Tax Return Of Business Tangible Personal Property For Local Taxation Only Form

ADVERTISEMENT

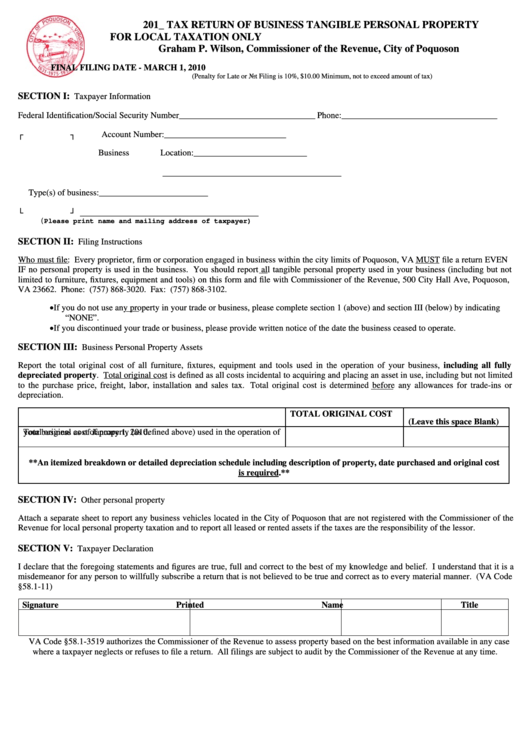

201_ TAX RETURN OF BUSINESS TANGIBLE PERSONAL PROPERTY

FOR LOCAL TAXATION ONLY

Graham P. Wilson, Commissioner of the Revenue, City of Poquoson

FINAL FILING DATE - MARCH 1, 2010

(Penalty for Late or Not Filing is 10%, $10.00 Minimum, not to exceed amount of tax)

SECTION I:

Taxpayer Information

Federal Identification/Social Security Number

Phone:

___________________________________

________________________________________

┌

┐

Account Number:____________________________

Business Location:__________________________

_________________________________________

Type(s) of business:_________________________

└

┘

_________________________________________

(

Please print name and mailing address of taxpayer)

SECTION II:

Filing Instructions

Who must file: Every proprietor, firm or corporation engaged in business within the city limits of Poquoson, VA MUST file a return EVEN

IF no personal property is used in the business. You should report all tangible personal property used in your business (including but not

limited to furniture, fixtures, equipment and tools) on this form and file with Commissioner of the Revenue, 500 City Hall Ave, Poquoson,

VA 23662. Phone: (757) 868-3020. Fax: (757) 868-3102.

•

If you do not use any property in your trade or business, please complete section 1 (above) and section III (below) by indicating

“NONE”.

•

If you discontinued your trade or business, please provide written notice of the date the business ceased to operate.

SECTION III:

Business Personal Property Assets

Report the total original cost of all furniture, fixtures, equipment and tools used in the operation of your business, including all fully

depreciated property. Total original cost is defined as all costs incidental to acquiring and placing an asset in use, including but not limited

to the purchase price, freight, labor, installation and sales tax. Total original cost is determined before any allowances for trade-ins or

depreciation.

TOTAL ORIGINAL COST

(Leave this space Blank)

Total original cost of property (as defined above) used in the operation of

your business as of January 1, 2010.

**An itemized breakdown or detailed depreciation schedule including description of property, date purchased and original cost

is required.**

SECTION IV:

Other personal property

Attach a separate sheet to report any business vehicles located in the City of Poquoson that are not registered with the Commissioner of the

Revenue for local personal property taxation and to report all leased or rented assets if the taxes are the responsibility of the lessor.

SECTION V:

Taxpayer Declaration

I declare that the foregoing statements and figures are true, full and correct to the best of my knowledge and belief. I understand that it is a

misdemeanor for any person to willfully subscribe a return that is not believed to be true and correct as to every material manner. (VA Code

§58.1-11)

Signature

Printed Name

Title

Date

VA Code §58.1-3519 authorizes the Commissioner of the Revenue to assess property based on the best information available in any case

where a taxpayer neglects or refuses to file a return. All filings are subject to audit by the Commissioner of the Revenue at any time.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1