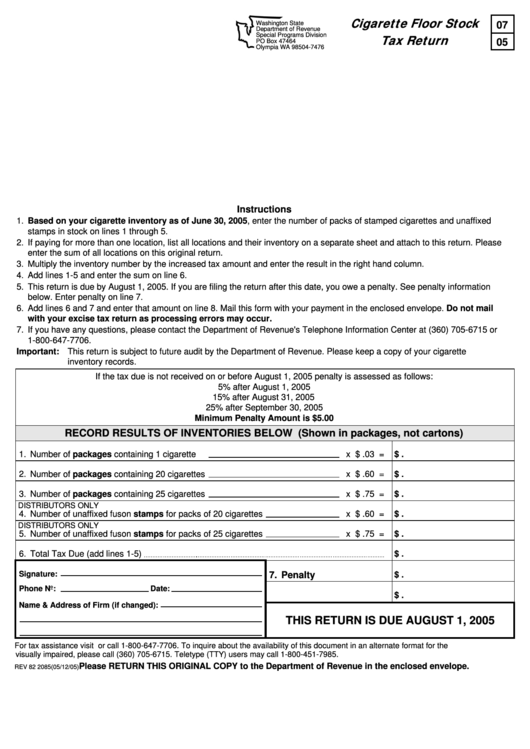

Cigarette Floor Stock Tax Return Form - 2005

ADVERTISEMENT

Cigarette Floor Stock

Washington State

07

Department of Revenue

Tax Return

Special Programs Division

05

PO Box 47464

Olympia WA 98504-7476

Instructions

1.

Based on your cigarette inventory as of June 30, 2005, enter the number of packs of stamped cigarettes and unaffixed

stamps in stock on lines 1 through 5.

2.

If paying for more than one location, list all locations and their inventory on a separate sheet and attach to this return. Please

enter the sum of all locations on this original return.

3.

Multiply the inventory number by the increased tax amount and enter the result in the right hand column.

4.

Add lines 1-5 and enter the sum on line 6.

5.

This return is due by August 1, 2005. If you are filing the return after this date, you owe a penalty. See penalty information

below. Enter penalty on line 7.

6.

Add lines 6 and 7 and enter that amount on line 8. Mail this form with your payment in the enclosed envelope. Do not mail

with your excise tax return as processing errors may occur.

7.

If you have any questions, please contact the Department of Revenue's Telephone Information Center at (360) 705-6715 or

1-800-647-7706.

Important:

This return is subject to future audit by the Department of Revenue. Please keep a copy of your cigarette

inventory records.

If the tax due is not received on or before August 1, 2005 penalty is assessed as follows:

5% after August 1, 2005

15% after August 31, 2005

25% after September 30, 2005

Minimum Penalty Amount is $5.00

RECORD RESULTS OF INVENTORIES BELOW (Shown in packages, not cartons)

1.

Number of packages containing 1 cigarette

x $ .03 =

$

.

2.

Number of packages containing 20 cigarettes

x $ .60 =

$

.

3.

Number of packages containing 25 cigarettes

x $ .75 =

$

.

DISTRIBUTORS ONLY

4.

Number of unaffixed fuson stamps for packs of 20 cigarettes

x $ .60 =

$

.

DISTRIBUTORS ONLY

5.

Number of unaffixed fuson stamps for packs of 25 cigarettes

x $ .75 =

$

.

6.

Total Tax Due (add lines 1-5)

$

.

Signature:

$

.

7. Penalty

Phone No:

Date:

8. This Amount Owed

$

.

Name & Address of Firm (if changed):

THIS RETURN IS DUE AUGUST 1, 2005

For tax assistance visit or call 1-800-647-7706. To inquire about the availability of this document in an alternate format for the

visually impaired, please call (360) 705-6715. Teletype (TTY) users may call 1-800-451-7985.

Please RETURN THIS ORIGINAL COPY to the Department of Revenue in the enclosed envelope.

REV 82 2085 (05/12/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1