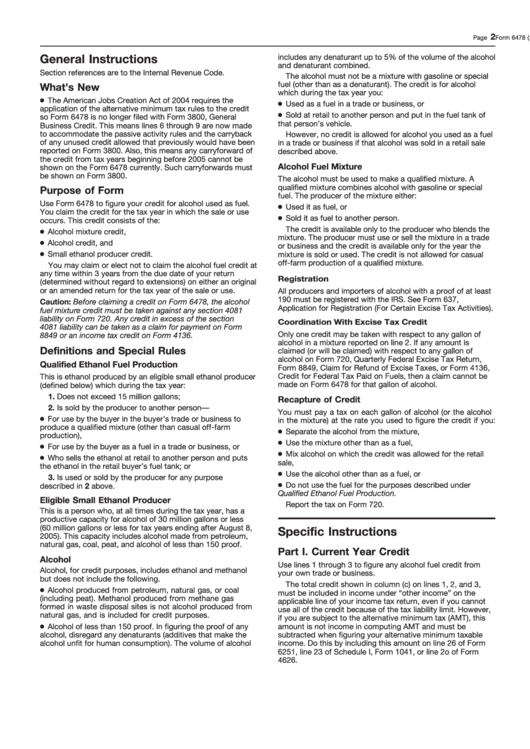

Instructions For Form 6478 - Credit For Alcohol Used As Fuel - 2005

ADVERTISEMENT

2

Form 6478 (2005)

Page

includes any denaturant up to 5% of the volume of the alcohol

General Instructions

and denaturant combined.

Section references are to the Internal Revenue Code.

The alcohol must not be a mixture with gasoline or special

fuel (other than as a denaturant). The credit is for alcohol

What’s New

which during the tax year you:

● The American Jobs Creation Act of 2004 requires the

● Used as a fuel in a trade or business, or

application of the alternative minimum tax rules to the credit

● Sold at retail to another person and put in the fuel tank of

so Form 6478 is no longer filed with Form 3800, General

that person’s vehicle.

Business Credit. This means lines 6 through 9 are now made

to accommodate the passive activity rules and the carryback

However, no credit is allowed for alcohol you used as a fuel

of any unused credit allowed that previously would have been

in a trade or business if that alcohol was sold in a retail sale

reported on Form 3800. Also, this means any carryforward of

described above.

the credit from tax years beginning before 2005 cannot be

Alcohol Fuel Mixture

shown on the Form 6478 currently. Such carryforwards must

be shown on Form 3800.

The alcohol must be used to make a qualified mixture. A

qualified mixture combines alcohol with gasoline or special

Purpose of Form

fuel. The producer of the mixture either:

Use Form 6478 to figure your credit for alcohol used as fuel.

● Used it as fuel, or

You claim the credit for the tax year in which the sale or use

● Sold it as fuel to another person.

occurs. This credit consists of the:

The credit is available only to the producer who blends the

● Alcohol mixture credit,

mixture. The producer must use or sell the mixture in a trade

● Alcohol credit, and

or business and the credit is available only for the year the

● Small ethanol producer credit.

mixture is sold or used. The credit is not allowed for casual

off-farm production of a qualified mixture.

You may claim or elect not to claim the alcohol fuel credit at

any time within 3 years from the due date of your return

Registration

(determined without regard to extensions) on either an original

or an amended return for the tax year of the sale or use.

All producers and importers of alcohol with a proof of at least

190 must be registered with the IRS. See Form 637,

Caution: Before claiming a credit on Form 6478, the alcohol

Application for Registration (For Certain Excise Tax Activities).

fuel mixture credit must be taken against any section 4081

liability on Form 720. Any credit in excess of the section

Coordination With Excise Tax Credit

4081 liability can be taken as a claim for payment on Form

Only one credit may be taken with respect to any gallon of

8849 or an income tax credit on Form 4136.

alcohol in a mixture reported on line 2. If any amount is

Definitions and Special Rules

claimed (or will be claimed) with respect to any gallon of

alcohol on Form 720, Quarterly Federal Excise Tax Return,

Qualified Ethanol Fuel Production

Form 8849, Claim for Refund of Excise Taxes, or Form 4136,

Credit for Federal Tax Paid on Fuels, then a claim cannot be

This is ethanol produced by an eligible small ethanol producer

made on Form 6478 for that gallon of alcohol.

(defined below) which during the tax year:

1. Does not exceed 15 million gallons;

Recapture of Credit

2. Is sold by the producer to another person—

You must pay a tax on each gallon of alcohol (or the alcohol

● For use by the buyer in the buyer’s trade or business to

in the mixture) at the rate you used to figure the credit if you:

produce a qualified mixture (other than casual off-farm

● Separate the alcohol from the mixture,

production),

● Use the mixture other than as a fuel,

● For use by the buyer as a fuel in a trade or business, or

● Mix alcohol on which the credit was allowed for the retail

● Who sells the ethanol at retail to another person and puts

sale,

the ethanol in the retail buyer’s fuel tank; or

● Use the alcohol other than as a fuel, or

3. Is used or sold by the producer for any purpose

● Do not use the fuel for the purposes described under

described in 2 above.

Qualified Ethanol Fuel Production.

Eligible Small Ethanol Producer

Report the tax on Form 720.

This is a person who, at all times during the tax year, has a

productive capacity for alcohol of 30 million gallons or less

(60 million gallons or less for tax years ending after August 8,

Specific Instructions

2005). This capacity includes alcohol made from petroleum,

natural gas, coal, peat, and alcohol of less than 150 proof.

Part I. Current Year Credit

Alcohol

Use lines 1 through 3 to figure any alcohol fuel credit from

Alcohol, for credit purposes, includes ethanol and methanol

your own trade or business.

but does not include the following.

The total credit shown in column (c) on lines 1, 2, and 3,

● Alcohol produced from petroleum, natural gas, or coal

must be included in income under “other income” on the

(including peat). Methanol produced from methane gas

applicable line of your income tax return, even if you cannot

formed in waste disposal sites is not alcohol produced from

use all of the credit because of the tax liability limit. However,

natural gas, and is included for credit purposes.

if you are subject to the alternative minimum tax (AMT), this

● Alcohol of less than 150 proof. In figuring the proof of any

amount is not income in computing AMT and must be

alcohol, disregard any denaturants (additives that make the

subtracted when figuring your alternative minimum taxable

alcohol unfit for human consumption). The volume of alcohol

income. Do this by including this amount on line 26 of Form

6251, line 23 of Schedule I, Form 1041, or line 2o of Form

4626.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3