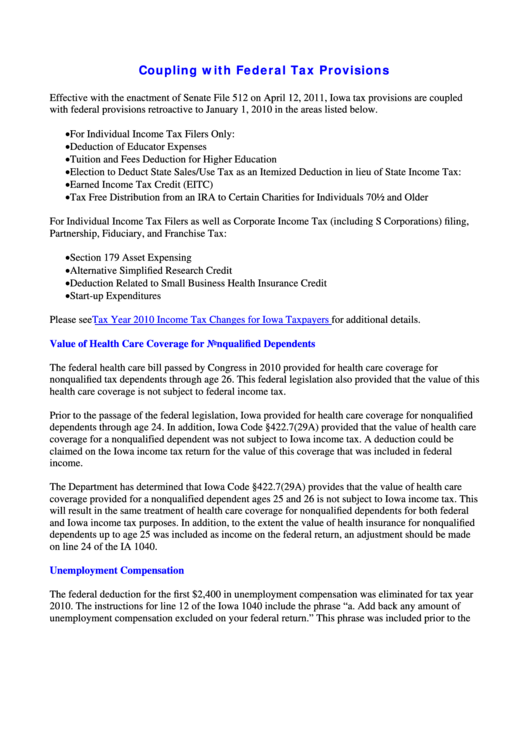

Coupling with Federal Tax Provisions

Effective with the enactment of Senate File 512 on April 12, 2011, Iowa tax provisions are coupled

with federal provisions retroactive to January 1, 2010 in the areas listed below.

• For Individual Income Tax Filers Only:

• Deduction of Educator Expenses

• Tuition and Fees Deduction for Higher Education

• Election to Deduct State Sales/Use Tax as an Itemized Deduction in lieu of State Income Tax:

• Earned Income Tax Credit (EITC)

• Tax Free Distribution from an IRA to Certain Charities for Individuals 70½ and Older

For Individual Income Tax Filers as well as Corporate Income Tax (including S Corporations) filing,

Partnership, Fiduciary, and Franchise Tax:

• Section 179 Asset Expensing

• Alternative Simplified Research Credit

• Deduction Related to Small Business Health Insurance Credit

• Start-up Expenditures

Please see

Tax Year 2010 Income Tax Changes for Iowa Taxpayers

for additional details.

Value of Health Care Coverage for Nonqualified Dependents

The federal health care bill passed by Congress in 2010 provided for health care coverage for

nonqualified tax dependents through age 26. This federal legislation also provided that the value of this

health care coverage is not subject to federal income tax.

Prior to the passage of the federal legislation, Iowa provided for health care coverage for nonqualified

dependents through age 24. In addition, Iowa Code §422.7(29A) provided that the value of health care

coverage for a nonqualified dependent was not subject to Iowa income tax. A deduction could be

claimed on the Iowa income tax return for the value of this coverage that was included in federal

income.

The Department has determined that Iowa Code §422.7(29A) provides that the value of health care

coverage provided for a nonqualified dependent ages 25 and 26 is not subject to Iowa income tax. This

will result in the same treatment of health care coverage for nonqualified dependents for both federal

and Iowa income tax purposes. In addition, to the extent the value of health insurance for nonqualified

dependents up to age 25 was included as income on the federal return, an adjustment should be made

on line 24 of the IA 1040.

Unemployment Compensation

The federal deduction for the first $2,400 in unemployment compensation was eliminated for tax year

2010. The instructions for line 12 of the Iowa 1040 include the phrase “a. Add back any amount of

unemployment compensation excluded on your federal return.” This phrase was included prior to the

1

1 2

2 3

3 4

4