Form Dr 0167 Proto - Alternative Fuels Rebate - 2004

ADVERTISEMENT

Departmental Use Only

60

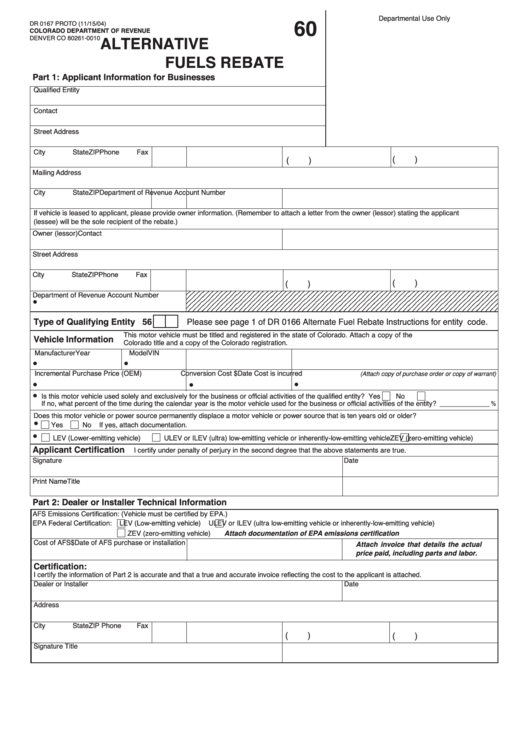

DR 0167 PROTO (11/15/04)

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0010

ALTERNATIVE

FUELS REBATE

Part 1: Applicant Information for Businesses

Qualified Entity

Contact

Street Address

City

State

ZIP

Phone

Fax

(

)

(

)

Mailing Address

City

State

ZIP

Department of Revenue Account Number

If vehicle is leased to applicant, please provide owner information. (Remember to attach a letter from the owner (lessor) stating the applicant

(lessee) will be the sole recipient of the rebate.)

Owner (lessor)

Contact

Street Address

City

State

ZIP

Phone

Fax

(

)

(

)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6

Department of Revenue Account Number

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6

•

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6

Type of Qualifying Entity 56

Please see page 1 of DR 0166 Alternate Fuel Rebate Instructions for entity code.

This motor vehicle must be titled and registered in the state of Colorado. Attach a copy of the

Vehicle Information

Colorado title and a copy of the Colorado registration.

Manufacturer

Year

Model

VIN

•

•

Incremental Purchase Price (OEM)

Conversion Cost $

Date Cost is incurred

(Attach copy of purchase order or copy of warrant)

•

•

•

•

Is this motor vehicle used solely and exclusively for the business or official activities of the qualified entity?

Yes

No

If no, what percent of the time during the calendar year is the motor vehicle used for the business or official activities of the entity? ________________ %

Does this motor vehicle or power source permanently displace a motor vehicle or power source that is ten years old or older?

•

Yes

No

If yes, attach documentation.

•

LEV (Lower-emitting vehicle)

ULEV or ILEV (ultra) low-emitting vehicle or inherently-low-emitting vehicle

ZEV (zero-emitting vehicle)

Applicant Certification

I certify under penalty of perjury in the second degree that the above statements are true.

Signature

Date

Print Name

Title

Part 2: Dealer or Installer Technical Information

AFS Emissions Certification: (Vehicle must be certified by EPA.)

EPA Federal Certification:

LEV (Low-emitting vehicle)

ULEV or ILEV (ultra low-emitting vehicle or inherently-low-emitting vehicle)

ZEV (zero-emitting vehicle)

Attach documentation of EPA emissions certification

Cost of AFS$

Date of AFS purchase or installation

Attach invoice that details the actual

price paid, including parts and labor.

Certification:

I certify the information of Part 2 is accurate and that a true and accurate invoice reflecting the cost to the applicant is attached.

Dealer or Installer

Date

Address

City

State

ZIP

Phone

Fax

(

)

(

)

Signature

Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1