Instructions For Form 1099-Q - 2006

ADVERTISEMENT

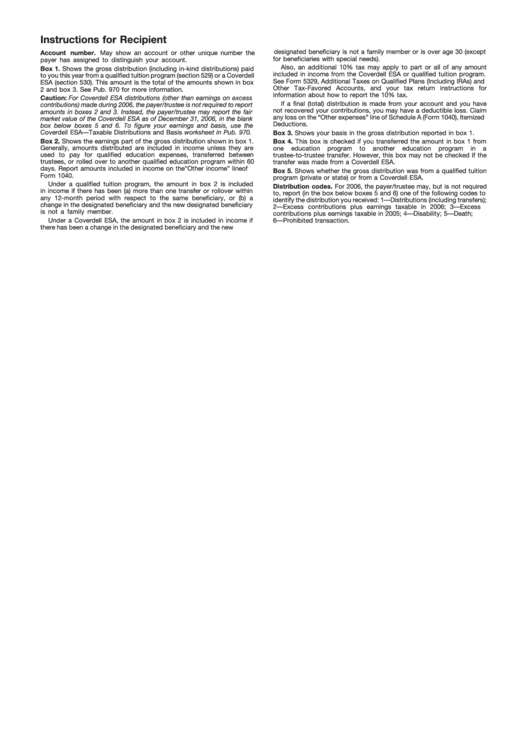

Instructions for Recipient

designated beneficiary is not a family member or is over age 30 (except

Account number. May show an account or other unique number the

for beneficiaries with special needs).

payer has assigned to distinguish your account.

Also, an additional 10% tax may apply to part or all of any amount

Box 1. Shows the gross distribution (including in-kind distributions) paid

included in income from the Coverdell ESA or qualified tuition program.

to you this year from a qualified tuition program (section 529) or a Coverdell

See Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and

ESA (section 530). This amount is the total of the amounts shown in box

Other Tax-Favored Accounts, and your tax return instructions for

2 and box 3. See Pub. 970 for more information.

information about how to report the 10% tax.

Caution: For Coverdell ESA distributions (other than earnings on excess

If a final (total) distribution is made from your account and you have

contributions) made during 2006, the payer/trustee is not required to report

not recovered your contributions, you may have a deductible loss. Claim

amounts in boxes 2 and 3. Instead, the payer/trustee may report the fair

any loss on the “Other expenses” line of Schedule A (Form 1040), Itemized

market value of the Coverdell ESA as of December 31, 2006, in the blank

Deductions.

box below boxes 5 and 6. To figure your earnings and basis, use the

Coverdell ESA—Taxable Distributions and Basis worksheet in Pub. 970.

Box 3. Shows your basis in the gross distribution reported in box 1.

Box 2. Shows the earnings part of the gross distribution shown in box 1.

Box 4. This box is checked if you transferred the amount in box 1 from

Generally, amounts distributed are included in income unless they are

one

education

program

to

another

education

program

in

a

used to pay for qualified education expenses, transferred between

trustee-to-trustee transfer. However, this box may not be checked if the

trustees, or rolled over to another qualified education program within 60

transfer was made from a Coverdell ESA.

days. Report amounts included in income on the “Other income” line of

Box 5. Shows whether the gross distribution was from a qualified tuition

Form 1040.

program (private or state) or from a Coverdell ESA.

Under a qualified tuition program, the amount in box 2 is included

Distribution codes. For 2006, the payer/trustee may, but is not required

in income if there has been (a) more than one transfer or rollover within

to, report (in the box below boxes 5 and 6) one of the following codes to

any 12-month period with respect to the same beneficiary, or (b) a

identify the distribution you received: 1—Distributions (including transfers);

change in the designated beneficiary and the new designated beneficiary

2—Excess contributions plus earnings taxable in 2006; 3—Excess

is not a family member.

contributions plus earnings taxable in 2005; 4—Disability; 5—Death;

Under a Coverdell ESA, the amount in box 2 is included in income if

6—Prohibited transaction.

there has been a change in the designated beneficiary and the new

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25