Form FT-102]

§

(Line 3 less Line 4c) (This is the amount on which the tax must be computed.)

6

Tax

[Enter on Line 6, Form FT-102]

§

(2% of Line 5 or .02 X Line 5)

7 a Dealer's Discount Rate - Dealer's discount is allowable only when your return

and payment are made on time. To determine the dealer's discount rate, first add

the taxable sales (Line 5) from each return you are required to file for this period.

Use this total taxable sales figure and the chart below to determine the appropriate

discount rate. Enter the discount rate on Line 7a. See instructions.

Total Monthly Taxable Sales From All Locations

Dealer's Discount Rate

Is At Least

But Less Than

$0

$62,501

.04

$62,501

$208,001

.03

$208,001

.02

b Dealer's Discount

[Enter on Line 7b, Form FT-102]

§

(Line 6 X Line 7a)

8

Line 6 Less Line 7b

[Enter on Line 8, Form FT-102]

§

9

Penalty for Late Filing and Payment

[Enter on Line 9, Form FT-102]

§

See instructions.

10

Interest for Late Filing and Payment

[Enter on Line 10, Form FT-102]

§

See instructions.

11

Total Amount Due

[Enter on Line 11, Form FT-102]

§

Add Lines 8, 9 and 10.

Do NOT mail. Worksheet is for your records only.

Va. Dept. of Taxation FT-101 W Rev. 12/06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2