(

)

_______________________________________________________________________________________________

_______________________________________________________________________________________________

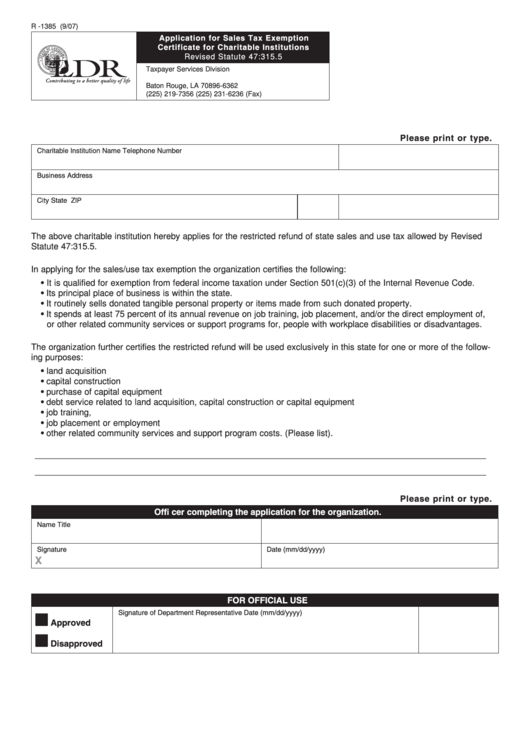

R -1385 (9/07)

Application for Sales Tax Exemption

Certificate for Charitable Institutions

Revised Statute 47:315.5

Taxpayer Services Division

P.O. Box 66362

Baton Rouge, LA 70896-6362

(225) 219-7356

(225) 231-6236 (Fax)

Please print or type.

Charitable Institution Name

Telephone Number

Business Address

City

State

ZIP

The above charitable institution hereby applies for the restricted refund of state sales and use tax allowed by Revised

Statute 47:315.5.

In applying for the sales/use tax exemption the organization certifies the following:

• It is qualified for exemption from federal income taxation under Section 501(c)(3) of the Internal Revenue Code.

• Its principal place of business is within the state.

• It routinely sells donated tangible personal property or items made from such donated property.

• It spends at least 75 percent of its annual revenue on job training, job placement, and/or the direct employment of,

or other related community services or support programs for, people with workplace disabilities or disadvantages.

The organization further certifies the restricted refund will be used exclusively in this state for one or more of the follow-

ing purposes:

• land acquisition

• capital construction

• purchase of capital equipment

• debt service related to land acquisition, capital construction or capital equipment

• job training,

• job placement or employment

• other related community services and support program costs. (Please list).

_______________________________________________________________________________________________

_______________________________________________________________________________________________

Please print or type.

Offi cer completing the application for the organization.

Name

Title

Signature

Date (mm/dd/yyyy)

X

FOR OFFICIAL USE

■

Signature of Department Representative

Date (mm/dd/yyyy)

Approved

■

Disapproved

1

1