Instructions For Shedule B (Form 1040) - Interest And Ordinary Dividents

ADVERTISEMENT

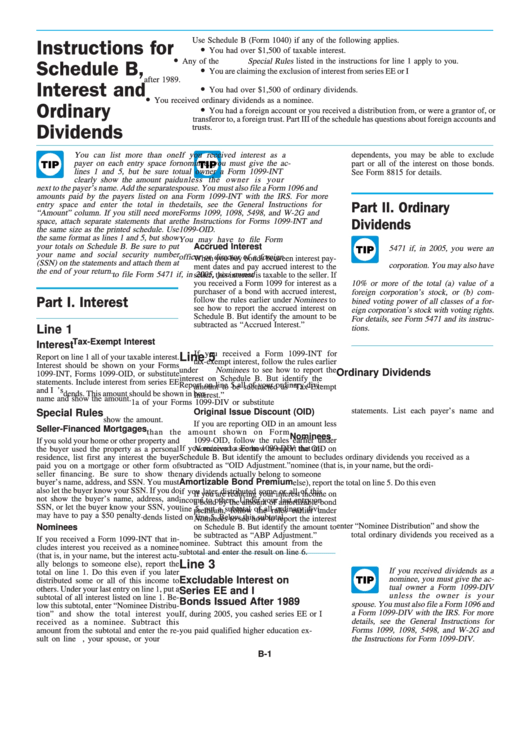

Use Schedule B (Form 1040) if any of the following applies.

Instructions for

•

You had over $1,500 of taxable interest.

•

Any of the Special Rules listed in the instructions for line 1 apply to you.

Schedule B,

•

You are claiming the exclusion of interest from series EE or I U.S. savings bonds issued

after 1989.

•

Interest and

You had over $1,500 of ordinary dividends.

•

You received ordinary dividends as a nominee.

•

Ordinary

You had a foreign account or you received a distribution from, or were a grantor of, or

transferor to, a foreign trust. Part III of the schedule has questions about foreign accounts and

trusts.

Dividends

You can list more than one

If you received interest as a

dependents, you may be able to exclude

payer on each entry space for

nominee, you must give the ac-

part or all of the interest on those bonds.

TIP

TIP

lines 1 and 5, but be sure to

tual owner a Form 1099-INT

See Form 8815 for details.

clearly show the amount paid

unless the owner is your

next to the payer’s name. Add the separate

spouse. You must also file a Form 1096 and

amounts paid by the payers listed on an

a Form 1099-INT with the IRS. For more

entry space and enter the total in the

details, see the General Instructions for

Part II. Ordinary

“Amount” column. If you still need more

Forms 1099, 1098, 5498, and W-2G and

space, attach separate statements that are

the Instructions for Forms 1099-INT and

Dividends

the same size as the printed schedule. Use

1099-OID.

the same format as lines 1 and 5, but show

You may have to file Form

your totals on Schedule B. Be sure to put

Accrued Interest

5471 if, in 2005, you were an

TIP

your name and social security number

officer or director of a foreign

When you buy bonds between interest pay-

(SSN) on the statements and attach them at

corporation. You may also have

ment dates and pay accrued interest to the

the end of your return.

to file Form 5471 if, in 2005, you owned

seller, this interest is taxable to the seller. If

you received a Form 1099 for interest as a

10% or more of the total (a) value of a

purchaser of a bond with accrued interest,

foreign corporation’s stock, or (b) com-

follow the rules earlier under Nominees to

Part I. Interest

bined voting power of all classes of a for-

see how to report the accrued interest on

eign corporation’s stock with voting rights.

Schedule B. But identify the amount to be

For details, see Form 5471 and its instruc-

subtracted as “Accrued Interest.”

Line 1

tions.

Tax-Exempt Interest

Interest

If you received a Form 1099-INT for

Line 5

Report on line 1 all of your taxable interest.

tax-exempt interest, follow the rules earlier

Interest should be shown on your Forms

under Nominees to see how to report the

Ordinary Dividends

1099-INT, Forms 1099-OID, or substitute

interest on Schedule B. But identify the

statements. Include interest from series EE

Report on line 5 all of your ordinary divi-

amount to be subtracted as “Tax-Exempt

and I U.S. savings bonds. List each payer’s

dends. This amount should be shown in box

Interest.”

name and show the amount.

1a of your Forms 1099-DIV or substitute

statements. List each payer’s name and

Original Issue Discount (OID)

Special Rules

show the amount.

If you are reporting OID in an amount less

Seller-Financed Mortgages

than the amount shown on Form

Nominees

1099-OID, follow the rules earlier under

If you sold your home or other property and

Nominees to see how to report the OID on

If you received a Form 1099-DIV that in-

the buyer used the property as a personal

Schedule B. But identify the amount to be

cludes ordinary dividends you received as a

residence, list first any interest the buyer

subtracted as “OID Adjustment.”

nominee (that is, in your name, but the ordi-

paid you on a mortgage or other form of

seller financing. Be sure to show the

nary dividends actually belong to someone

Amortizable Bond Premium

buyer’s name, address, and SSN. You must

else), report the total on line 5. Do this even

also let the buyer know your SSN. If you do

if you later distributed some or all of this

If you are reducing your interest income on

not show the buyer’s name, address, and

income to others. Under your last entry on

a bond by the amount of amortizable bond

SSN, or let the buyer know your SSN, you

line 5, put a subtotal of all ordinary divi-

premium, follow the rules earlier under

may have to pay a $50 penalty.

dends listed on line 5. Below this subtotal,

Nominees to see how to report the interest

enter “Nominee Distribution” and show the

Nominees

on Schedule B. But identify the amount to

total ordinary dividends you received as a

be subtracted as “ABP Adjustment.”

If you received a Form 1099-INT that in-

nominee. Subtract this amount from the

cludes interest you received as a nominee

subtotal and enter the result on line 6.

(that is, in your name, but the interest actu-

Line 3

ally belongs to someone else), report the

If you received dividends as a

total on line 1. Do this even if you later

nominee, you must give the ac-

Excludable Interest on

TIP

distributed some or all of this income to

tual owner a Form 1099-DIV

others. Under your last entry on line 1, put a

Series EE and I U.S. Savings

unless the owner is your

subtotal of all interest listed on line 1. Be-

Bonds Issued After 1989

spouse. You must also file a Form 1096 and

low this subtotal, enter “Nominee Distribu-

a Form 1099-DIV with the IRS. For more

tion” and show the total interest you

If, during 2005, you cashed series EE or I

details, see the General Instructions for

received as a nominee. Subtract this

U.S. savings bonds issued after 1989 and

Forms 1099, 1098, 5498, and W-2G and

amount from the subtotal and enter the re-

you paid qualified higher education ex-

the Instructions for Form 1099-DIV.

sult on line 2.

penses for yourself, your spouse, or your

B-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2