Form 1040me - Schedules 1, 2, 3 - 2000

ADVERTISEMENT

*000210200*

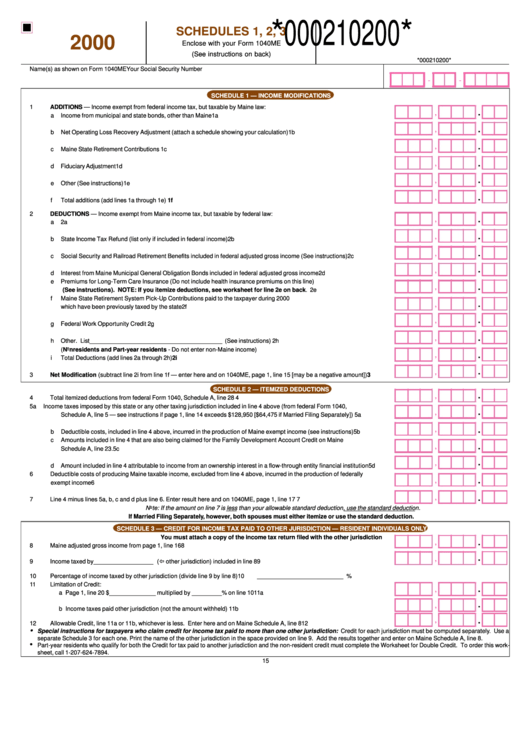

SCHEDULES 1, 2, 3

2000

Enclose with your Form 1040ME

(See instructions on back)

*000210200*

Name(s) as shown on Form 1040ME

Your Social Security Number

-

-

SCHEDULE 1 — INCOME MODIFICATIONS

1

ADDITIONS — Income exempt from federal income tax, but taxable by Maine law:

.

,

a

Income from municipal and state bonds, other than Maine ................................................................................................. 1a

,

.

b

Net Operating Loss Recovery Adjustment (attach a schedule showing your calculation) .................................................... 1b

,

.

c

Maine State Retirement Contributions ................................................................................................................................. 1c

,

.

d

Fiduciary Adjustment ........................................................................................................................................................... 1d

.

,

e

Other (See instructions) ...................................................................................................................................................... 1e

,

.

f

Total additions (add lines 1a through 1e) ............................................................................................................................. 1f

2

DEDUCTIONS — Income exempt from Maine income tax, but taxable by federal law:

,

.

a

U.S. Government Bond interest included in federal adjusted gross income ........................................................................ 2a

.

,

b

State Income Tax Refund (list only if included in federal income) ........................................................................................ 2b

,

.

c

Social Security and Railroad Retirement Benefits included in federal adjusted gross income (See instructions) ................ 2c

.

,

d

Interest from Maine Municipal General Obligation Bonds included in federal adjusted gross income .................................. 2d

e

Premiums for Long-Term Care Insurance (Do not include health insurance premiums on this line)

,

.

(See instructions). NOTE: If you itemize deductions, see worksheet for line 2e on back. ......................................... 2e

f

Maine State Retirement System Pick-Up Contributions paid to the taxpayer during 2000

.

,

which have been previously taxed by the state .................................................................................................................... 2f

,

.

g

Federal Work Opportunity Credit ......................................................................................................................................... 2g

,

.

h

Other. List ________________________________________ (See instructions) ........................................................... 2h

(Nonresidents and Part-year residents - Do not enter non-Maine income)

,

.

i

Total Deductions (add lines 2a through 2h) ......................................................................................................................... 2i

,

.

3

Net Modification (subtract line 2i from line 1f — enter here and on 1040ME, page 1, line 15 [may be a negative amount]) .... 3

SCHEDULE 2 — ITEMIZED DEDUCTIONS

.

,

4

Total itemized deductions from federal Form 1040, Schedule A, line 28 .................................................................................... 4

5

a

Income taxes imposed by this state or any other taxing jurisdiction included in line 4 above (from federal Form 1040,

.

,

Schedule A, line 5 — see instructions if page 1, line 14 exceeds $128,950 [$64,475 if Married Filing Separately]) ............. 5a

,

.

b

Deductible costs, included in line 4 above, incurred in the production of Maine exempt income (see instructions) ............. 5b

c

Amounts included in line 4 that are also being claimed for the Family Development Account Credit on Maine

,

.

Schedule A, line 23. ............................................................................................................................................................ 5c

.

,

d

Amount included in line 4 attributable to income from an ownership interest in a flow-through entity financial institution .... 5d

6

Deductible costs of producing Maine taxable income, excluded from line 4 above, incurred in the production of federally

,

.

exempt income .......................................................................................................................................................................... 6

,

.

7

Line 4 minus lines 5a, b, c and d plus line 6. Enter result here and on 1040ME, page 1, line 17 ............................................... 7

Note: If the amount on line 7 is less than your allowable standard deduction, use the standard deduction.

If Married Filing Separately, however, both spouses must either itemize or use the standard deduction.

SCHEDULE 3 — CREDIT FOR INCOME TAX PAID TO OTHER JURISDICTION — RESIDENT INDIVIDUALS ONLY

You must attach a copy of the income tax return filed with the other jurisdiction

,

.

8

Maine adjusted gross income from page 1, line 16 ................................................................................................................... 8

.

,

9

Income taxed by __________________ (ï other jurisdiction) included in line 8 .................................................................... 9

10

Percentage of income taxed by other jurisdiction (divide line 9 by line 8) .................................................................................. 10

__________________________ %

11

Limitation of Credit:

,

.

a Page 1, line 20 $______________ multiplied by _________% on line 10 ........................................................................ 11a

.

,

b Income taxes paid other jurisdiction (not the amount withheld) ......................................................................................... 11b

,

.

12

Allowable Credit, line 11a or 11b, whichever is less. Enter here and on Maine Schedule A, line 8 ........................................... 12

•

Special instructions for taxpayers who claim credit for income tax paid to more than one other jurisdiction: Credit for each jurisdiction must be computed separately. Use a

separate Schedule 3 for each one. Print the name of the other jurisdiction in the space provided on line 9. Add the results together and enter on Maine Schedule A, line 8.

•

Part-year residents who qualify for both the Credit for tax paid to another jurisdiction and the non-resident credit must complete the Worksheet for Double Credit. To order this work-

sheet, call 1-207-624-7894.

15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1