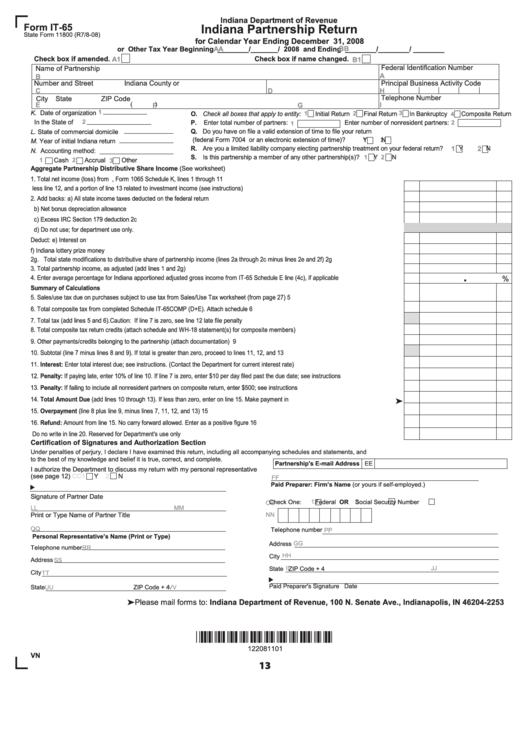

Indiana Department of Revenue

Form IT-65

Indiana Partnership Return

State Form 11800 (R7/8-08)

for Calendar Year Ending December 31, 2008

BB

or Other Tax Year Beginning ________/_______/ 2008 and Ending ________/________/ ________

AA

Check box if amended.

Check box if name changed.

A1

B1

Federal Identification Number

Name of Partnership

A

B

Number and Street

Indiana County or O.O.S.

Principal Business Activity Code

C

D

H

Telephone Number

City

State

ZIP Code

(

)

E

I

G

F

K. Date of organization

1

3

1

2

O. Check all boxes that apply to entity:

Initial Return

Final Return

In Bankruptcy

4

Composite Return

In the State of

2

P. Enter total number of partners:

Enter number of nonresident partners:

2

1

Q. Do you have on file a valid extension of time to file your return

L. State of commercial domicile

(federal Form 7004 or an electronic extension of time)?

Y

N

1

2

M. Year of initial Indiana return

R. Are you a limited liability company electing partnership treatment on your federal return?

1

Y

2

N

N. Accounting method:

S. Is this partnership a member of any other partnership(s)?

1

Y

2

N

Cash

Accrual

Other

1

2

3

Aggregate Partnership Distributive Share Income (See worksheet)

1.

Total net income (loss) from U.S. Partnership return, Form 1065 Schedule K, lines 1 through 11

less line 12, and a portion of line 13 related to investment income (see instructions) ......................................................................................

1

2.

Add backs:

a) All state income taxes deducted on the federal return ........................................................................................................... 2a

b) Net bonus depreciation allowance .......................................................................................................................................... 2b

c) Excess IRC Section 179 deduction ......................................................................................................................................... 2c

d) Do not use; for department use only.

Deduct:

e) Interest on U.S. government obligations ................................................................................................................................. 2e

f) Indiana lottery prize money ...................................................................................................................................................... 2f

2g. Total state modifications to distributive share of partnership income (lines 2a through 2c minus lines 2e and 2f) .......................................... 2g

3.

Total partnership income, as adjusted (add lines 1 and 2g) .............................................................................................................................

3

.

4.

Enter average percentage for Indiana apportioned adjusted gross income from IT-65 Schedule E line (4c), if applicable ............................

4

%

Summary of Calculations

5.

Sales/use tax due on purchases subject to use tax from Sales/Use Tax worksheet (from page 27)...............................................................

5

6.

Total composite tax from completed Schedule IT-65COMP (D+E). Attach schedule ......................................................................................

6

7.

Total tax (add lines 5 and 6). Caution: If line 7 is zero, see line 12 late file penalty .........................................................................................

7

8.

Total composite tax return credits (attach schedule and WH-18 statement(s) for composite members) ........................................................

8

9.

Other payments/credits belonging to the partnership (attach documentation) ................................................................................................

9

10. Subtotal (line 7 minus lines 8 and 9). If total is greater than zero, proceed to lines 11, 12, and 13 .................................................................. 10

11. Interest: Enter total interest due; see instructions. (Contact the Department for current interest rate) .......................................................... 11

12. Penalty: If paying late, enter 10% of line 10. If line 7 is zero, enter $10 per day filed past the due date; see instructions ............................. 12

13. Penalty: If failing to include all nonresident partners on composite return, enter $500; see instructions ....................................................... 13

14. Total Amount Due (add lines 10 through 13). If less than zero, enter on line 15. Make payment in U.S. funds ............................................. 14

15. Overpayment (line 8 plus line 9, minus lines 7, 11, 12, and 13) ....................................................................................................................... 15

16. Refund: Amount from line 15. No carry forward allowed. Enter as a positive figure ....................................................................................... 16

Do no write in line 20. Reserved for Department's use only ............................................................................................................................. 20

Certification of Signatures and Authorization Section

Under penalties of perjury, I declare I have examined this return, including all accompanying schedules and statements, and

to the best of my knowledge and belief it is true, correct, and complete.

Partnership's E-mail Address EE

I authorize the Department to discuss my return with my personal representative

(see page 12)

CC1

Y

2

N

FF

Paid Preparer: Firm’s Name (or yours if self-employed.)

Signature of Partner

Date

Check One:

1

Federal I.D. Number

2

PTIN OR

3

Social Security Number

OO

LL

MM

Print or Type Name of Partner

Title

NN

QQ

Telephone number

PP

Personal Representative’s Name (Print or Type)

Address

GG

Telephone number

RR

HH

City

Address

SS

II

JJ

State

ZIP Code + 4

City

TT

Paid Preparer's Signature

Date

State

UU

ZIP Code + 4

VV

Please mail forms to: Indiana Department of Revenue, 100 N. Senate Ave., Indianapolis, IN 46204-2253

*122081101*

122081101

VN

13

1

1