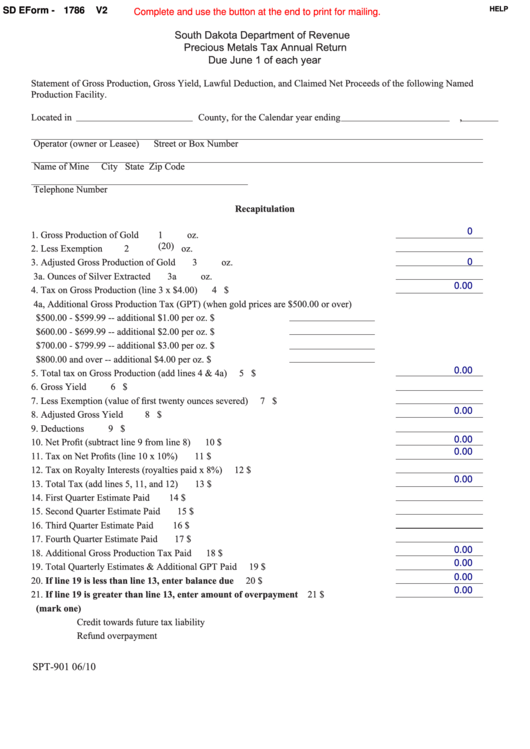

SD EForm - 1786

V2

HELP

Complete and use the button at the end to print for mailing.

South Dakota Department of Revenue

Precious Metals Tax Annual Return

Due June 1 of each year

Statement of Gross Production, Gross Yield, Lawful Deduction, and Claimed Net Proceeds of the following Named

Production Facility.

Located in

County, for the Calendar year ending

,

Operator (owner or Leasee)

Street or Box Number

Name of Mine

City

State

Zip Code

Telephone Number

Recapitulation

0

1. Gross Production of Gold

1

oz.

(20) oz.

2. Less Exemption

2

3. Adjusted Gross Production of Gold

3

oz.

0

3a. Ounces of Silver Extracted

3a

oz.

0.00

4. Tax on Gross Production (line 3 x $4.00)

4 $

4a, Additional Gross Production Tax (GPT) (when gold prices are $500.00 or over)

$500.00 - $599.99 -- additional $1.00 per oz.

$

$600.00 - $699.99 -- additional $2.00 per oz.

$

$700.00 - $799.99 -- additional $3.00 per oz.

$

$800.00 and over -- additional $4.00 per oz.

$

5. Total tax on Gross Production (add lines 4 & 4a)

5 $

0.00

6. Gross Yield

6 $

7. Less Exemption (value of first twenty ounces severed)

7 $

0.00

8. Adjusted Gross Yield

8 $

9. Deductions

9 $

10. Net Profit (subtract line 9 from line 8)

10 $

0.00

0.00

11. Tax on Net Profits (line 10 x 10%)

11 $

12. Tax on Royalty Interests (royalties paid x 8%)

12 $

0.00

13. Total Tax (add lines 5, 11, and 12)

13 $

14. First Quarter Estimate Paid

14 $

15. Second Quarter Estimate Paid

15 $

16. Third Quarter Estimate Paid

16 $

17. Fourth Quarter Estimate Paid

17 $

0.00

18. Additional Gross Production Tax Paid

18 $

0.00

19. Total Quarterly Estimates & Additional GPT Paid

19 $

0.00

20. If line 19 is less than line 13, enter balance due

20 $

0.00

21. If line 19 is greater than line 13, enter amount of overpayment

21 $

(mark one)

Credit towards future tax liability

Refund overpayment

SPT-901

06/10

1

1 2

2 3

3 4

4