Instruction For Nebraska Tax Application And Return For Mechanical Amusement Device Decals

ADVERTISEMENT

INSTRUCTIONS

WHO MUST FILE.

WHO MUST FILE.

WHO MUST FILE.

WHO MUST FILE.

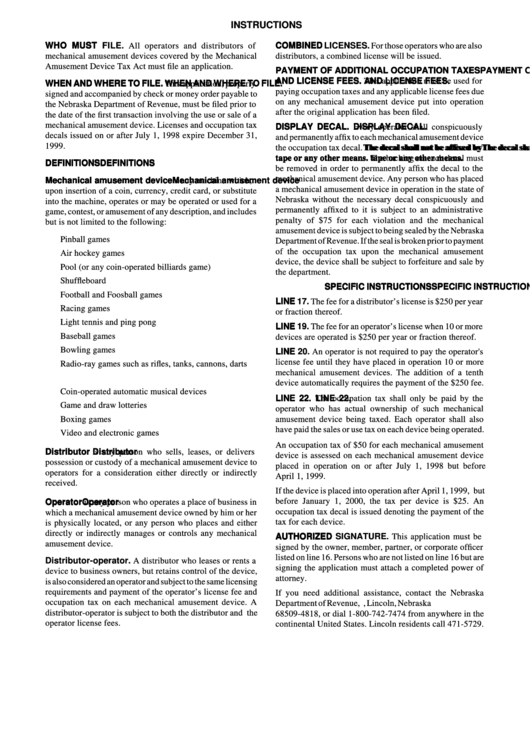

WHO MUST FILE. All operators and distributors of

COMBINED LICENSES.

COMBINED LICENSES.

COMBINED LICENSES.

COMBINED LICENSES.

COMBINED LICENSES. For those operators who are also

mechanical amusement devices covered by the Mechanical

distributors, a combined license will be issued.

Amusement Device Tax Act must file an application.

PAYMENT OF ADDITIONAL OCCUPATION TAXES

PAYMENT OF ADDITIONAL OCCUPATION TAXES

PAYMENT OF ADDITIONAL OCCUPATION TAXES

PAYMENT OF ADDITIONAL OCCUPATION TAXES

PAYMENT OF ADDITIONAL OCCUPATION TAXES

AND LICENSE FEES.

AND LICENSE FEES.

AND LICENSE FEES.

AND LICENSE FEES.

AND LICENSE FEES. This application must be used for

WHEN AND WHERE TO FILE.

WHEN AND WHERE TO FILE.

WHEN AND WHERE TO FILE.

WHEN AND WHERE TO FILE.

WHEN AND WHERE TO FILE. This application, properly

paying occupation taxes and any applicable license fees due

signed and accompanied by check or money order payable to

on any mechanical amusement device put into operation

the Nebraska Department of Revenue, must be filed prior to

after the original application has been filed.

the date of the first transaction involving the use or sale of a

mechanical amusement device. Licenses and occupation tax

DISPLAY DECAL.

DISPLAY DECAL.

DISPLAY DECAL. Every operator shall conspicuously

DISPLAY DECAL.

DISPLAY DECAL.

decals issued on or after July 1, 1998 expire December 31,

and permanently affix to each mechanical amusement device

1999.

The decal shall not be affixed by

The decal shall not be affixed by

the occupation tax decal. The decal shall not be affixed by

The decal shall not be affixed by

The decal shall not be affixed by

tape or any other means.

tape or any other means.

tape or any other means.

tape or any other means.

tape or any other means. The backing on each decal must

DEFINITIONS

DEFINITIONS

DEFINITIONS

DEFINITIONS

DEFINITIONS

be removed in order to permanently affix the decal to the

mechanical amusement device. Any person who has placed

Mechanical amusement device

Mechanical amusement device

Mechanical amusement device

Mechanical amusement device

Mechanical amusement device is any machine which,

a mechanical amusement device in operation in the state of

upon insertion of a coin, currency, credit card, or substitute

Nebraska without the necessary decal conspicuously and

into the machine, operates or may be operated or used for a

permanently affixed to it is subject to an administrative

game, contest, or amusement of any description, and includes

penalty of $75 for each violation and the mechanical

but is not limited to the following:

amusement device is subject to being sealed by the Nebraska

Pinball games

Department of Revenue. If the seal is broken prior to payment

of the occupation tax upon the mechanical amusement

Air hockey games

device, the device shall be subject to forfeiture and sale by

Pool (or any coin-operated billiards game)

the department.

Shuffleboard

SPECIFIC INSTRUCTIONS

SPECIFIC INSTRUCTIONS

SPECIFIC INSTRUCTIONS

SPECIFIC INSTRUCTIONS

SPECIFIC INSTRUCTIONS

Football and Foosball games

LINE 17.

LINE 17.

LINE 17.

LINE 17.

LINE 17. The fee for a distributor’s license is $250 per year

Racing games

or fraction thereof.

Light tennis and ping pong

LINE 19.

LINE 19.

LINE 19.

LINE 19.

LINE 19. The fee for an operator’s license when 10 or more

Baseball games

devices are operated is $250 per year or fraction thereof.

Bowling games

LINE 20.

LINE 20.

LINE 20.

LINE 20.

LINE 20. An operator is not required to pay the operator's

license fee until they have placed in operation 10 or more

Radio-ray games such as rifles, tanks, cannons, darts

mechanical amusement devices. The addition of a tenth

I.Q. games

device automatically requires the payment of the $250 fee.

Coin-operated automatic musical devices

LINE 22.

LINE 22.

LINE 22. The occupation tax shall only be paid by the

LINE 22.

LINE 22.

Game and draw lotteries

operator who has actual ownership of such mechanical

Boxing games

amusement device being taxed. Each operator shall also

have paid the sales or use tax on each device being operated.

Video and electronic games

An occupation tax of $50 for each mechanical amusement

Distributor

Distributor

Distributor

Distributor

Distributor is any person who sells, leases, or delivers

device is assessed on each mechanical amusement device

possession or custody of a mechanical amusement device to

placed in operation on or after July 1, 1998 but before

operators for a consideration either directly or indirectly

April 1, 1999.

received.

If the device is placed into operation after April 1, 1999, but

before January 1, 2000, the tax per device is $25. An

Operator

Operator

Operator

Operator

Operator is any person who operates a place of business in

occupation tax decal is issued denoting the payment of the

which a mechanical amusement device owned by him or her

tax for each device.

is physically located, or any person who places and either

directly or indirectly manages or controls any mechanical

AUTHORIZED SIGNATURE.

AUTHORIZED SIGNATURE.

AUTHORIZED SIGNATURE.

AUTHORIZED SIGNATURE.

AUTHORIZED SIGNATURE. This application must be

amusement device.

signed by the owner, member, partner, or corporate officer

listed on line 16. Persons who are not listed on line 16 but are

Distributor-operator.

Distributor-operator.

Distributor-operator. A distributor who leases or rents a

Distributor-operator.

Distributor-operator.

signing the application must attach a completed power of

device to business owners, but retains control of the device,

attorney.

is also considered an operator and subject to the same licensing

requirements and payment of the operator’s license fee and

If you need additional assistance, contact the Nebraska

occupation tax on each mechanical amusement device. A

Department of Revenue, P.O. Box 94818, Lincoln, Nebraska

distributor-operator is subject to both the distributor and the

68509-4818, or dial 1-800-742-7474 from anywhere in the

operator license fees.

continental United States. Lincoln residents call 471-5729.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1