Instructions For Schedule H (Form 1040) Household Employment Taxes - 2010

ADVERTISEMENT

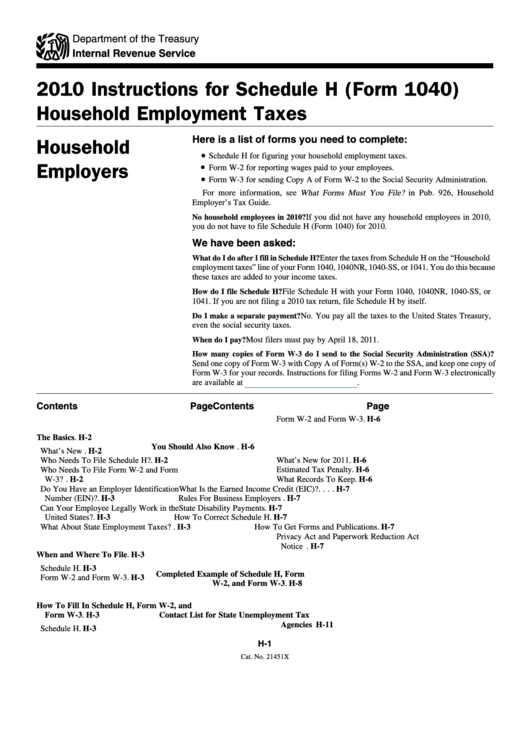

Department of the Treasury

Internal Revenue Service

2010 Instructions for Schedule H (Form 1040)

Household Employment Taxes

Here is a list of forms you need to complete:

Household

•

Schedule H for figuring your household employment taxes.

Employers

•

Form W-2 for reporting wages paid to your employees.

•

Form W-3 for sending Copy A of Form W-2 to the Social Security Administration.

For more information, see What Forms Must You File? in Pub. 926, Household

Employer’s Tax Guide.

No household employees in 2010?

If you did not have any household employees in 2010,

you do not have to file Schedule H (Form 1040) for 2010.

We have been asked:

What do I do after I fill in Schedule H?

Enter the taxes from Schedule H on the “Household

employment taxes” line of your Form 1040, 1040NR, 1040-SS, or 1041. You do this because

these taxes are added to your income taxes.

How do I file Schedule H?

File Schedule H with your Form 1040, 1040NR, 1040-SS, or

1041. If you are not filing a 2010 tax return, file Schedule H by itself.

No. You pay all the taxes to the United States Treasury,

Do I make a separate payment?

even the social security taxes.

Most filers must pay by April 18, 2011.

When do I pay?

How many copies of Form W-3 do I send to the Social Security Administration (SSA)?

Send one copy of Form W-3 with Copy A of Form(s) W-2 to the SSA, and keep one copy of

Form W-3 for your records. Instructions for filing Forms W-2 and Form W-3 electronically

are available at

.

Contents

Page

Contents

Page

Form W-2 and Form W-3 . . . . . . . . . . . . . . . H-6

The Basics . . . . . . . . . . . . . . . . . . . . . . . . . . H-2

You Should Also Know . . . . . . . . . . . . . . . . . H-6

What’s New . . . . . . . . . . . . . . . . . . . . . . . . . H-2

Who Needs To File Schedule H? . . . . . . . . . . H-2

What’s New for 2011 . . . . . . . . . . . . . . . . . . H-6

Estimated Tax Penalty . . . . . . . . . . . . . . . . . . H-6

Who Needs To File Form W-2 and Form

W-3? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . H-2

What Records To Keep . . . . . . . . . . . . . . . . . H-6

Do You Have an Employer Identification

What Is the Earned Income Credit (EIC)? . . . . H-7

Number (EIN)? . . . . . . . . . . . . . . . . . . . . . . H-3

Rules For Business Employers . . . . . . . . . . . . H-7

State Disability Payments . . . . . . . . . . . . . . . H-7

Can Your Employee Legally Work in the

United States? . . . . . . . . . . . . . . . . . . . . . . H-3

How To Correct Schedule H . . . . . . . . . . . . . H-7

What About State Employment Taxes? . . . . . . H-3

How To Get Forms and Publications . . . . . . . H-7

Privacy Act and Paperwork Reduction Act

Notice . . . . . . . . . . . . . . . . . . . . . . . . . . . . H-7

When and Where To File . . . . . . . . . . . . . . . H-3

Schedule H . . . . . . . . . . . . . . . . . . . . . . . . . H-3

Completed Example of Schedule H, Form

Form W-2 and Form W-3 . . . . . . . . . . . . . . . H-3

W-2, and Form W-3 . . . . . . . . . . . . . . . . . H-8

How To Fill In Schedule H, Form W-2, and

Form W-3 . . . . . . . . . . . . . . . . . . . . . . . . . H-3

Contact List for State Unemployment Tax

Agencies . . . . . . . . . . . . . . . . . . . . . . . . . H-11

Schedule H . . . . . . . . . . . . . . . . . . . . . . . . . H-3

H-1

Cat. No. 21451X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12