Form 200-Es - Declaration Of Estimated Income Tax - Delaware Division Of Revenue

ADVERTISEMENT

co

0

0

('II

an

,...

l-

e..

w

en

co

0

0

('II

ID

,...

w

Z

::::)

""')

co

0

0

('II

0

M

..J

a:

e..

<t

0

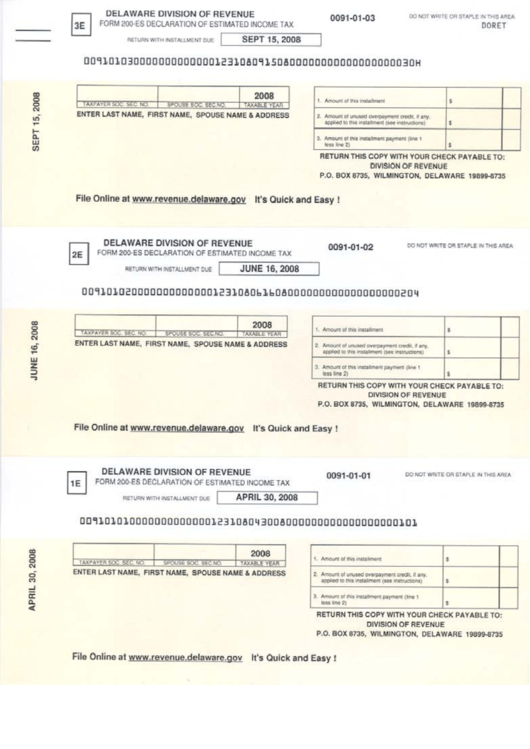

DELAWARE DIVISION OF REVENUE

~

FORM200-ESDECLARATION OF ESTIMATED INCOME TAX

RETURN WITH INSTALLMENT DUE

I

SEPT 15, 2008

0091-01-03

DO NOT WRITE OR STAPLE IN THIS AREA

DORET

00910103000000000000012310809150800000000000000000030H

TAXPAYER SOC. SEC. NO.

2008

TAXABLE YEAR

SPOUSE SOC. SEC.NC):

ENTER LAST NAME, FIRST NAME, SPOUSE NAME & ADDRESS

File Online

at

RETURN THIS COpy WITH YOUR CHECK PAYABLE TO:

DIVISION OF REVENUE

P.O. BOX 8735, WILMINGTON, DELAWARE 19899-8735

It's Quick and Easy!

0

DELAWARE DIVISION OF REVENUE

~

FORM 200-ES DECLARATION OF ESTIMATED INCOME TAX

RETURN WITH INSTALLMENT DUE

I

JUNE 16, 2008

0091-01-02

DO NOT WRITE OR STAPLE IN THIS AREA

009101020000000000000123108061608000000000000000000204

TAXPAYER SOC. SEC.NO.

2008

TAXABLE YEAR

SPOUSE SOC:-SEC.NO.

ENTER LAST NAME, FIRST NAME, SPOUSE NAME & ADDRESS

File Online at

RETURN THIS COpy WITH YOUR CHECK PAYABLE TO:

DIVISION OF REVENUE

P.O. BOX 8735, WILMINGTON, DELAWARE 19899-8735

It's Quick and Easy!

Q

DELAWARE DIVISION OF REVENUE

~

FORM 200-ES DECLARATION OF ESTIMATED INCOME TAX

RETURN WITH INSTALLMENT DUE

I

APRIL 30, 2008

0091-01-01

DO NOT WRITE OR STAPLE IN THIS AREA

009101010000000000000123108043008000000000000000000101

2008

TAXPAYER SOC. SEC. NO.

SPOUSE SOC. SEC.NO.

TAXABLE YEAR

ENTER LAST NAME, FIRST NAME, SPOUSE NAME & ADDRESS

File Online at

RETURN THIS COpy WITH YOUR CHECK PAYABLE TO:

DIVISION OF REVENUE

P.O. BOX 8735, WILMINGTON, DELAWARE 19899-8735

It's Quick and Easy!

1. Amount of this installment

$

2. Amount of unused overpayment credit, if any,

applied to this installment (see instructions)

$

3. Amount of this installment payment (line 1

less line 2)

$

1. Amount of this installment

$

2. Amount of unused overpayment credit, if any,

applied to this installment (see instructions)

$

3. Amount of this installment payment (line 1

less line 2)

$

1. Amount of this installment

$

2. Amount of unused overpayment credit, if any,

applied to this installment (see instructions)

$

3. Amount of this installment payment (line 1

less line 2)

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2