General Information For Filing Local Earned Income And Net Profits Tax Return - Greencastle-Antrim

ADVERTISEMENT

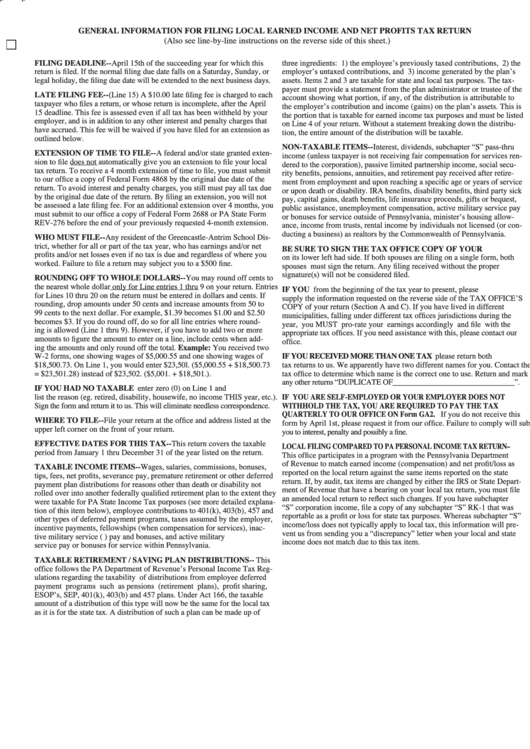

GENERAL INFORMATION FOR FILING LOCAL EARNED INCOME AND NET PROFITS TAX RETURN

(Also see line-by-line instructions on the reverse side of this sheet.)

FILING DEADLINE--April 15th of the succeeding year for which this

three ingredients: 1) the employee’s previously taxed contributions, 2) the

return is filed. If the normal filing due date falls on a Saturday, Sunday, or

employer’s untaxed contributions, and 3) income generated by the plan’s

legal holiday, the filing due date will be extended to the next business days.

assets. Items 2 and 3 are taxable for state and local tax purposes. The tax-

payer must provide a statement from the plan administrator or trustee of the

LATE FILING FEE--(Line 15) A $10.00 late filing fee is charged to each

account showing what portion, if any, of the distribution is attributable to

taxpayer who files a return, or whose return is incomplete, after the April

the employer’s contribution and income (gains) on the plan’s assets. This is

15 deadline. This fee is assessed even if all tax has been withheld by your

the portion that is taxable for earned income tax purposes and must be listed

employer, and is in addition to any other interest and penalty charges that

on Line 4 of your return. Without a statement breaking down the distribu-

have accrued. This fee will be waived if you have filed for an extension as

tion, the entire amount of the distribution will be taxable.

outlined below.

NON-TAXABLE ITEMS--Interest, dividends, subchapter “S” pass-thru

EXTENSION OF TIME TO FILE--A federal and/or state granted exten-

income (unless taxpayer is not receiving fair compensation for services ren-

sion to file does not automatically give you an extension to file your local

dered to the corporation), passive limited partnership income, social secu-

tax return. To receive a 4 month extension of time to file, you must submit

rity benefits, pensions, annuities, and retirement pay received after retire-

to our office a copy of Federal Form 4868 by the original due date of the

ment from employment and upon reaching a specific age or years of service

return. To avoid interest and penalty charges, you still must pay all tax due

or upon death or disability. IRA benefits, disability benefits, third party sick

by the original due date of the return. By filing an extension, you will not

pay, capital gains, death benefits, life insurance proceeds, gifts or bequest,

be assessed a late filing fee. For an additional extension over 4 months, you

public assistance, unemployment compensation, active military service pay

must submit to our office a copy of Federal Form 2688 or PA State Form

or bonuses for service outside of Pennsylvania, minister’s housing allow-

REV-276 before the end of your previously requested 4-month extension.

ance, income from trusts, rental income by individuals not licensed (or con-

ducting a business) as realtors by the Commonwealth of Pennsylvania.

WHO MUST FILE--Any resident of the Greencastle-Antrim School Dis-

trict, whether for all or part of the tax year, who has earnings and/or net

BE SURE TO SIGN THE TAX OFFICE COPY OF YOUR RETURN...

profits and/or net losses even if no tax is due and regardless of where you

on its lower left had side. If both spouses are filing on a single form, both

worked. Failure to file a return may subject you to a $500 fine.

spouses must sign the return. Any filing received without the proper

signature(s) will not be considered filed.

ROUNDING OFF TO WHOLE DOLLARS--You may round off cents to

the nearest whole dollar only for Line entries 1 thru 9 on your return. Entries

IF YOU MOVED...from the beginning of the tax year to present, please

for Lines 10 thru 20 on the return must be entered in dollars and cents. If

supply the information requested on the reverse side of the TAX OFFICE’S

rounding, drop amounts under 50 cents and increase amounts from 50 to

COPY of your return (Section A and C). If you have lived in different

99 cents to the next dollar. For example, $1.39 becomes $1.00 and $2.50

municipalities, falling under different tax offices jurisdictions during the

becomes $3. If you do round off, do so for all line entries where round-

year, you MUST pro-rate your earnings accordingly and file with the

ing is allowed (Line 1 thru 9). However, if you have to add two or more

appropriate tax offices. If you need assistance with this, please contact our

amounts to figure the amount to enter on a line, include cents when add-

office.

ing the amounts and only round off the total. Example: You received two

IF YOU RECEIVED MORE THAN ONE TAX RETURN...please return both

W-2 forms, one showing wages of $5,000.55 and one showing wages of

$18,500.73. On Line 1, you would enter $23,50l. ($5,000.55 + $18,500.73

tax returns to us. We apparently have two different names for you. Contact the

= $23,501.28) instead of $23,502. ($5,001. + $18,501.).

tax office to determine which name is the correct one to use. Return and mark

any other returns “DUPLICATE OF________________________________”.

IF YOU HAD NO TAXABLE EARNINGS...enter zero (0) on Line 1 and

list the reason (eg. retired, disability, housewife, no income THIS year, etc.).

IF YOU ARE SELF-EMPLOYED OR YOUR EMPLOYER DOES NOT

Sign the form and return it to us. This will eliminate needless correspondence.

WITHHOLD THE TAX, YOU ARE REQUIRED TO PAY THE TAX

QUARTERLY TO OUR OFFICE ON Form GA2. If you do not receive this

WHERE TO FILE--File your return at the office and address listed at the

form by April 1st, please request it from our office. Failure to comply will subject

upper left corner on the front of your return.

you to interest, penalty and possibly a fine.

EFFECTIVE DATES FOR THIS TAX--This return covers the taxable

LOCAL FILING COMPARED TO PA PERSONAL INCOME TAX RETURN–

period from January 1 thru December 31 of the year listed on the return.

This office participates in a program with the Pennsylvania Department

of Revenue to match earned income (compensation) and net profit/loss as

TAXABLE INCOME ITEMS--Wages, salaries, commissions, bonuses,

reported on the local return against the same items reported on the state

tips, fees, net profits, severance pay, premature retirement or other deferred

return. If, by audit, tax items are changed by either the IRS or State Depart-

payment plan distributions for reasons other than death or disability not

ment of Revenue that have a bearing on your local tax return, you must file

rolled over into another federally qualified retirement plan to the extent they

an amended local return to reflect such changes. If you have subchapter

were taxable for PA State Income Tax purposes (see more detailed explana-

“S” corporation income, file a copy of any subchapter “S” RK-1 that was

tion of this item below), employee contributions to 401(k), 403(b), 457 and

reportable as a profit or loss for state tax purposes. Whereas subchapter “S”

other types of deferred payment programs, taxes assumed by the employer,

income/loss does not typically apply to local tax, this information will pre-

incentive payments, fellowships (when compensation for services), inac-

vent us from sending you a “discrepancy” letter when your local and state

tive military service (e.g. reserves) pay and bonuses, and active military

income does not match due to this tax item.

service pay or bonuses for service within Pennsylvania.

TAXABLE RETIREMENT / SAVING PLAN DISTRIBUTIONS-- This

office follows the PA Department of Revenue’s Personal Income Tax Reg-

ulations regarding the taxability of distributions from employee deferred

payment programs such as pensions (retirement plans), profit sharing,

ESOP’s, SEP, 401(k), 403(b) and 457 plans. Under Act 166, the taxable

amount of a distribution of this type will now be the same for the local tax

as it is for the state tax. A distribution of such a plan can be made up of

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2