Instructions For Forms W-2 And W-3 - Wage And Tax Statement And Transmittal Of Wage And Tax Statements - 2006

ADVERTISEMENT

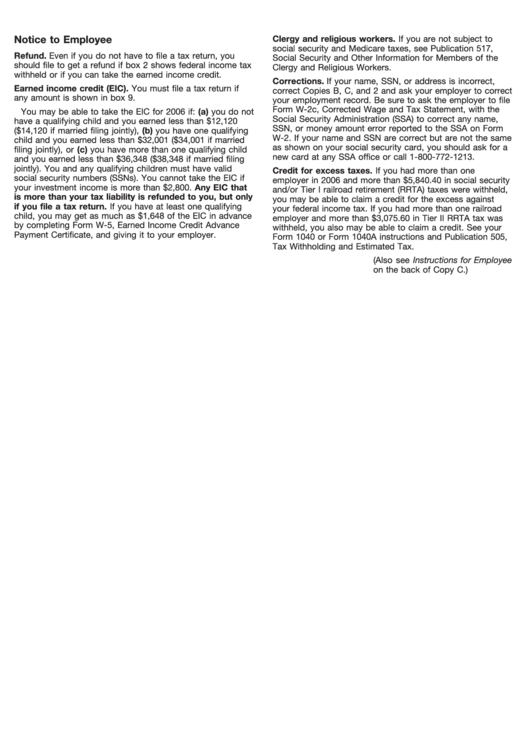

Notice to Employee

Clergy and religious workers. If you are not subject to

social security and Medicare taxes, see Publication 517,

Refund. Even if you do not have to file a tax return, you

Social Security and Other Information for Members of the

should file to get a refund if box 2 shows federal income tax

Clergy and Religious Workers.

withheld or if you can take the earned income credit.

Corrections. If your name, SSN, or address is incorrect,

Earned income credit (EIC). You must file a tax return if

correct Copies B, C, and 2 and ask your employer to correct

any amount is shown in box 9.

your employment record. Be sure to ask the employer to file

Form W-2c, Corrected Wage and Tax Statement, with the

You may be able to take the EIC for 2006 if: (a) you do not

Social Security Administration (SSA) to correct any name,

have a qualifying child and you earned less than $12,120

SSN, or money amount error reported to the SSA on Form

($14,120 if married filing jointly), (b) you have one qualifying

W-2. If your name and SSN are correct but are not the same

child and you earned less than $32,001 ($34,001 if married

as shown on your social security card, you should ask for a

filing jointly), or (c) you have more than one qualifying child

new card at any SSA office or call 1-800-772-1213.

and you earned less than $36,348 ($38,348 if married filing

jointly). You and any qualifying children must have valid

Credit for excess taxes. If you had more than one

social security numbers (SSNs). You cannot take the EIC if

employer in 2006 and more than $5,840.40 in social security

your investment income is more than $2,800. Any EIC that

and/or Tier I railroad retirement (RRTA) taxes were withheld,

is more than your tax liability is refunded to you, but only

you may be able to claim a credit for the excess against

if you file a tax return. If you have at least one qualifying

your federal income tax. If you had more than one railroad

child, you may get as much as $1,648 of the EIC in advance

employer and more than $3,075.60 in Tier II RRTA tax was

by completing Form W-5, Earned Income Credit Advance

withheld, you also may be able to claim a credit. See your

Payment Certificate, and giving it to your employer.

Form 1040 or Form 1040A instructions and Publication 505,

Tax Withholding and Estimated Tax.

(Also see Instructions for Employee

on the back of Copy C.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26