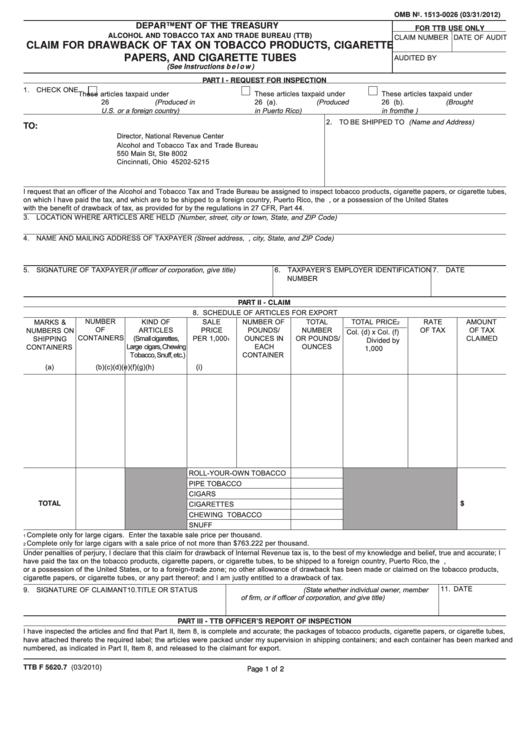

OMB No. 1513-0026 (03/31/2012)

DEPARTMENT OF THE TREASURY

FOR TTB USE ONLY

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU (TTB)

CLAIM NUMBER

DATE OF AUDIT

CLAIM FOR DRAWBACK OF TAX ON TOBACCO PRODUCTS, CIGARETTE

AUDITED BY

PAPERS, AND CIGARETTE TUBES

(See Instructions b e l o w)

PART I - REQUEST FOR INSPECTION

1. CHECK ONE

These articles taxpaid under

These articles taxpaid under

These articles taxpaid under

26 U.S.C. 5701. (Produced in

26 U.S.C. 7652(a). (Produced

26 U.S.C. 7652(b). (Brought

U.S. or a foreign country)

in Puerto Rico)

in from the U.S. Virgin Islands)

2. TO BE SHIPPED TO (Name and Address)

TO:

Director, National Revenue Center

Alcohol and Tobacco Tax and Trade Bureau

550 Main St, Ste 8002

Cincinnati, Ohio 45202-5215

I request that an officer of the Alcohol and Tobacco Tax and Trade Bureau be assigned to inspect tobacco products, cigarette papers, or cigarette tubes,

on which I have paid the tax, and which are to be shipped to a foreign country, Puerto Rico, the U.S. Virgin Islands, or a possession of the United States

with the benefit of drawback of tax, as provided for by the regulations in 27 CFR, Part 44.

3. LOCATION WHERE ARTICLES ARE HELD (Number, street, city or to wn, State, and ZIP Code)

4. NAME AND MAILING ADDRESS OF TAXPAYER (Street address, P.O. Box or R.F.D. number, city, State, and ZIP Code)

5. SIGNATURE OF TAXPAYER (if officer of cor poration, give title)

6. TAXPAYER’S EMPLOYER IDENTIFICATION

7. DATE

NUMBER

PART II - CLAIM

8. SCHEDULE OF ARTICLES FOR EXPORT

NUMBER

KIND OF

SALE

NUMBER OF

TOTAL

TOTAL PRICE

RATE

AMOUNT

MARKS &

2

OF

ARTICLES

PRICE

POUNDS/

NUMBER

OF TAX

OF TAX

NUMBERS ON

Col. (d) x Col. (f)

CONTAINERS

(Small cigarettes,

PER 1,000

OUNCES IN

OR POUNDS/

CLAIMED

SHIPPING

Divided by

1

Large cigars , Chewing

EACH

OUNCES

CONTAINERS

1,000

Tobacco, Snuff, etc.)

CONTAINER

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

ROLL-YOUR-OWN TOBACCO

PIPE TOBACCO

CIGARS

CIGARETTES

TOTAL

$

CHEWING TOBACCO

SNUFF

Complete only for large cigars. Enter the taxable sale price per thousand.

1

Complete only for large cigars with a sale pr ice of not more than $ 763.222 per thousand.

2

Under penalties of perjury, I declare that this claim for drawback of Internal Revenue tax is, to the best of my knowledge and belief, true and accurate; I

have paid the tax on the tobacco products , cigarette papers, or cigarette tubes, to be shipped to a f oreign country, Puerto Rico, the U.S. Virgin Islands,

or a possession of the United States , or to a foreign-trade zone; no other allowance of drawback has been made or claimed on the tob acco products,

cigarette papers, or cigarette tubes, or any part thereof; and I am justly entitled to a dr awback of tax.

11. DATE

9. SIGNATURE OF CLAIMANT

10. TITLE OR STATUS (State whether individual owner, member

of firm, or if officer of corporation, and give title)

PART III - TTB OFFICER’S REPORT OF INSPECTION

I have inspected the ar ticles and find that Part II, Item 8, is complete and accur ate; the packages of tobacco products, cigarette papers, or cigarette tubes,

have attached thereto the required label; the ar ticles were packed under my supervision in shipping containers; and each container has been mar ked and

numbered, as indicated in Part II, Item 8, and released to the claimant f or export.

TTB F 5620.7 (03/2010)

Page 1 of 2

1

1 2

2