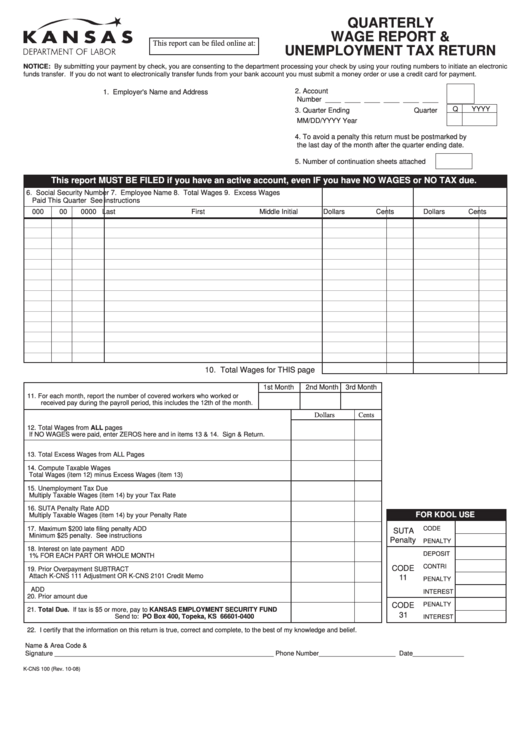

Form K-Cns 100 - Quarterly Wage Report & Unemployment Tax Return

ADVERTISEMENT

QUARTERLY

WAGE REPORT &

This report can be filed online at:

UNEMPLOYMENT TAX RETURN

NOTICE: By submitting your payment by check, you are consenting to the department processing your check by using your routing numbers to initiate an electronic

funds transfer. If you do not want to electronically transfer funds from your bank account you must submit a money order or use a credit card for payment.

2. Account

1. Employer's Name and Address

Number ____ ____ ____ ____ ____ ____

Q

YYYY

3. Quarter Ending

Quarter

MM/DD/YYYY

Year

4. To avoid a penalty this return must be postmarked by

the last day of the month after the quarter ending date.

5. Number of continuation sheets attached

This report MUST BE FILED if you have an active account, even IF you have NO WAGES or NO TAX due.

6. Social Security Number

7. Employee Name

8. Total Wages

9. Excess Wages

Paid This Quarter

See instructions

000

00

0000

Last

First

Middle Initial

Dollars

Cents

Dollars

Cents

10. Total Wages for THIS page

1st Month

2nd Month

3rd Month

11. For each month, report the number of covered workers who worked or

received pay during the payroll period, this includes the 12th of the month.

Dollars

Cents

12. Total Wages from ALL pages

If NO WAGES were paid, enter ZEROS here and in items 13 & 14. Sign & Return.

13. Total Excess Wages from ALL Pages

14. Compute Taxable Wages

Total Wages (item 12) minus Excess Wages (item 13)

15. Unemployment Tax Due

Multiply Taxable Wages (item 14) by your Tax Rate

16. SUTA Penalty Rate

ADD

FOR KDOL USE

Multiply Taxable Wages (item 14) by your Penalty Rate

17. Maximum $200 late filing penalty

ADD

CODE

SUTA

Minimum $25 penalty. See instructions

Penalty

PENALTY

18. Interest on late payment

ADD

DEPOSIT

1% FOR EACH PART OR WHOLE MONTH

CONTRI

CODE

19. Prior Overpayment

SUBTRACT

Attach K-CNS 111 Adjustment OR K-CNS 2101 Credit Memo

11

PENALTY

ADD

INTEREST

20. Prior amount due

CODE

PENALTY

21. Total Due. If tax is $5 or more, pay to

KANSAS EMPLOYMENT SECURITY FUND

31

Send to:

PO Box 400, Topeka, KS 66601-0400

INTEREST

22. I certify that the information on this return is true, correct and complete, to the best of my knowledge and belief.

Name &

Area Code &

Signature ____________________________________________________________

Phone Number_____________________

Date______________

K-CNS 100 (Rev. 10-08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2