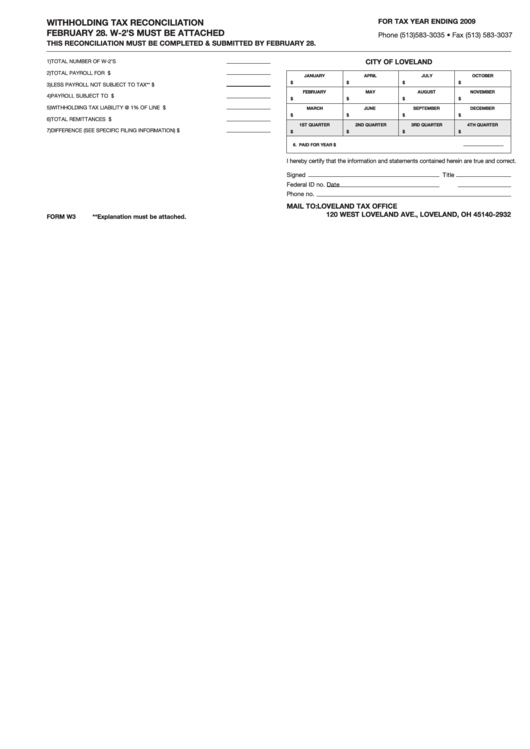

Withholding Tax Reconciliation Form - City Of Loveland

ADVERTISEMENT

FOR TAX YEAR ENDING 2009

WITHHOLDING TAX RECONCILIATION

FEBRUARY 28. W-2’S MUST BE ATTACHED

Phone (513)583-3035 • Fax (513) 583-3037

THIS RECONCILIATION MUST BE COMPLETED & SUBMITTED BY FEBRUARY 28.

1) TOTAL NUMBER OF W-2’S ATTACHED...................................................

CITY OF LOVELAND

2) TOTAL PAYROLL FOR YEAR .................................................................... $

JANUARY

APRIL

JULY

OCTOBER

$

$

$

$

3) LESS PAYROLL NOT SUBJECT TO TAX** ............................................... $

FEBRUARY

MAY

AUGUST

NOVEMBER

4) PAYROLL SUBJECT TO TAX .................................................................... $

$

$

$

$

5) WITHHOLDING TAX LIABILITY @ 1% OF LINE 4 .................................... $

MARCH

JUNE

SEPTEMBER

DECEMBER

$

$

$

$

6) TOTAL REMITTANCES MADE................................................................... $

1ST QUARTER

2ND QUARTER

3RD QUARTER

4TH QUARTER

7) DIFFERENCE (SEE SPECIFIC FILING INFORMATION)............................ $

$

$

$

$

6. PAID FOR YEAR .......................................................................................................... $

I hereby certify that the information and statements contained herein are true and correct.

Signed

Title

Federal ID no.

Date

Phone no.

MAIL TO:

LOVELAND TAX OFFICE

120 WEST LOVELAND AVE., LOVELAND, OH 45140-2932

FORM W3

**Explanation must be attached.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1