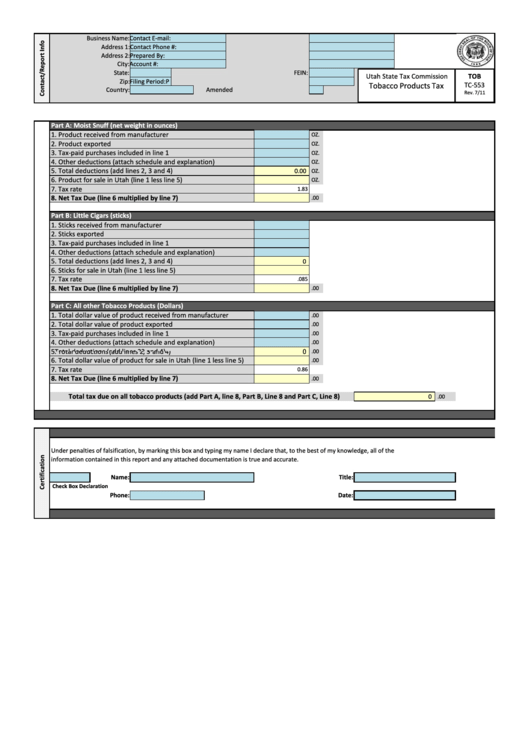

Form Tc-553 - Tobacco Products Tax

ADVERTISEMENT

Business Name:

Contact E-mail:

Address 1:

Contact Phone #:

Address 2:

Prepared By:

City:

Account #:

State:

FEIN:

Utah State Tax Commission

TOB

Zip:

Filing Period:

utah@utah.gov

P

Tobacco Products Tax

TC-553

Country:

Amended

Rev. 7/11

Part A: Moist Snuff (net weight in ounces)

1. Product received from manufacturer

OZ.

2. Product exported

OZ.

3. Tax-paid purchases included in line 1

OZ.

4. Other deductions (attach schedule and explanation)

OZ.

5. Total deductions (add lines 2, 3 and 4)

0.00

OZ.

6. Product for sale in Utah (line 1 less line 5)

OZ.

7. Tax rate

1.83

8. Net Tax Due (line 6 multiplied by line 7)

.00

Part B: Little Cigars (sticks)

1. Sticks received from manufacturer

2. Sticks exported

3. Tax-paid purchases included in line 1

4. Other deductions (attach schedule and explanation)

5. Total deductions (add lines 2, 3 and 4)

0

6. Sticks for sale in Utah (line 1 less line 5)

7. Tax rate

.085

8. Net Tax Due (line 6 multiplied by line 7)

.00

Part C: All other Tobacco Products (Dollars)

1. Total dollar value of product received from manufacturer

.00

2. Total dollar value of product exported

.00

3. Tax-paid purchases included in line 1

.00

4. Other deductions (attach schedule and explanation)

.00

5 Total deductions (add lines 2 3 and 4)

5. Total deductions (add lines 2, 3 and 4)

0

0

.00

00

6. Total dollar value of product for sale in Utah (line 1 less line 5)

.00

7. Tax rate

0.86

8. Net Tax Due (line 6 multiplied by line 7)

.00

Total tax due on all tobacco products (add Part A, line 8, Part B, Line 8 and Part C, Line 8)

0

.00

Under penalties of falsification, by marking this box and typing my name I declare that, to the best of my knowledge, all of the

information contained in this report and any attached documentation is true and accurate.

Name:

Title:

Check Box Declaration

Phone:

Date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1