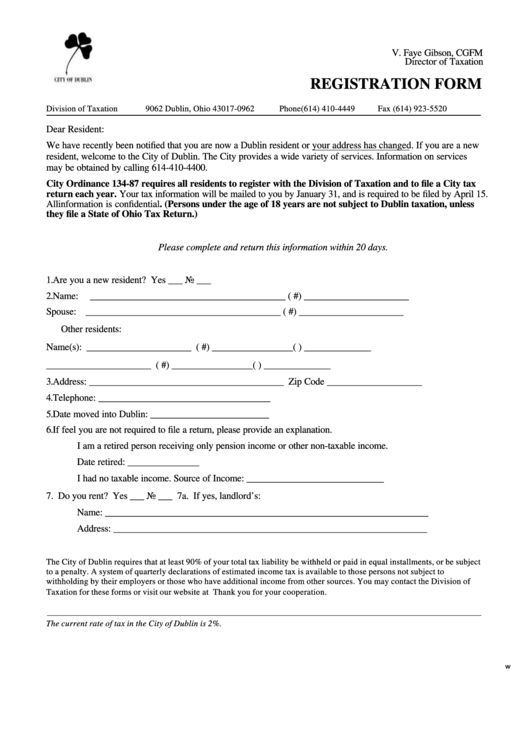

V. Faye Gibson, CGFM

Director of Taxation

REGISTRATION FORM

Division of Taxation

P.O. Box 9062 Dublin, Ohio 43017-0962

Phone(614) 410-4449

Fax (614) 923-5520

Dear Resident:

We have recently been notified that you are now a Dublin resident or your address has changed. If you are a new

resident, welcome to the City of Dublin. The City provides a wide variety of services. Information on services

may be obtained by calling 614-410-4400.

City Ordinance 134-87 requires all residents to register with the Division of Taxation and to file a City tax

return each year. Your tax information will be mailed to you by January 31, and is required to be filed by April 15.

All information is confidential. (Persons under the age of 18 years are not subject to Dublin taxation, unless

they file a State of Ohio Tax Return.)

Please complete and return this information within 20 days.

1. Are you a new resident? Yes ___ No ___

2. Name:

_________________________________________ (S.S.#) ______________________

Spouse: _________________________________________ (S.S.#) ______________________

Other residents:

Name(s): ______________________ (S.S.#) _________________ (D.O.B) ______________

______________________ (S.S.#) _________________ (D.O.B) ______________

3. Address: _________________________________________ Zip Code ____________________

4. Telephone: ____________________________________

5. Date moved into Dublin: _________________________

6. If feel you are not required to file a return, please provide an explanation.

I am a retired person receiving only pension income or other non-taxable income.

Date retired: _______________

I had no taxable income. Source of Income: _____________________________

7. Do you rent? Yes ___ No ___ 7a. If yes, landlord’s:

Name: ____________________________________________________________________

Address: __________________________________________________________________

The City of Dublin requires that at least 90% of your total tax liability be withheld or paid in equal installments, or be subject

to a penalty. A system of quarterly declarations of estimated income tax is available to those persons not subject to

withholding by their employers or those who have additional income from other sources. You may contact the Division of

Taxation for these forms or visit our website at

Thank you for your cooperation.

The current rate of tax in the City of Dublin is 2%.

w

1

1