Annual Privilege License Tax Return Form - City Of Huntsville - Alabama

ADVERTISEMENT

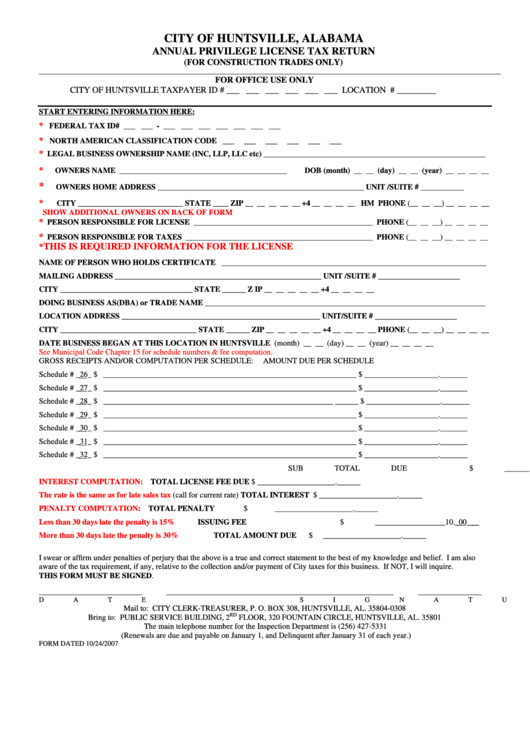

CITY OF HUNTSVILLE, ALABAMA

ANNUAL PRIVILEGE LICENSE TAX RETURN

(FOR CONSTRUCTION TRADES ONLY)

__________________________________________________________________________________________________________________________________

FOR OFFICE USE ONLY

CITY OF HUNTSVILLE TAXPAYER ID # ___ ___ ___ ___ ___ ___

LOCATION # _________

START ENTERING INFORMATION HERE:

*

FEDERAL TAX ID# ___ ___ - ___ ___ ___ ___ ___ ___ ___

*

NORTH AMERICAN CLASSIFICATION CODE ___

___

___

___

___

___

*

LEGAL BUSINESS OWNERSHIP NAME (INC, LLP, LLC etc) _________________________________________________________

*

OWNERS NAME ___________________________________________

DOB (month) __ __ (day) __ __ (year) __ __ __ __

*

OWNERS HOME ADDRESS _____________________________________________________

UNIT /SUITE #

___________

*

CITY ___________________________ STATE ____ ZIP __ __ __ __ __ +4 __ __ __ __ HM PHONE (__ __ __) __ __ __ __

SHOW ADDITIONAL OWNERS ON BACK OF FORM

*

PERSON RESPONSIBLE FOR LICENSE ______________________________________________ PHONE (__ __ __) __ __ __ __

*

PERSON RESPONSIBLE FOR TAXES ________________________________________________ PHONE (__ __ __) __ __ __ __

THIS IS REQUIRED INFORMATION FOR THE LICENSE

*

NAME OF PERSON WHO HOLDS CERTIFICATE ____________________________________________________________________

MAILING ADDRESS _____________________________________________________

UNIT /SUITE # _____________________

CITY __________________________________ STATE ______ Z IP __ __ __ __ __ +4 __ __ __ __

DOING BUSINESS AS (DBA) or TRADE NAME ________________________________________________________________________

LOCATION ADDRESS ___________________________________________________

UNIT/SUITE # _____________________

CITY ___________________________________ STATE ______ ZIP __ __ __ __ __ +4 __ __ __ __ PHONE (__ __ __) __ __ __ __

DATE BUSINESS BEGAN AT THIS LOCATION IN HUNTSVILLE

(month) __ __ (day) __ __ (year) __ __ __ __

See Municipal Code Chapter 15 for schedule numbers & fee computation.

GROSS RECEIPTS AND/OR COMPUTATION PER SCHEDULE:

AMOUNT DUE PER SCHEDULE

Schedule # _26_

$ _________________________________________________________________

$ ___________________._______

Schedule # _27_

$ _________________________________________________________________

$ ___________________._______

Schedule # _28_

$ ___________________________________________________________ ______

$ ___________________._______

Schedule # _29_

$ _________________________________________________________________

$ ___________________._______

Schedule # _30_

$ _________________________________________________________________

$ ___________________._______

Schedule # _31_

$ _________________________________________________________________

$ ___________________._______

Schedule # _32_

$ _________________________________________________________________

$ ___________________._______

SUB TOTAL DUE

$ ___________________._______

INTEREST COMPUTATION:

TOTAL LICENSE FEE DUE

$ ____________________.______

The rate is the same as for late sales tax

(call for current rate)

TOTAL INTEREST

$ ____________________.______

PENALTY COMPUTATION:

TOTAL PENALTY

$ ____________________.______

Less than 30 days late the penalty is 15%

ISSUING FEE

$ __________________10._00___

More than 30 days late the penalty is 30%

TOTAL AMOUNT DUE

$ ____________________.______

I swear or affirm under penalties of perjury that the above is a true and correct statement to the best of my knowledge and belief. I am also

aware of the tax requirement, if any, relative to the collection and/or payment of City taxes for this business. If NOT, I will inquire.

THIS FORM MUST BE SIGNED

.

_____________________________

________________________________________________________________

__________________

DATE

SIGNATURE

TITLE

Mail to: CITY CLERK-TREASURER, P. O. BOX 308, HUNTSVILLE, AL. 35804-0308

RD

Bring to: PUBLIC SERVICE BUILDING, 2

FLOOR, 320 FOUNTAIN CIRCLE, HUNTSVILLE, AL. 35801

The main telephone number for the Inspection Department is (256) 427-5331

(Renewals are due and payable on January 1, and Delinquent after January 31 of each year.)

FORM DATED 10/24/2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2