Net Operating Loss Deduction For Loss Year

ADVERTISEMENT

29

Government of the

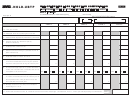

D-30 NOL Net Operating Loss Deduction for Loss Year

District of Columbia

Complete a separate D-30 NOL for each business carrying forward an NOL.

Be sure to list NOLs before the year 2000 separate from those for 2000 and after.

Enter Year

Enter Year

Before 2000

2000 and After

Name of business

FEIN/SSN

Year

District net income/loss

Losses claimed

Losses remaining

Oldest loss year

$

$

$

Subsequent year 1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Total losses claimed

Total losses remaining (to be carried

forward)

200___ Summary:

$

$

•

Enter loss for years before 2000 on Line 24, page 2 of the D-30

•

Enter loss from year 2000 and after on Line 35, page 2 of D-30

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1