Reset Form

Print Form

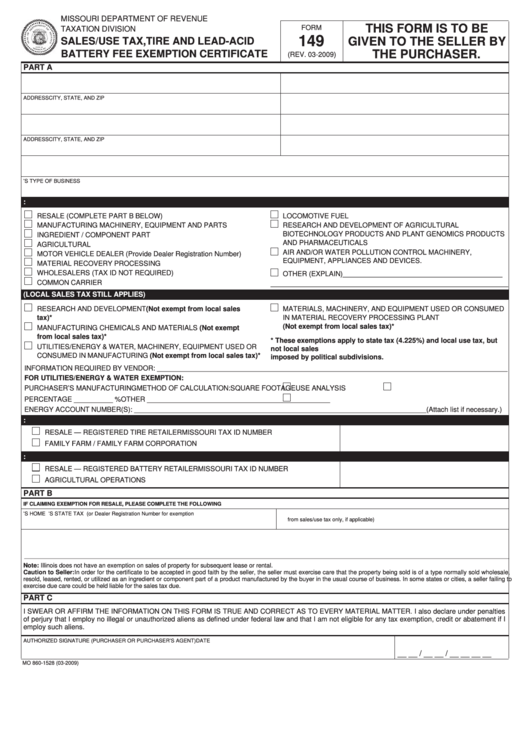

MISSOURI DEPARTMENT OF REVENUE

THIS FORM IS TO BE

FORM

TAXATION DIVISION

149

SALES/USE TAX, TIRE AND LEAD-ACID

GIVEN TO THE SELLER BY

BATTERY FEE EXEMPTION CERTIFICATE

THE PURCHASER.

(REV. 03-2009)

PART A

1. PURCHASER

DOING BUSINESS AS

ADDRESS

CITY, STATE, AND ZIP

2. SELLER

DOING BUSINESS AS

ADDRESS

CITY, STATE, AND ZIP

3. PRODUCT OR SERVICES PURCHASED

4. PURCHASER’S TYPE OF BUSINESS

5A. CLAIMING EXEMPTION FROM SALES/USE TAX FOR:

RESALE (COMPLETE PART B BELOW)

LOCOMOTIVE FUEL

MANUFACTURING MACHINERY, EQUIPMENT AND PARTS

RESEARCH AND DEVELOPMENT OF AGRICULTURAL

BIOTECHNOLOGY PRODUCTS AND PLANT GENOMICS PRODUCTS

INGREDIENT / COMPONENT PART

AND PHARMACEUTICALS

AGRICULTURAL

AIR AND/OR WATER POLLUTION CONTROL MACHINERY,

MOTOR VEHICLE DEALER (Provide Dealer Registration Number)

EQUIPMENT, APPLIANCES AND DEVICES.

MATERIAL RECOVERY PROCESSING

WHOLESALERS (TAX ID NOT REQUIRED)

OTHER (EXPLAIN) _________________________________________

COMMON CARRIER

_____________________________________________________________

5B. CLAIMING PARTIAL EXEMPTION FROM SALES/USE TAX (LOCAL SALES TAX STILL APPLIES)

RESEARCH AND DEVELOPMENT (Not exempt from local sales

MATERIALS, MACHINERY, AND EQUIPMENT USED OR CONSUMED

tax)*

IN MATERIAL RECOVERY PROCESSING PLANT

(Not exempt from local sales tax)*

MANUFACTURING CHEMICALS AND MATERIALS (Not exempt

from local sales tax)*

* These exemptions apply to state tax (4.225%) and local use tax, but

UTILITIES/ENERGY & WATER, MACHINERY, EQUIPMENT USED OR

not local sales tax. The seller must collect and report local sales taxes

CONSUMED IN MANUFACTURING (Not exempt from local sales tax)*

imposed by political subdivisions.

INFORMATION REQUIRED BY VENDOR: __________________________________________________________________________________________

FOR UTILITIES/ENERGY & WATER EXEMPTION:

PURCHASER’S MANUFACTURING

METHOD OF CALCULATION:

SQUARE FOOTAGE

USE ANALYSIS

PERCENTAGE __________ %

OTHER _______________________________________________

ENERGY ACCOUNT NUMBER(S): ___________________________________________________________________________ (Attach list if necessary.)

6. CLAIMING EXEMPTION FROM TIRE FEE FOR:

RESALE — REGISTERED TIRE RETAILER

MISSOURI TAX ID NUMBER

FAMILY FARM / FAMILY FARM CORPORATION

7. CLAIMING EXEMPTION FROM LEAD-ACID BATTERY FEE FOR:

RESALE — REGISTERED BATTERY RETAILER

MISSOURI TAX ID NUMBER

AGRICULTURAL OPERATIONS

PART B

IF CLAIMING EXEMPTION FOR RESALE, PLEASE COMPLETE THE FOLLOWING

1. PURCHASER’S HOME STATE

2. PURCHASER’S STATE TAX I.D. NUMBER (or Dealer Registration Number for exemption

from sales/use tax only, if applicable)

3. GENERAL DESCRIPTION OF PRODUCT TO BE PURCHASED FROM THE SELLER ______________________________________________________________________________________________

______________________________________________________________________________________________________________________________________________________________________

Note: Illinois does not have an exemption on sales of property for subsequent lease or rental.

Caution to Seller: In order for the certificate to be accepted in good faith by the seller, the seller must exercise care that the property being sold is of a type normally sold wholesale,

resold, leased, rented, or utilized as an ingredient or component part of a product manufactured by the buyer in the usual course of business. In some states or cities, a seller failing to

exercise due care could be held liable for the sales tax due.

PART C

I SWEAR OR AFFIRM THE INFORMATION ON THIS FORM IS TRUE AND CORRECT AS TO EVERY MATERIAL MATTER. I also declare under penalties

of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption, credit or abatement if I

employ such aliens.

AUTHORIZED SIGNATURE (PURCHASER OR PURCHASER’S AGENT)

DATE

__ __ / __ __ / __ __ __ __

MO 860-1528 (03-2009)

1

1