HELP

Complete and use the button at the end to print for mailing.

SD EForm -

1309

V3

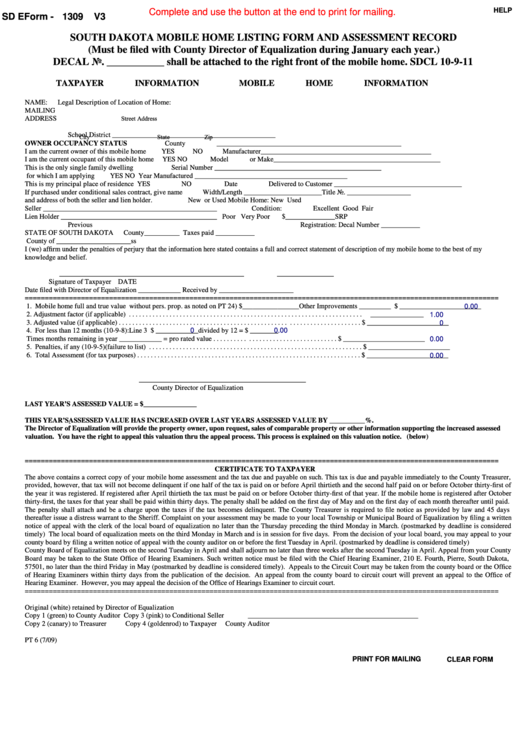

SOUTH DAKOTA MOBILE HOME LISTING FORM AND ASSESSMENT RECORD

(Must be filed with County Director of Equalization during January each year.)

DECAL No. ___________ shall be attached to the right front of the mobile home. SDCL 10-9-11

TAXPAYER INFORMATION

MOBILE HOME INFORMATION

NAME:

Legal Description of Location of Home:

MAILING

Street Address

ADDRESS

School District ______________________________________________

City

State

Zip

OWNER OCCUPANCY STATUS

County ____________________________________________________

I am the current owner of this mobile home

YES

NO

Manufacturer________________________________________________

I am the current occupant of this mobile home

YES

NO

Model or Make_______________________________________________

This is the only single family dwelling

Serial Number _______________________________________________

for which I am applying

YES

NO

Year Manufactured ___________________________________________

This is my principal place of residence

YES

NO

Date Delivered to Customer ____________________________________

If purchased under conditional sales contract, give name

Width/Length ______________________Title No. __________________

and address of both the seller and lien holder.

New or Used Mobile Home: New

Used

Seller _________________________________________________

Condition: Excellent

Good

Fair

Lien Holder ____________________________________________

Poor

Very Poor

$______________SRP

Previous Registration: Decal Number ___________

STATE OF SOUTH DAKOTA

County__________ Taxes paid ___________

County of _____________________ss

I (we) affirm under the penalties of perjury that the information here stated contains a full and correct statement of description of my mobile home to the best of my

knowledge and belief.

____________________________________________________

________________

Signature of Taxpayer

DATE

Date filed with Director of Equalization ____________ Received by _____________________

======================================================================================================================

1. Mobile home full and true value without pers. prop. as noted on PT 24) $________________ Other Improvements _________ $ _______________________

0.00

2. Adjustment factor (if applicable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

_______________

1.00

3. Adjusted value (if applicable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

0

0

0.00

4. For less than 12 months (10-9-8):Line 3 $ ____________divided by 12 = $ ________

Times months remaining in year ____________ = pro rated value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

0.00

5. Penalties, if any (10-9-5)(failure to list) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

6. Total Assessment (for tax purposes) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

0.00

_______________________________________________

County Director of Equalization

LAST YEAR’S ASSESSED VALUE = $_______________

THIS YEAR’S ASSESSED VALUE HAS INCREASED OVER LAST YEARS ASSESSED VALUE BY __________%.

The Director of Equalization will provide the property owner, upon request, sales of comparable property or other information supporting the increased assessed

valuation. You have the right to appeal this valuation thru the appeal process. This process is explained on this valuation notice. (below)

======================================================================================================================

CERTIFICATE TO TAXPAYER

The above contains a correct copy of your mobile home assessment and the tax due and payable on such. This tax is due and payable immediately to the County Treasurer,

provided, however, that tax will not become delinquent if one half of the tax is paid on or before April thirtieth and the second half paid on or before October thirty-first of

the year it was registered. If registered after April thirtieth the tax must be paid on or before October thirty-first of that year. If the mobile home is registered after October

thirty-first, the taxes for that year shall be paid within thirty days. The penalty shall be added on the first day of May and on the first day of each month thereafter until paid.

The penalty shall attach and be a charge upon the taxes if the tax becomes delinquent. The County Treasurer is required to file notice as provided by law and 45 days

thereafter issue a distress warrant to the Sheriff. Complaint on your assessment may be made to your local Township or Municipal Board of Equalization by filing a written

notice of appeal with the clerk of the local board of equalization no later than the Thursday preceding the third Monday in March. (postmarked by deadline is considered

timely) The local board of equalization meets on the third Monday in March and is in session for five days. From the decision of your local board, you may appeal to your

county board by filing a written notice of appeal with the county auditor on or before the first Tuesday in April. (postmarked by deadline is considered timely)

County Board of Equalization meets on the second Tuesday in April and shall adjourn no later than three weeks after the second Tuesday in April. Appeal from your County

Board may be taken to the State Office of Hearing Examiners. Such written notice must be filed with the Chief Hearing Examiner, 210 E. Fourth, Pierre, South Dakota,

57501, no later than the third Friday in May (postmarked by deadline is considered timely). Appeals to the Circuit Court may be taken from the county board or the Office

of Hearing Examiners within thirty days from the publication of the decision. An appeal from the county board to circuit court will prevent an appeal to the Office of

Hearing Examiner. However, you may appeal the decision of the Office of Hearings Examiner to circuit court.

======================================================================================================================

Original (white) retained by Director of Equalization

Copy 1 (green) to County Auditor Copy 3 (pink) to Conditional Seller

________________________________________________

Copy 2 (canary) to Treasurer

Copy 4 (goldenrod) to Taxpayer

County Auditor

PT 6 (7/09)

PRINT FOR MAILING

CLEAR FORM

1

1