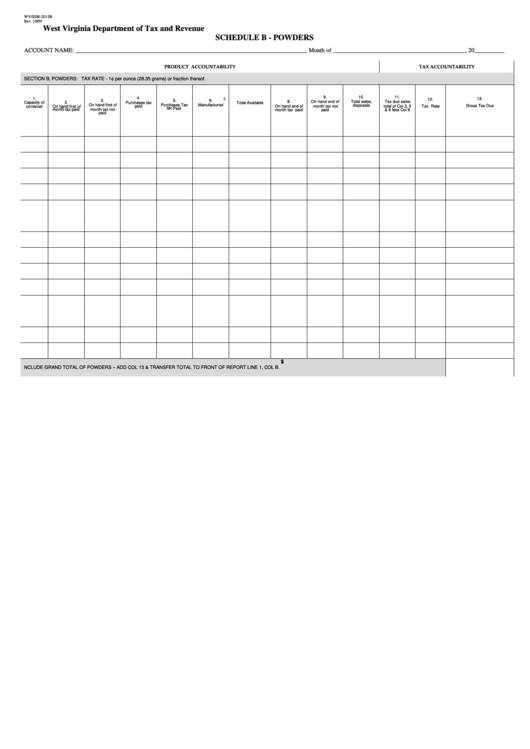

Schedule B - Powders - West Virginia Department Of Tax And Revenue

ADVERTISEMENT

WV/SDR-2015B

Rev. 10/09

West Virginia Department of Tax and Revenue

SCHEDULE B - POWDERS

ACCOUNT NAME: _____________________________________________________________________________ Month of ____________________________________________, 20__________

PRODUCT ACCOUNTABILITY

TAX ACCOUNTABILITY

SECTION B, POWDERS: TAX RATE - 1¢ per ounce (28.35 grams) or fraction thereof

.

9.

10.

11.

4.

1.

13.

7.

12.

3.

5.

6.

8.

On hand end of

Total sales,

Tax due sales

Capacity of

2.

Purchases tax

Total Available

On hand first of

Purchases Tax

Manufactured

Gross Tax Due

On hand end of

month tax not

disposals

total of Col 3, 5

Tax Rate

container

On hand first of

paid

month tax not

Not Paid

month tax paid

month tax paid

paid

& 6 less Col 9

paid

$

NCLUDE GRAND TOTAL OF POWDERS – ADD COL 13 & TRANSFER TOTAL TO FRONT OF REPORT LINE 1, COL B.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1