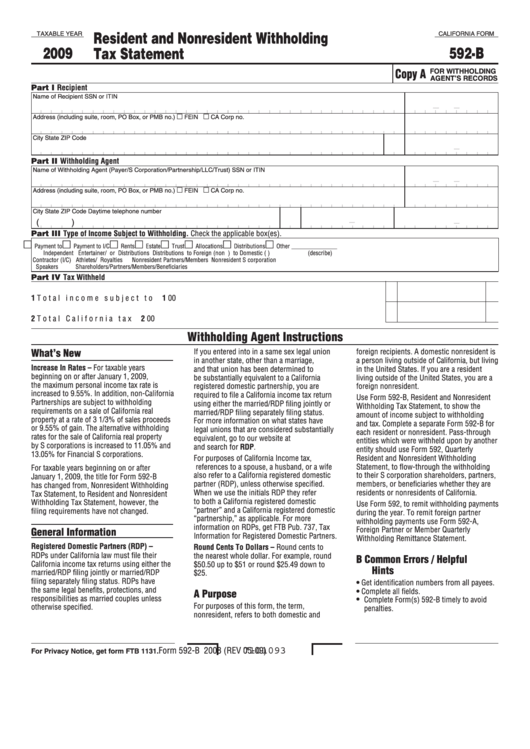

Resident and Nonresident Withholding

TAXABLE YEAR

CALIFORNIA FORM

2009

592-B

Tax Statement

Copy A

FOR WITHHOLDING

AGENT’S RECORDS

Part I Recipient

Name of Recipient

SSN or ITIN

Address (including suite, room, PO Box, or PMB no.)

FEIN

CA Corp no.

City

State

ZIP Code

Part II Withholding Agent

Name of Withholding Agent (Payer/S Corporation/Partnership/LLC/Trust)

SSN or ITIN

Address (including suite, room, PO Box, or PMB no.)

FEIN

CA Corp no.

City

State ZIP Code

Daytime telephone number

(

)

Part III Type of Income Subject to Withholding. Check the applicable box(es).

Payment to

Payment to I/C

Rents

Estate

Trust

Allocations

Distributions

Other _______________

Independent

Entertainer/

or

Distributions

Distributions

to Foreign (non U.S.)

to Domestic (U.S.)

(describe)

Contractor (I/C)

Athletes/

Royalties

Nonresident Partners/Members

Nonresident S corporation

Speakers

Shareholders/Partners/Members/Beneficiaries

Part IV Tax Withheld

1 Total income subject to withholding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2 Total California tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

Withholding Agent Instructions

What’s New

If you entered into in a same sex legal union

foreign recipients. A domestic nonresident is

in another state, other than a marriage,

a person living outside of California, but living

Increase In Rates – For taxable years

and that union has been determined to

in the United States. If you are a resident

beginning on or after January 1, 2009,

be substantially equivalent to a California

living outside of the United States, you are a

the maximum personal income tax rate is

registered domestic partnership, you are

foreign nonresident.

increased to 9.55%. In addition, non-California

required to file a California income tax return

Use Form 592-B, Resident and Nonresident

Partnerships are subject to withholding

using either the married/RDP filing jointly or

Withholding Tax Statement, to show the

requirements on a sale of California real

married/RDP filing separately filing status.

amount of income subject to withholding

property at a rate of 3 1/3% of sales proceeds

For more information on what states have

and tax. Complete a separate Form 592-B for

or 9.55% of gain. The alternative withholding

legal unions that are considered substantially

each resident or nonresident. Pass-through

rates for the sale of California real property

equivalent, go to our website at ftb.ca.gov

entities which were withheld upon by another

by S corporations is increased to 11.05% and

and search for RDP.

entity should use Form 592, Quarterly

13.05% for Financial S corporations.

For purposes of California Income tax,

Resident and Nonresident Withholding

references to a spouse, a husband, or a wife

Statement, to flow-through the withholding

For taxable years beginning on or after

also refer to a California registered domestic

to their S corporation shareholders, partners,

January 1, 2009, the title for Form 592-B

partner (RDP), unless otherwise specified.

members, or beneficiaries whether they are

has changed from, Nonresident Withholding

When we use the initials RDP they refer

residents or nonresidents of California.

Tax Statement, to Resident and Nonresident

to both a California registered domestic

Withholding Tax Statement, however, the

Use Form 592, to remit withholding payments

“partner” and a California registered domestic

filing requirements have not changed.

during the year. To remit foreign partner

“partnership,” as applicable. For more

withholding payments use Form 592-A,

information on RDPs, get FTB Pub. 737, Tax

General Information

Foreign Partner or Member Quarterly

Information for Registered Domestic Partners.

Withholding Remittance Statement.

Registered Domestic Partners (RDP) –

Round Cents To Dollars – Round cents to

RDPs under California law must file their

the nearest whole dollar. For example, round

B Common Errors / Helpful

California income tax returns using either the

$50.50 up to $51 or round $25.49 down to

Hints

married/RDP filing jointly or married/RDP

$25.

filing separately filing status. RDPs have

• Get identification numbers from all payees.

the same legal benefits, protections, and

• Complete all fields.

A Purpose

responsibilities as married couples unless

• Complete Form(s) 592-B timely to avoid

For purposes of this form, the term,

otherwise specified.

penalties.

nonresident, refers to both domestic and

Form 592-B 2008 (REV 05-09)

7101093

For Privacy Notice, get form FTB 1131.

1

1 2

2