2006 Instructions For Schedule R (Form 1040) - Credit For The Elderly Or The Disabled

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

2006 Instructions for Schedule R (Form 1040)

Use Schedule R (Form 1040) to figure the credit for the elderly or the disabled.

Credit for the

Additional information.

See Pub. 524 for more details.

Elderly or the

Disabled

Married Persons Filing Separate

Who Can Take the Credit

Returns

The credit is based on your filing status, age, and income. If you are

If your filing status is married filing separately and you lived with

married filing a joint return, it is also based on your spouse’s age

your spouse at any time during 2006, you cannot take the credit.

and income. You may be able to take this credit if either of the

following applies.

1. You were age 65 or older at the end of 2006, or

Nonresident Aliens

2. You were under age 65 at the end of 2006 and you meet all of

If you were a nonresident alien at any time during 2006, you may be

the following.

able to take the credit only if your filing status is married filing

a. You were permanently and totally disabled on the date you

jointly.

retired. If you retired before 1977, you must have been permanently

and totally disabled on January 1, 1976, or January 1, 1977.

Income Limits

b. You received taxable disability income for 2006.

c. On January 1, 2006, you had not reached mandatory retire-

See the chart below.

ment age (the age when your employer’s retirement program would

have required you to retire).

Want the IRS To Figure Your Credit?

For the definition of permanent and total disability, see What Is

If you can take the credit and you want us to figure it for you, check

Permanent and Total Disability? on page R-2. Also, see the instruc-

the box in Part I of Schedule R for your filing status and age. Fill in

tions for Part II on page R-2.

Part II and lines 11 and 13 of Part III if they apply to you. Then,

enter “CFE” on the dotted line next to line 49 on Form 1040 and

attach Schedule R to your return.

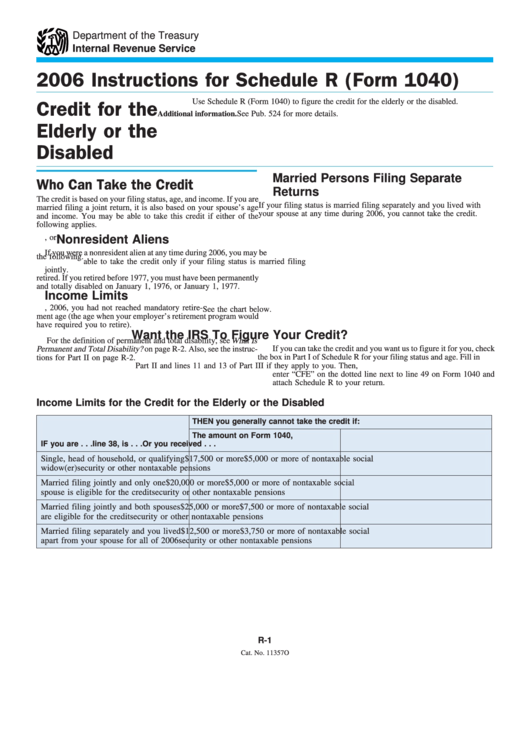

Income Limits for the Credit for the Elderly or the Disabled

THEN you generally cannot take the credit if:

The amount on Form 1040,

IF you are . . .

line 38, is . . .

Or you received . . .

Single, head of household, or qualifying $17,500 or more

$5,000 or more of nontaxable social

widow(er)

security or other nontaxable pensions

Married filing jointly and only one

$20,000 or more

$5,000 or more of nontaxable social

spouse is eligible for the credit

security or other nontaxable pensions

Married filing jointly and both spouses

$25,000 or more

$7,500 or more of nontaxable social

are eligible for the credit

security or other nontaxable pensions

Married filing separately and you lived

$12,500 or more

$3,750 or more of nontaxable social

apart from your spouse for all of 2006

security or other nontaxable pensions

R-1

Cat. No. 11357O

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4