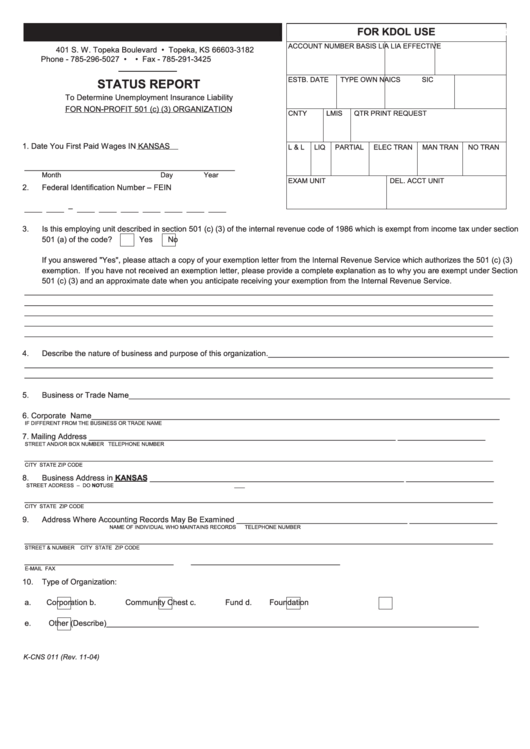

Form K-Cns 011 - Status Report - Kansas Department Of Labor

ADVERTISEMENT

Kansas Department of Labor

FOR KDOL USE

ACCOUNT NUMBER

BASIS LIA

LIA EFFECTIVE

401 S. W. Topeka Boulevard • Topeka, KS 66603-3182

Phone - 785-296-5027 • • Fax - 785-291-3425

ESTB. DATE

TYPE OWN

NAICS

SIC

STATUS REPORT

To Determine Unemployment Insurance Liability

FOR NON-PROFIT 501 (c) (3) ORGANIZATION

CNTY

LMIS

QTR PRINT REQUEST

1.

Date You First Paid Wages IN KANSAS

L & L

LIQ

PARTIAL

ELEC TRAN

MAN TRAN

NO TRAN

________________________________________________

Month Day Year

EXAM UNIT

DEL. ACCT UNIT

2.

Federal Identification Number – FEIN

____ ____ – ____ ____ ____ ____ ____ ____ ____

3.

Is this employing unit described in section 501 (c) (3) of the internal revenue code of 1986 which is exempt from income tax under section

501 (a) of the code?

Yes

No

If you answered "Yes", please attach a copy of your exemption letter from the Internal Revenue Service which authorizes the 501 (c) (3)

exemption. If you have not received an exemption letter, please provide a complete explanation as to why you are exempt under Section

501 (c) (3) and an approximate date when you anticipate receiving your exemption from the Internal Revenue Service.

__________________________________________________________________________________________________________

__________________________________________________________________________________________________________

__________________________________________________________________________________________________________

__________________________________________________________________________________________________________

__________________________________________________________________________________________________________

4.

Describe the nature of business and purpose of this organization._______________________________________________________

__________________________________________________________________________________________________________

__________________________________________________________________________________________________________

5.

Business or Trade Name_______________________________________________________________________________________

6.

Corporate Name_____________________________________________________________________________________________

IF DIFFERENT FROM THE BUSINESS OR TRADE NAME

7.

Mailing Address ______________________________________________________________________

____________________

STREET AND/OR BOX NUMBER

TELEPHONE NUMBER

__________________________________________________________________________________________________________

CITY

STATE

ZIP CODE

8.

Business Address in KANSAS __________________________________________________________

____________________

STREET ADDRESS – DO NOT USE P.O. BOX NUMBER

TELEPHONE NUMBER

__________________________________________________________________________________________________________

CITY

STATE

ZIP CODE

9.

Address Where Accounting Records May Be Examined _______________________________________

____________________

NAME OF INDIVIDUAL WHO MAINTAINS RECORDS

TELEPHONE NUMBER

__________________________________________________________________________________________________________

STREET & NUMBER

CITY

STATE

ZIP CODE

__________________________________

__________________________________

E-MAIL

FAX

10. Type of Organization:

a.

Corporation

b.

Community Chest

c.

Fund

d.

Foundation

e.

Other (Describe)_____________________________________________________________________________________

K-CNS 011 (Rev. 11-04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2