Instructions For Form 5884 - Work Opportunity Credit - 2005

ADVERTISEMENT

2

Form 5884 (2005)

Page

● Qualified SSI recipient.

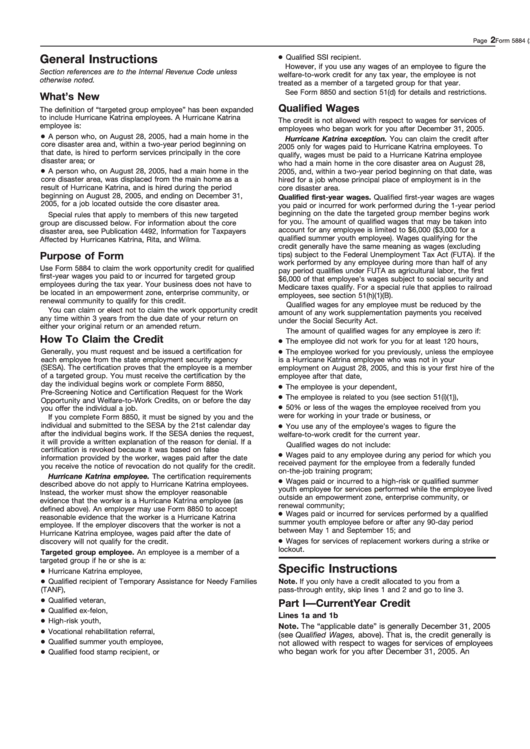

General Instructions

However, if you use any wages of an employee to figure the

Section references are to the Internal Revenue Code unless

welfare-to-work credit for any tax year, the employee is not

otherwise noted.

treated as a member of a targeted group for that year.

See Form 8850 and section 51(d) for details and restrictions.

What’s New

Qualified Wages

The definition of “targeted group employee” has been expanded

to include Hurricane Katrina employees. A Hurricane Katrina

The credit is not allowed with respect to wages for services of

employee is:

employees who began work for you after December 31, 2005.

● A person who, on August 28, 2005, had a main home in the

Hurricane Katrina exception. You can claim the credit after

core disaster area and, within a two-year period beginning on

2005 only for wages paid to Hurricane Katrina employees. To

that date, is hired to perform services principally in the core

qualify, wages must be paid to a Hurricane Katrina employee

disaster area; or

who had a main home in the core disaster area on August 28,

● A person who, on August 28, 2005, had a main home in the

2005, and, within a two-year period beginning on that date, was

core disaster area, was displaced from the main home as a

hired for a job whose principal place of employment is in the

result of Hurricane Katrina, and is hired during the period

core disaster area.

beginning on August 28, 2005, and ending on December 31,

Qualified first-year wages. Qualified first-year wages are wages

2005, for a job located outside the core disaster area.

you paid or incurred for work performed during the 1-year period

beginning on the date the targeted group member begins work

Special rules that apply to members of this new targeted

for you. The amount of qualified wages that may be taken into

group are discussed below. For information about the core

account for any employee is limited to $6,000 ($3,000 for a

disaster area, see Publication 4492, Information for Taxpayers

qualified summer youth employee). Wages qualifying for the

Affected by Hurricanes Katrina, Rita, and Wilma.

credit generally have the same meaning as wages (excluding

Purpose of Form

tips) subject to the Federal Unemployment Tax Act (FUTA). If the

work performed by any employee during more than half of any

Use Form 5884 to claim the work opportunity credit for qualified

pay period qualifies under FUTA as agricultural labor, the first

first-year wages you paid to or incurred for targeted group

$6,000 of that employee’s wages subject to social security and

employees during the tax year. Your business does not have to

Medicare taxes qualify. For a special rule that applies to railroad

be located in an empowerment zone, enterprise community, or

employees, see section 51(h)(1)(B).

renewal community to qualify for this credit.

Qualified wages for any employee must be reduced by the

You can claim or elect not to claim the work opportunity credit

amount of any work supplementation payments you received

any time within 3 years from the due date of your return on

under the Social Security Act.

either your original return or an amended return.

The amount of qualified wages for any employee is zero if:

How To Claim the Credit

● The employee did not work for you for at least 120 hours,

● The employee worked for you previously, unless the employee

Generally, you must request and be issued a certification for

each employee from the state employment security agency

is a Hurricane Katrina employee who was not in your

(SESA). The certification proves that the employee is a member

employment on August 28, 2005, and this is your first hire of the

of a targeted group. You must receive the certification by the

employee after that date,

day the individual begins work or complete Form 8850,

● The employee is your dependent,

Pre-Screening Notice and Certification Request for the Work

● The employee is related to you (see section 51(i)(1)),

Opportunity and Welfare-to-Work Credits, on or before the day

● 50% or less of the wages the employee received from you

you offer the individual a job.

were for working in your trade or business, or

If you complete Form 8850, it must be signed by you and the

● You use any of the employee’s wages to figure the

individual and submitted to the SESA by the 21st calendar day

after the individual begins work. If the SESA denies the request,

welfare-to-work credit for the current year.

it will provide a written explanation of the reason for denial. If a

Qualified wages do not include:

certification is revoked because it was based on false

● Wages paid to any employee during any period for which you

information provided by the worker, wages paid after the date

received payment for the employee from a federally funded

you receive the notice of revocation do not qualify for the credit.

on-the-job training program;

Hurricane Katrina employee. The certification requirements

● Wages paid or incurred to a high-risk or qualified summer

described above do not apply to Hurricane Katrina employees.

youth employee for services performed while the employee lived

Instead, the worker must show the employer reasonable

outside an empowerment zone, enterprise community, or

evidence that the worker is a Hurricane Katrina employee (as

renewal community;

defined above). An employer may use Form 8850 to accept

● Wages paid or incurred for services performed by a qualified

reasonable evidence that the worker is a Hurricane Katrina

summer youth employee before or after any 90-day period

employee. If the employer discovers that the worker is not a

between May 1 and September 15; and

Hurricane Katrina employee, wages paid after the date of

● Wages for services of replacement workers during a strike or

discovery will not qualify for the credit.

lockout.

Targeted group employee. An employee is a member of a

targeted group if he or she is a:

Specific Instructions

● Hurricane Katrina employee,

● Qualified recipient of Temporary Assistance for Needy Families

Note. If you only have a credit allocated to you from a

pass-through entity, skip lines 1 and 2 and go to line 3.

(TANF),

● Qualified veteran,

Part I—Current Year Credit

● Qualified ex-felon,

Lines 1a and 1b

● High-risk youth,

Note. The “applicable date” is generally December 31, 2005

● Vocational rehabilitation referral,

(see Qualified Wages, above). That is, the credit generally is

● Qualified summer youth employee,

not allowed with respect to wages for services of employees

● Qualified food stamp recipient, or

who began work for you after December 31, 2005. An

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2