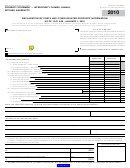

BOE-517-PW (S1B) REv. 30 (12-08)

special iNstructioNs pertaiNiNg to state assessees of

iNtercouNty flumes, caNals, ditches, aQueducts

Under the provisions of section 826 and 830 of the Revenue and Taxation Code and section 901, Title 18, California Code of Regulations,

the BOE requests that you file a property statement with the BOE between January 1, 2009, and 5:00 p.m. on March 1, 2009. The property

statement shall be completed in accordance with instructions included with the property statement and in publication 67-PL, Instructions

for Reporting State-Assessed Property, for lien date 2008. If you do not have these instructions, please let us know and we will mail them to

you.

All parts of the property statement must be filed by March 1 (exception — see “N/A” below). Extensions of time for filing the property statement

or any of its parts may be granted only on a showing of good cause under a written request made prior to March 1. If you do not file timely, it

may result in an added penalty of ten percent of the assessed value as required by section 830 of the Revenue and Taxation Code.

A positive response is required for all parts of the property statement. If a requested item does not apply, please so state. If you do not respond

to all parts of the property statement, you may be subject to the penalties of section 830 of the Revenue and Taxation Code.

Item 3 requirements and Statement of Land Changes need not be returned if there is nothing to report. However, a positive response under

the “N/A” column on page S1F is required for those forms not returned.

the property statemeNt iNcludes:

1. A copy of your annual report(s) to federal regulatory agencies, if required.

2. A copy of your annual report(s) to California regulatory agencies, if required.

3. A copy of your Form 10K filed with the Securities and Exchange Commission, if required.

4. Three (3) copies of your 2008 annual report to stockholders.

5. BOE-551, Statements of Land Changes, and Land Identification Maps will be filed for all land and easements which convey surface

use and which are used by intercounty operations by March 1. General instructions will be found in Instructions for Reporting State-

Assessed Property, under the heading Statement of Land Changes.

6. BOE-517-PW Schedule C (RENTALS) should include 2008 payments to local California governments for the use of public property.

Please indicate those payments which are on the basis of agreements entered into prior to December 1955 and which have not been

subsequently extended or renewed.

7. A statement of changes in revenue and/or costs for the future that are certain, such as rate increases ordered by federal and/or California

regulatory agencies.

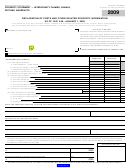

Report book cost (100 percent of actual cost). Include excise, sales and use taxes (see instructions below for important use tax information),

freight-in, installation charges, finance charges during construction, and all other relevant costs required to place the property in service. do

not reduce costs for depreciation (which must be reported separately). Report separately the details of any write-downs of cost, extraordinary

damage or obsolescence, or any other information that may help the BOE in estimating fair market value.

N/A — Not Applicable

For purposes of these instructions, flumes, canals, ditches, and aqueducts shall include the facilities and appurtenances that are essential to

the intercounty transportation or transmission systems, but shall exclude the contents of such flumes, canals, ditches, and aqueducts.

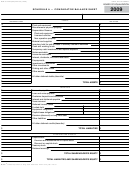

dollar-age detail report: fixed equipment — (BOE-533-PF)

Items shall be identified by location, description (i.e., account number and account name), acquisition date and acquisition cost. No more

than one location per page.

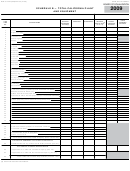

dollar-age detail report: continuous pipeline — (BOE-533-PP)

Flumes, canals, ditches or aqueducts shall be identified by location, description (i.e., account number and name), acquisition date and

acquisition cost. No more than one flume, canal, ditch or aqueduct per page.

pipeliNe mileage report — (BOE-575-P)

Each flume, canal, ditch, aqueduct shall be identified by name with lengths shown to the nearest hundredth of a mile for each county. No

more than one flume, canal, ditch or aqueduct per page.

Note: All replacement cost studies, obsolescence requests, and other voluntary information that assessees believe affects the value of their

property must be filed with the property statement or by a date granted by a formal extension. If such information is not filed by that date,

staff is not required to consider it in determining its unitary value recommendation.

use taX iNformatioN

California use tax is imposed on consumers of tangible personal property that is used, consumed, given away or stored in this state.

Businesses must report and pay use tax on items purchased from out-of-state vendors not required to collect California tax on their

sales. If your business is not required to have a seller’s permit with the BOE, the use tax may be reported and paid on your California

State Income Tax Return or directly to the BOE on the tax return provided in publication 79-B, California Use Tax. Obtain additional

use tax information by calling the BOE Taxpayer Information Section at 800-400-7155 or from the website

usetaxreturn.htm.

1

1 2

2 3

3 4

4 5

5 6

6